Highwoods Properties to Reveal Earnings Results on Tuesday, February 7th.

February 5, 2023

Trending News 🌥️

Highwoods Properties ($NYSE:HIW) Inc. is a publicly traded real estate investment trust (REIT) based in Raleigh, North Carolina. It is one of the largest REITs in the United States, with a portfolio of office, industrial, and retail properties located primarily in the Southeast and Midwest regions. Highwoods Properties will be releasing their earnings report on Tuesday, February 7th after the market closes. Investors will be watching to see if the company’s earnings are in line with analysts’ expectations or if they have exceeded them.

Additionally, they will be looking at any potential changes in the company’s dividend policy as well as any updates on its current projects. Analysts anticipate that Highwoods Properties will report solid earnings due to its strong portfolio of properties and its ability to attract tenants. They also expect that the company’s dividend policy will remain unchanged and that there will be no major news events in the near-term. Highwoods Properties is an attractive option for investors who are looking for a stable dividend-paying stock. The company has been able to weather the storm of the pandemic relatively well and its portfolio of properties continues to generate steady cash flow.

Price History

The company’s stock opened at $30.2 on Wednesday and closed at $30.4, up by 0.3% from its previous closing price of $30.4. This is a significant development for investors and analysts, as the company’s financial performance will be closely watched to gauge its prospects for the year ahead. In addition to the earnings report, investors and analysts will be looking for further details on the company’s strategy and plans for the year ahead. Highwoods Properties has been very active in recent years in expanding its portfolio of properties and acquiring new ones. The company is also investing heavily in its existing properties to modernize and improve them. As such, investors and analysts will be keen to hear about the progress that has been made in these areas and the expected impact on future earnings.

Highwoods Properties has also been active in the capital markets, raising funds through the issuance of debt and equity securities to finance acquisitions and investments in its properties. Investors and analysts will therefore be interested to hear about any plans the company may have to raise more capital or to pay off existing debt. Overall, Tuesday’s earnings report from Highwoods Properties will be closely watched by investors and analysts alike. It is expected that the company’s financial performance will be strong and that it will provide further insight into the company’s plans for the year ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Highwoods Properties. More…

| Total Revenues | Net Income | Net Margin |

| 820.42 | 253.94 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Highwoods Properties. More…

| Operations | Investing | Financing |

| 425.22 | -256.05 | -180.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Highwoods Properties. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.87k | 3.28k | 23.53 |

Key Ratios Snapshot

Some of the financial key ratios for Highwoods Properties are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 29.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

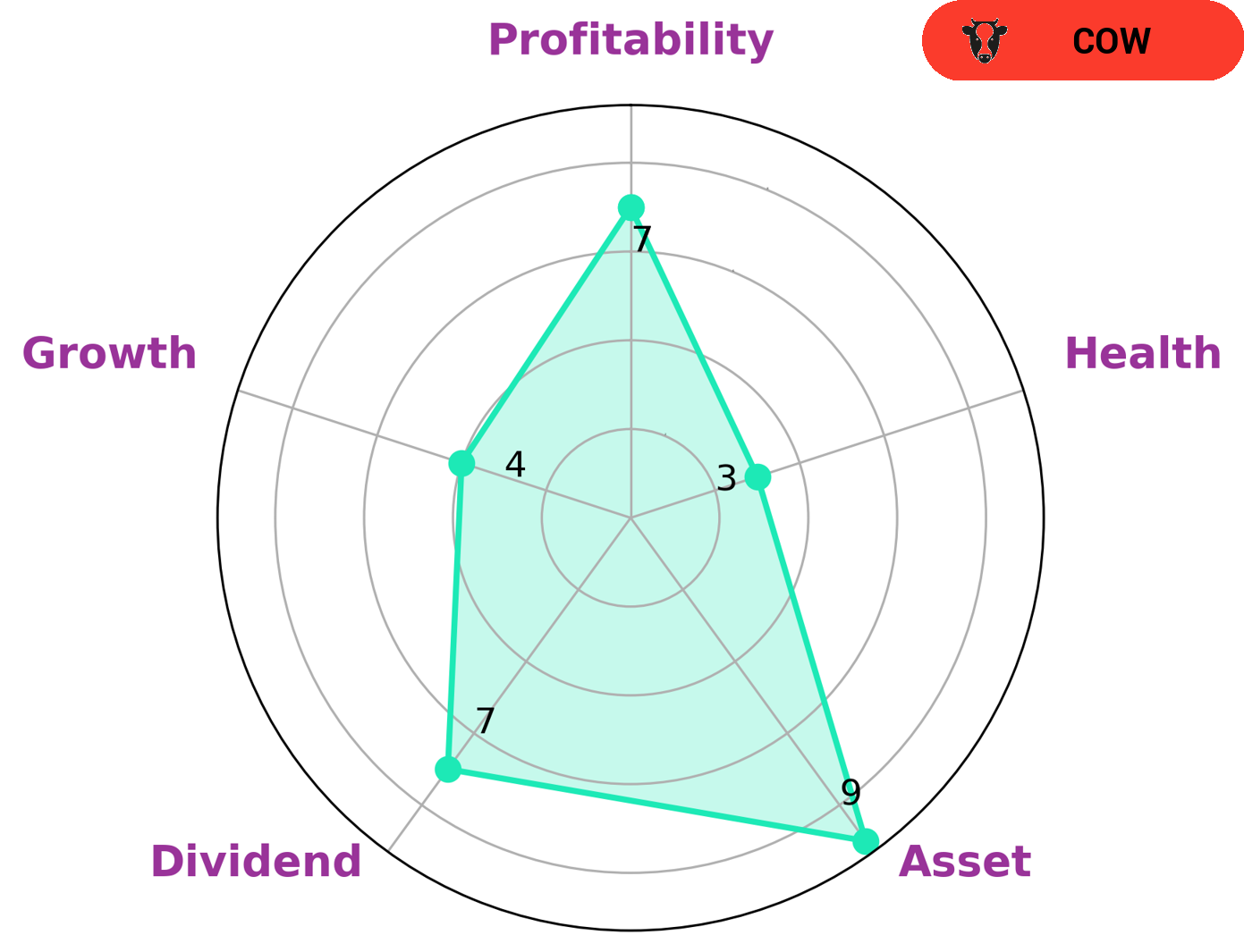

GoodWhale is a great tool to analyze the financials of HIGHWOODS PROPERTIES, a real estate investment trust. Its Star Chart analysis shows that the company is strong in asset, dividend, and profitability and only medium in growth. It is classified as a ‘cow’, which suggests that the company has a track record of paying out consistent and sustainable dividends. The low health score of 3/10 with regard to its cashflows and debt indicates that HIGHWOODS PROPERTIES is less likely to pay off debt or fund future operations. Therefore, investors who are looking for a steady stream of income may be interested in this company. However, due to its low health score, investors should be aware that the company may not be able to meet its debt obligations or fund future operations. Investors who are looking for capital appreciation may also consider investing in HIGHWOODS PROPERTIES, as its strong asset and dividend structure indicate that the company is well established and may have better potential for growth. In addition, due to its medium growth rating, investors may also benefit from the potential upside of the company’s stock. Overall, HIGHWOODS PROPERTIES appears to be an attractive option for investors looking for steady income and potential capital appreciation. However, investors should be aware of the company’s low health score before investing in it. More…

Peers

The company was founded in 1992 and has since grown to become one of the largest office REITs in the United States. Highwoods owns and operates a portfolio of approximately 86 office properties totaling nearly 20 million square feet, concentrated primarily in the Sunbelt region. Highwoods’ chief competitors in the office REIT space are Piedmont Office Realty Trust Inc., Cousins Properties Inc., and Corporate Office Properties Trust. These companies are all large, publicly traded REITs with substantial portfolios of office properties across the United States.

– Piedmont Office Realty Trust Inc ($NYSE:PDM)

Piedmont Office Realty Trust, Inc. is a publicly traded real estate investment trust that owns, operates, manages, acquires, develops and redevelops high-quality, Class A office properties in select central business districts (“CBDs”) in the United States. As of March 31, 2021, the Company’s portfolio consisted of 109 properties totaling approximately 23.0 million square feet. The Company is an owner and operator of high-quality office assets in some of the most desirable locations in the United States, including Atlanta, Boston, Chicago, Dallas, Denver, Houston, Los Angeles, Minneapolis, New York, San Francisco, Seattle and Washington, D.C.

– Cousins Properties Inc ($NYSE:CUZ)

Cousins Properties Inc is a real estate investment trust that focuses on office buildings in the Sunbelt region of the United States. As of 2022, its market cap is 3.76B. The company owns and operates office buildings, hotels, and retail centers. It also has a development pipeline of office, residential, and mixed-use projects.

– Corporate Office Properties Trust ($NYSE:OFC)

Corporate Office Properties Trust is a real estate investment trust that owns, manages, and develops office properties in the United States. The company’s market cap is $2.98 billion as of 2022. Corporate Office Properties Trust is headquartered in Maryland.

Summary

Highwoods Properties is set to release their earnings report on Tuesday, February 7th. Investors will be looking at their financial performance to assess the company’s performance and determine whether it is a good investment opportunity. Analysts will be examining the company’s revenue, operating income, net income, and cash flow statements to gain insight into their financial standing. They will also be analyzing the balance sheet to assess the company’s liquidity and leverage ratios.

Additionally, they will look at factors such as market share, competitive landscape, and management strategies to gain a better understanding of the company’s future prospects. Investors should be aware of any positive or negative trends that may arise from this report before making any decisions.

Recent Posts