Horace Mann Educators to Report Quarterly Earnings on Tuesday

February 3, 2023

Trending News 🌥️

Horace Mann Educators ($NYSE:HMN), a publicly traded insurance and financial services company in the United States, will be announcing their quarterly earnings on Tuesday. They are also the largest corporate sponsor of the National Association of Educators, providing millions in scholarships and grants. Investors will be eager to hear how the company fared in the quarter and what their plans are for the future. Many analysts are expecting strong earnings from Horace Mann Educators, as they have been taking advantage of the recent market volatility to increase their market share. The company has been expanding its product offerings and services in recent months, with their new online platform offering a variety of products and services for educators.

They have also been investing in technology to improve customer service and make it easier for customers to manage their accounts. Investors will be looking for an update on the company’s financial performance and any guidance on future plans. With Horace Mann Educators continuing to focus on education and technology, Tuesday’s announcement could be a major catalyst for the stock.

Stock Price

This release is highly anticipated as investors look to gain insight into the company’s financial performance. On Thursday, HORACE MANN EDUCATORS stock opened at $35.3 and closed at $35.8, up by 1.3% from prior closing price of 35.4. Analysts have been keeping a close eye on the company’s financials and are expecting to see an increase in revenue and earnings growth compared to the same period last year. Horace Mann Educators Corporation is a leading provider of insurance, retirement planning and investment services for educators in the United States. The company has a long history of providing high quality products and services to its customers and its commitment to educational excellence is unparalleled. Investors will be looking for further details on how the company plans to capitalize on its strengths and continue to grow its business in the coming months and years.

With the release of its quarterly earnings report, investors will gain insight into the company’s financial performance and will be able to make informed decisions about their investments in the stock. The market’s reaction to the news will provide further insight into the company’s outlook and investor sentiment. Therefore, Tuesday’s earnings report will be highly anticipated by investors as they look to gain further insight into the performance of Horace Mann Educators Corporation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HMN. More…

| Total Revenues | Net Income | Net Margin |

| 1.34k | 56.4 | 4.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HMN. More…

| Operations | Investing | Financing |

| 168.3 | -302 | 208.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HMN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.76k | 12.5k | 30.81 |

Key Ratios Snapshot

Some of the financial key ratios for HMN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.9% | – | 6.2% |

| FCF Margin | ROE | ROA |

| 12.6% | 4.1% | 0.4% |

Analysis

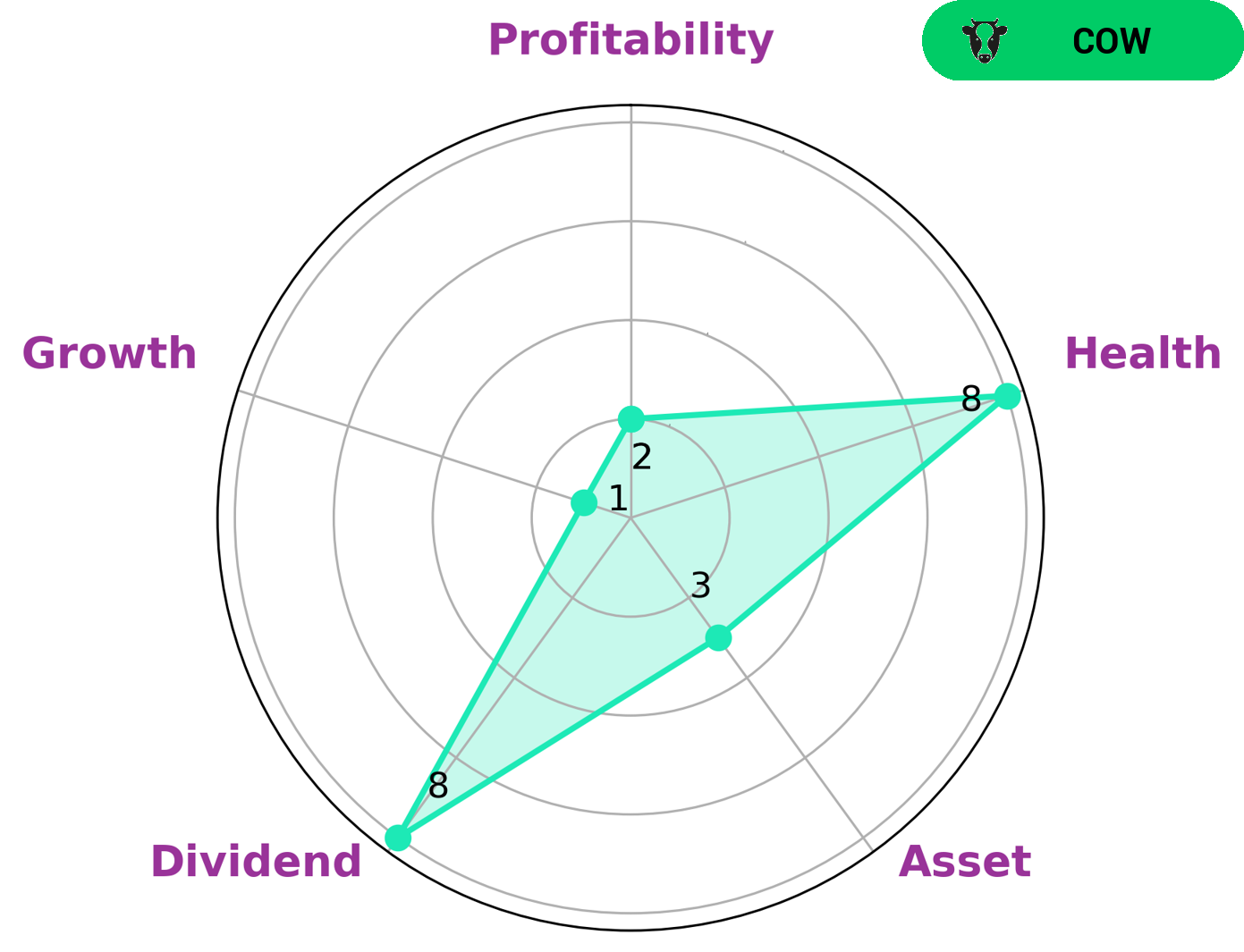

GoodWhale’s analysis of the fundamentals of HORACE MANN EDUCATORS has classified it as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes it an attractive prospect for investors seeking steady returns. HORACE MANN EDUCATORS is strong in dividend, but weak in asset, growth, and profitability. Nevertheless, its high health score of 8/10 in terms of cashflows and debt indicates it is capable of sustaining future operations even in times of crisis. For investors who are seeking a stable investment that offers consistent returns, HORACE MANN EDUCATORS may be an ideal option. Its high dividend rate makes it an attractive option for those looking to generate income from their investments. Furthermore, its high health score implies that the company is well-positioned to weather any economic downturns or market volatility. Investors looking for higher returns or more rapid growth may find HORACE MANN EDUCATORS less attractive due to its weak asset, growth and profitability scores. However, for those seeking a consistent and reliable source of income, this stock may be a good option. Additionally, the company’s ability to withstand difficult economic times means that investors can have some peace of mind when investing in this stock. More…

Peers

The Company’s competitors in the property and casualty insurance industry are Kemper Corporation, Safety Insurance Group, Inc. and Definity Financial Corporation.

– Kemper Corp ($NYSE:KMPR)

Kemper Corporation (KMPR) is a diversified insurance holding company with subsidiaries that write and provide property and casualty, life and health, and specialty insurance products in the United States. The company was founded in 1926 and is headquartered in Chicago, Illinois.

As of 2022, Kemper Corporation had a market capitalization of $3.58 billion and a return on equity of -9.68%. The company’s property and casualty insurance subsidiaries wrote $4.4 billion in premiums in 2020, while its life and health insurance subsidiaries wrote $1.6 billion in premiums. Kemper’s specialty insurance subsidiaries wrote $2.2 billion in premiums in 2020.

– Safety Insurance Group Inc ($NASDAQ:SAFT)

Safe Auto Group is a leading provider of insurance products for both individuals and businesses in the United States. The company offers a wide range of products, including auto insurance, homeowners insurance, and business insurance. Safe Auto Group is a publicly traded company, and its shares are listed on the Nasdaq Stock Market.

– Definity Financial Corp ($TSX:DFY)

Definity Financial Corp is a financial services company that offers a range of products and services to its clients. The company has a market cap of 4.71B as of 2022 and a return on equity of 5.49%. Definity Financial Corp offers a variety of products and services including investment banking, asset management, and wealth management. The company has a strong focus on providing its clients with the best possible financial outcomes. Definity Financial Corp is a well-established financial services company with a long history of providing quality products and services to its clients.

Summary

Horace Mann Educators, a publicly traded insurance and financial services company, will report their quarterly earnings on Tuesday. Investors looking to gain insight into the company’s financial performance should watch for key metrics such as earnings per share, revenue, operating income and other relevant information. Analysts will be evaluating the company’s performance to determine whether the stock is a good buy. Investors should also consider the industry outlook and potential risks associated with investing in the company.

Additionally, they should consider the company’s competitive landscape, management quality, and dividend policy when making their investment decision.

Recent Posts