HCA HEALTHCARE Reports Strong Q4 Earnings with 14.9% YOY Revenue Increase and 2.9% Net Income Growth.

February 6, 2023

Earnings report

HCA HEALTHCARE ($NYSE:HCA), one of the largest for-profit healthcare systems in the United States, recently released their earnings report for the fourth quarter of fiscal year 2022, ending December 31, 2022. The report revealed that HCA HEALTHCARE has experienced strong growth in their quarterly revenue and net income. Total revenue for the quarter was reported to be USD 2.1 billion, representing a 14.9% year-over-year increase. Net income came in at USD 15.5 billion, up 2.9% from the same period last year. These numbers demonstrate the strength of HCA HEALTHCARE’s business model, especially given the highly competitive industry they operate in.

In addition, they also provide a range of other healthcare services, such as outpatient centers, home health agencies, hospice centers, and diagnostic laboratories. The strong Q4 earnings results released by HCA HEALTHCARE indicate that their strategy of providing high quality healthcare services at competitive prices is paying off. This is good news for both investors and patients alike, as it shows that HCA HEALTHCARE is continuing to be financially successful and can continue to provide quality care to those in need.

Share Price

HCA HEALTHCARE, a leading provider of healthcare services, reported strong fourth quarter earnings with a 14.9% year-over-year revenue increase and 2.9% net income growth. On Friday, HCA HEALTHCARE stock opened at $248.7 and closed at $254.8. HCA HEALTHCARE’s Q4 performance was driven by a strong performance in its acute-care hospital business. The company also reported double-digit year-over-year revenue growth in its other businesses, including ambulatory surgery centers, diagnostic imaging centers, and outpatient services. In addition to its strong financial performance, HCA HEALTHCARE also reported progress in its ongoing efforts to improve patient care and safety.

The company has implemented a number of initiatives to reduce infection rates, improve patient outcomes, and increase patient satisfaction. These initiatives have resulted in a decrease in the rate of hospital acquired infections and an increase in patient satisfaction scores. Overall, HCA HEALTHCARE’s Q4 performance was driven by strong revenue growth across its various businesses and ongoing efforts to improve patient care and safety. The company’s stock price reflects investors’ confidence in the company’s future prospects and is expected to remain strong moving forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hca Healthcare. More…

| Total Revenues | Net Income | Net Margin |

| 60.23k | 5.64k | 7.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hca Healthcare. More…

| Operations | Investing | Financing |

| 8.52k | -3.39k | -5.66k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hca Healthcare. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 52.44k | 52.51k | -11.87 |

Key Ratios Snapshot

Some of the financial key ratios for Hca Healthcare are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.5% | 7.8% | 17.1% |

| FCF Margin | ROE | ROA |

| 6.9% | -210.2% | 12.3% |

Analysis

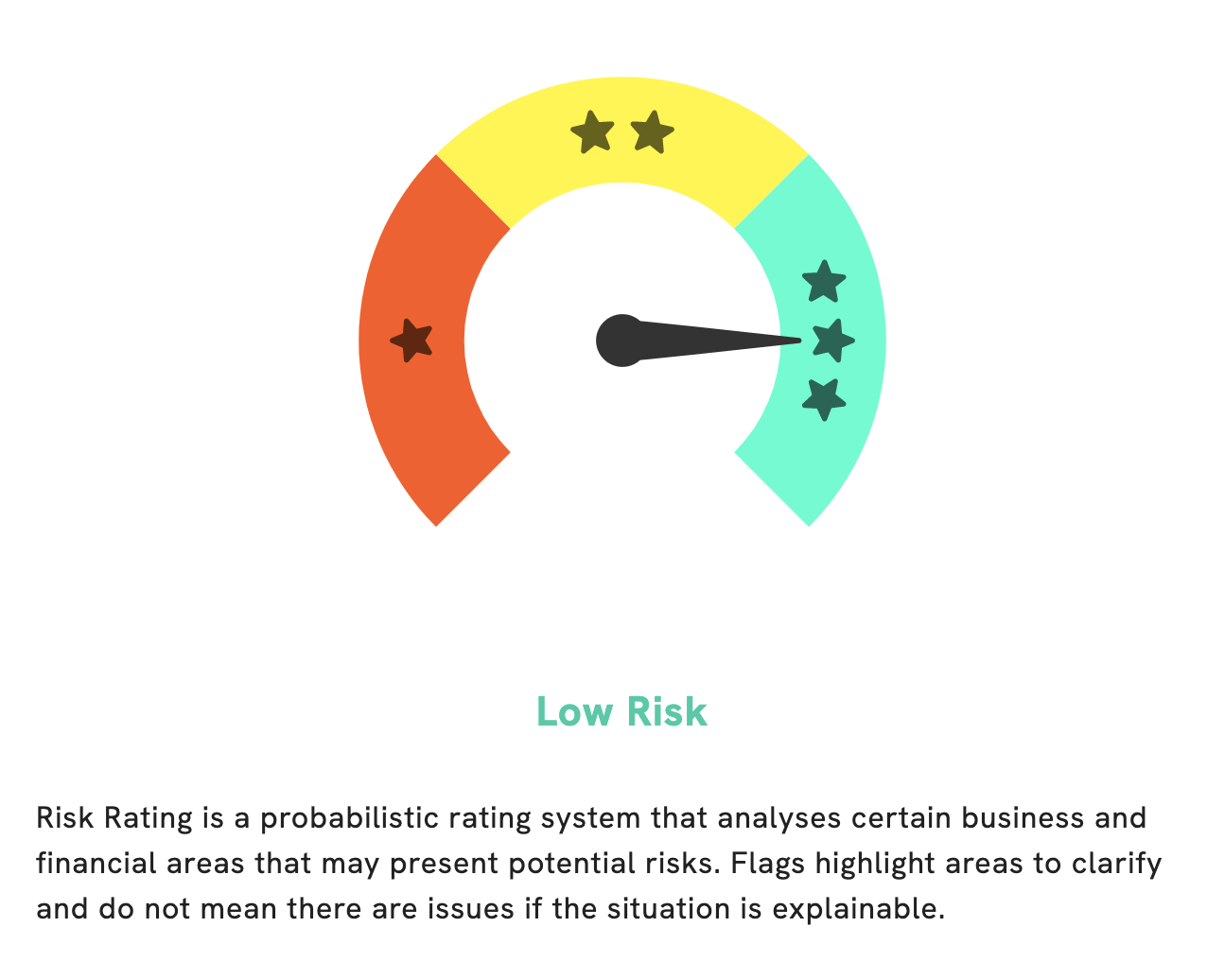

GoodWhale has examined the fundamentals of HCA HEALTHCARE and provided an analysis. GoodWhale’s analysis also considered potential risks in these areas, such as competitive threats or changes in legislation. We recommend that potential investors register with us to gain access to insights and recommendations on these potential risks. GoodWhale’s analysis looks at a range of financial metrics, including profitability, leverage and liquidity, to assess the financial health of the company. In addition, our analysis covers business areas such as market position, customer base and growth potential. Overall, GoodWhale’s rating of HCA HEALTHCARE as a low risk investment is based on our thorough evaluation of both financial and business elements. We believe that this rating provides investors with the assurance that HCA HEALTHCARE is a sound investment choice. Furthermore, those interested in further assessing the potential risks associated with HCA HEALTHCARE are encouraged to register with us to gain access to our insights and recommendations. More…

Peers

HCA Healthcare Inc is a healthcare company that operates in the United States. The company’s competitors include Universal Health Services Inc, Tenet Healthcare Corp, and Community Health Systems Inc.

– Universal Health Services Inc ($NYSE:UHS)

Universal Health Services, Inc. is one of the largest healthcare management companies in the United States. The company owns and operates hospitals, physician groups, ambulatory surgery centers, and other healthcare facilities. Universal Health Services is headquartered in King of Prussia, Pennsylvania.

– Tenet Healthcare Corp ($NYSE:THC)

Tenet Healthcare Corporation is an American for-profit healthcare services company based in Dallas, Texas. through its subsidiaries, the company owns and operates hospitals, outpatient facilities, and Conifer Health Solutions, a health services company. As of February 2021, Tenet operated 79 hospitals and more than 470 outpatient centers in the United States.

– Community Health Systems Inc ($NYSE:CYH)

Community Health Systems Inc (CHS) is a for-profit operator of general acute care hospitals. As of 2022, it has a market capitalization of 311.19 million and a return on equity of -48.01%. The company’s hospitals offer a wide range of services, including emergency care, surgery, laboratory and imaging services. CHS also owns and operates a number of home health, hospice and outpatient facilities.

Summary

HCA Healthcare reported strong earnings results for the fourth quarter of FY2022, with total revenue increasing by 14.9% year-over-year and net income increasing by 2.9%. This marked yet another period of positive growth for the company and is a positive sign for potential investors. HCA Healthcare’s strong financial results are driven by a combination of increased sales and operational efficiencies. The company’s ability to efficiently manage its operations and generate profits has enabled it to deliver consistent growth over the past several quarters. As a result, HCA Healthcare has become an attractive target for investors interested in healthcare-related investments. Furthermore, HCA Healthcare’s strong performance reflects its commitment to innovation and customer service.

The company has invested heavily in the development of new products and services to better serve its customers. This has contributed to its ability to generate consistent revenue growth and improved its position in the healthcare industry. Overall, HCA Healthcare’s strong performance in the fourth quarter of FY2022 is a positive sign for potential investors. The company’s ability to generate consistent revenue growth and improved efficiency indicate that it is well-positioned to continue delivering positive financial results in the foreseeable future. As such, HCA Healthcare is an attractive option for investors looking to capitalize on healthcare-related investments.

Recent Posts