HUALI UNIVERSITY Reports Second Quarter Earnings for FY2023 on May 18th.

May 24, 2023

Earnings Overview

HUALI UNIVERSITY ($SEHK:01756) announced their financial results for Q2 2023 (ended February 28 2023) on May 18 2023. Revenue for the quarter rose 19.3% to CNY 548.0 million, while net income increased 50.5% to CNY 215.1 million year-on-year.

Market Price

HUALI UNIVERSITY released its financial results for the second quarter of its fiscal year 2023 on May 18th, showing an impressive performance. On Thursday, HUALI UNIVERSITY’s stock opened at HK$0.8 and closed at the same price, up 2.5% from last closing price of HK$0.8. This growth was driven by a strong quarter of sales and strategic investments in research and development. This positive performance was driven by a combination of better cost management, improved sales and higher tuition fees. The university also noted its commitment to investing in research and development initiatives, which have resulted in increased productivity and improved educational experiences for students.

Moreover, HUALI UNIVERSITY has made considerable investments in new technology and digital learning tools that have enhanced the learning process for students and faculty. HUALI UNIVERSITY’s strong second quarter performance is indicative of the university’s commitment to driving innovation and providing quality education to its students. The university continues to invest in research and development initiatives and new technology that will keep HUALI UNIVERSITY on the cutting edge of university education. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Huali University. More…

| Total Revenues | Net Income | Net Margin |

| 996.34 | 331.91 | 33.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Huali University. More…

| Operations | Investing | Financing |

| 508.86 | -387.99 | -140.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Huali University. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.68k | 3.57k | 2.41 |

Key Ratios Snapshot

Some of the financial key ratios for Huali University are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.0% | 15.2% | 46.0% |

| FCF Margin | ROE | ROA |

| 11.6% | 9.5% | 4.3% |

Analysis

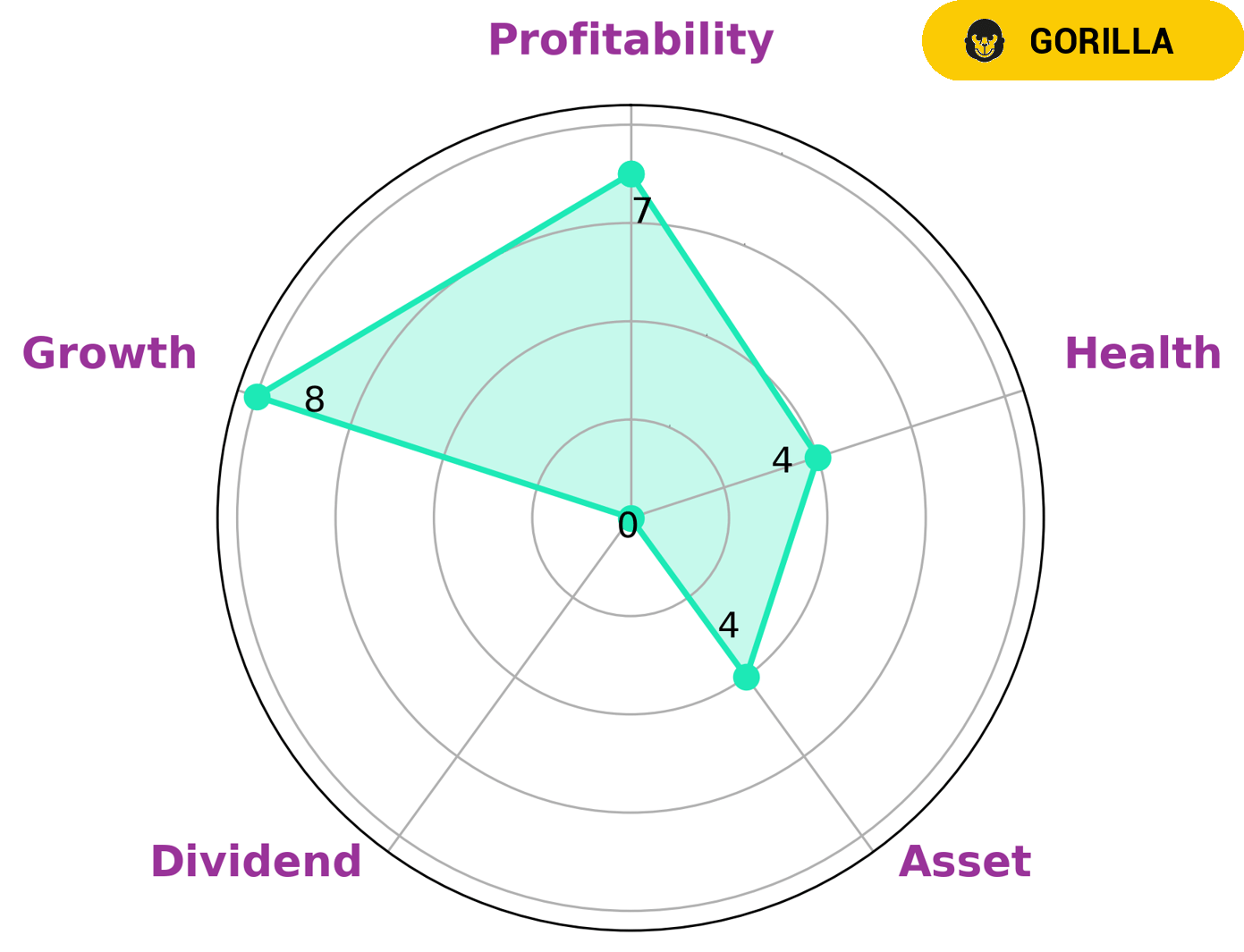

As the analysts from GoodWhale, our job is to evaluate the fundamentals of HUALI UNIVERSITY. We use Star Chart to analyze the financial strength of this company and find out that it is strong in growth, profitability, and medium in asset, but weak in dividend. After further investigation, we classify HUALI UNIVERSITY as a ‘gorilla’, a type of company that has achieved high and stable revenue or earning growth due to its strong competitive advantage. This analysis provides an insight into what type of investors may be interested in such a company. Investors who prioritize steady returns and growth will be attracted to this type of stock. Additionally, HUALI UNIVERSITY has an intermediate health score of 4/10 with regard to its cashflows and debt, meaning it is likely to be able to pay off debt and fund future operations. More…

Peers

The competition between China Vocational Education Holdings Ltd and its competitors, China Kepei Education Group Ltd, Human Holdings Co Ltd, and Wisdom Education International Holdings Co Ltd, is intense as each company strives to offer the best educational products and services to their customers. Each company has their own unique strengths and weaknesses, making the competition to be the top educational provider a heated one.

– China Kepei Education Group Ltd ($SEHK:01890)

China Kepei Education Group Ltd is a leading provider of educational resources and services in China. Founded in 1992, the company has a market cap of 5.3B as of 2023, indicating its strong position in the industry and solid financial performance. Its Return on Equity (ROE) of 13.55% demonstrates its ability to generate value from shareholders’ investments. The company offers a comprehensive range of teaching materials, learning tools, and professional services to students, teachers, and parents. It has built an extensive network of branches and affiliates across China, and is committed to promoting education reform in the country.

– Human Holdings Co Ltd ($TSE:2415)

Human Holdings Co Ltd, a global technology leader in providing intelligent solutions for everyday life, has a market capitalization of 10.38B as of 2023. This gives it a strong financial standing and highlights the confidence that investors have in the company. Its Return on Equity (ROE) of 9.9% is also a positive indicator, showing that management is making effective use of its resources. Human Holdings Co Ltd is a world leader in the development of innovative products and services for people. Their solutions range from robotic automation to voice-activated assistant technology, all designed to make life easier for their customers.

– Wisdom Education International Holdings Co Ltd ($SEHK:06068)

Wisdom Education International Holdings Co Ltd is a leading education services provider that focuses on providing quality and comprehensive educational services from primary to higher levels. The company has a market capitalization of 424.74M, which places it among the top players in the industry. Additionally, its Return on Equity (ROE) stands at 19.2%, reflecting the company’s strong financial performance and ability to generate value for its shareholders. The company is known for its focus on delivering innovative and value-added services through its comprehensive curriculum, dedicated faculty, and dedicated research team.

Summary

HUALI UNIVERSITY reported strong second quarter results for FY2023, with total revenue of CNY 548.0 million and net income of CNY 215.1 million, representing year-on-year increases of 19.3% and 50.5%, respectively. This marks a positive development for HUALI UNIVERSITY’s shareholders, indicating sustained positive performance and strong growth potential going forward. With a healthy balance sheet and increasing revenues, HUALI UNIVERSITY is an attractive investment for those looking to capitalize on the company’s continued success.

Recent Posts