HEALTHEQUITY Reports Fourth Quarter Earnings Results for FY2023

April 2, 2023

Earnings Overview

On March 21 2023, HEALTHEQUITY ($NASDAQ:HQY) reported their fourth quarter FY2023 earnings results ending on January 31 2023. Total revenue for the quarter experienced an increase of 99.4% year-over-year, reaching USD -0.2 million. Net income increased by 15.0%, amounting to USD 233.8 million compared to the same period in the prior year.

Transcripts Simplified

All lines have been placed on mute to prevent any background noise. After the speakers’ remarks, there will be a question and answer session. At that time, if you would like to ask a question, press star one on your telephone keypad. Our team is dedicated to helping people make the most of their health savings accounts and to reducing the burden of medical debt. We also successfully executed on our strategy to diversify our revenue streams and drive additional organic growth opportunities by expanding our product and service offerings. We continue to drive strong member acquisition and engagement, which has resulted in excellent top-line growth.

This was driven by broad-based strength across all of our core businesses and the contribution from our recent acquisitions. We remain focused on delivering long-term value for all of our stakeholders and creating a great experience for our members. Thank you for your continued support and interest in Healthequity. We look forward to updating you on our progress in the coming quarters.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Healthequity. healthequity-reports-fourth-quarter-earnings-results-for-fy2023″>More…

| Total Revenues | Net Income | Net Margin |

| 861.75 | -26.14 | -0.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Healthequity. healthequity-reports-fourth-quarter-earnings-results-for-fy2023″>More…

| Operations | Investing | Financing |

| 150.65 | -119.13 | -2.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Healthequity. healthequity-reports-fourth-quarter-earnings-results-for-fy2023″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.09k | 1.19k | 22.37 |

Key Ratios Snapshot

Some of the financial key ratios for Healthequity are shown below. healthequity-reports-fourth-quarter-earnings-results-for-fy2023″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.4% | -29.9% | 1.2% |

| FCF Margin | ROE | ROA |

| 3.7% | 0.3% | 0.2% |

Price History

The company’s stock opened at $57.6 and closed at $58.3, up by 2.8% from its last closing price of 56.7. This marked a strong start for the company’s financial performance this year, as the positive results have driven investor confidence in HEALTHEQUITY. The strong performance in the fourth quarter has set HEALTHEQUITY up for success in FY2023.

The company expects to see further revenue and income growth as it continues to strengthen its foothold in the healthcare and financial services markets. Investors will be watching closely to see how the company continues to perform in the coming quarters. Live Quote…

Analysis

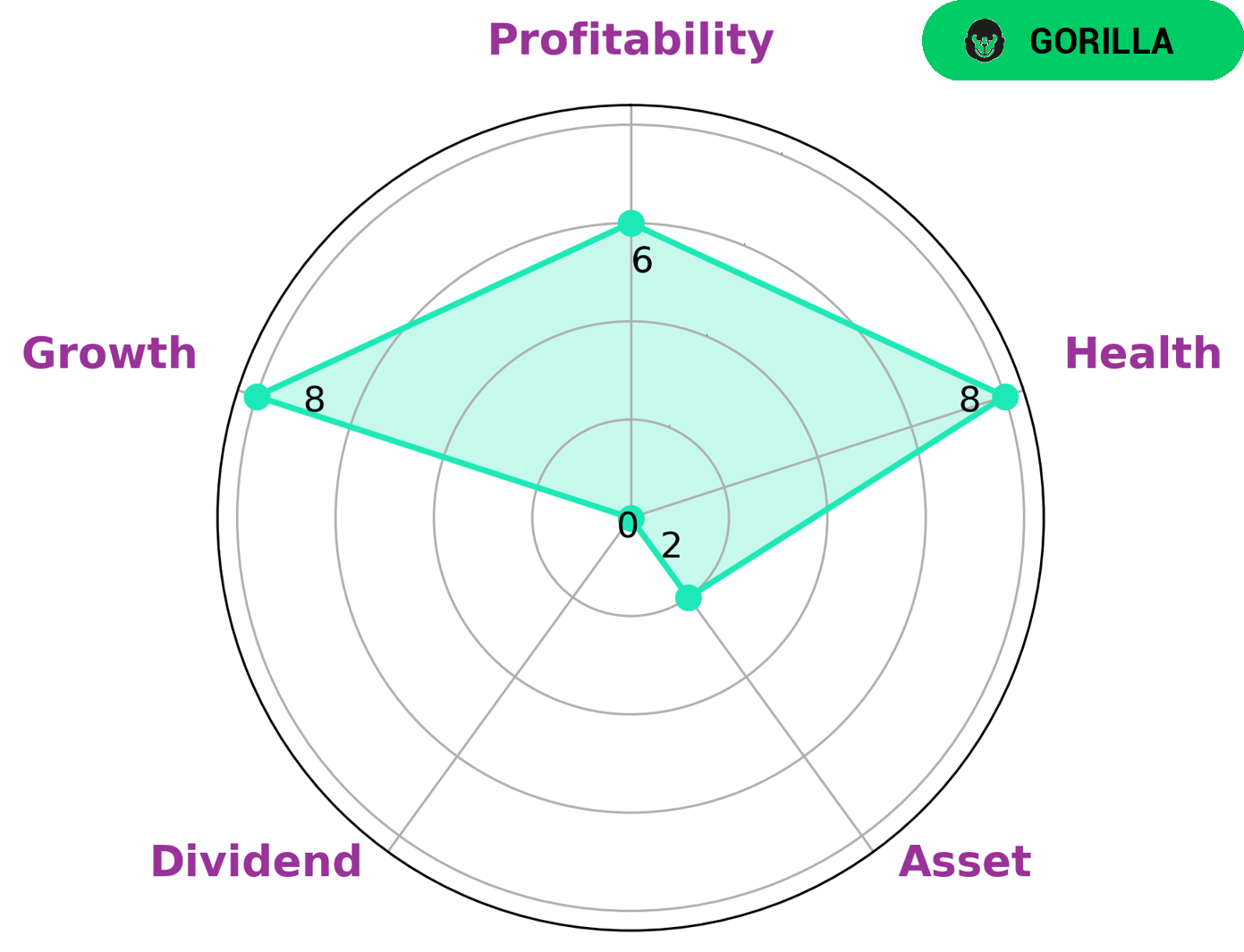

GoodWhale has completed an analysis of HEALTHEQUITY‘s fundamentals and our Star Chart gives HEALTHEQUITY a high health score of 8/10. This score takes into consideration the cashflows, debt and its ability to pay off debt and fund future operations. Based on our analysis we have concluded that HEALTHEQUITY is classified as a ‘gorilla’, meaning that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given its strong growth, medium profitability, and weak asset and dividend scores, HEALTHEQUITY is likely to be of interest to investors who are looking for companies that have a strong competitive advantage and the potential for future growth. Investors who are looking for immediate returns in the form of dividends may not be as interested. More…

Peers

There is fierce competition in the healthcare industry between HealthEquity Inc and its competitors: Accolade Inc, Definitive Healthcare Corp, Sharecare Inc. All four companies are striving to provide the best possible healthcare services to their customers. Each company has its own unique strengths and weaknesses, and it is up to the customer to decide which company best meets their needs.

– Accolade Inc ($NASDAQ:ACCD)

Accolade, Inc. is a technology company that provides personalized health and benefits solutions. The company offers a platform that helps people navigate the health care system, make better health decisions, and lead healthier lives. Accolade has a market cap of 789.17M as of 2022 and a Return on Equity of -47.5%. The company’s platform is used by more than 20 million people in the United States.

– Definitive Healthcare Corp ($NASDAQ:DH)

Definitive Healthcare Corp is a healthcare intelligence and analytics platform that provides insights into the healthcare industry. The company’s platform provides access to data on more than 8,500 hospitals, 1.5 million physicians, and 300,000 clinical trials. The company’s data and insights are used by healthcare organizations to drive clinical and operational decision-making.

– Sharecare Inc ($NASDAQ:SHCR)

Sharecare is a digital health company that allows users to track their health and wellness data in one place. The company has a wide range of products and services that help users track their health, including a weight loss program, a fitness tracker, and a health journal. Sharecare also offers a variety of health and wellness content, including articles, videos, and podcasts.

Summary

Investors in HEALTHEQUITY have reason to be optimistic following the company’s fourth quarter of FY2023 earnings results, released on March 21, 2023. Revenue for the quarter was USD -0.2 million, a whopping 99.4% increase year-over-year. Moreover, net income was USD 233.8 million, a 15.0% increase from the same period a year ago. These strong numbers bode well for continued growth and profitability for the company in future quarters.

Recent Posts