HARSCO CORP Reports Fourth Quarter Fiscal Year 2022 Earnings Results on February 27 2023.

March 19, 2023

Earnings Overview

HARSCO CORP ($BER:HA7) revealed its financial performance for the fourth quarter of fiscal year 2022, which ended on December 31 2022, on February 27 2023. Total revenue for the quarter was reported at USD -36.7 million, a decline of 50.9% from the same period in the prior year. Net income for the quarter was USD 468.3 million, representing a year-over-year growth of 1.3%.

Share Price

The company opened the day with a stock priced at €7.6 and finished the day at the same price, marking a 4.4% drop from its prior closing price of €7.9. The decrease in stock price was due to the announcement of the earnings results, which revealed a major decrease in profits from the previous quarter. This significant drop in profits and revenue was attributed to several factors including increased competition in the industry, higher costs related to certain projects, and a saturated market. Despite the decrease in profits and revenue, there were some positive takeaways from the earnings report.

Additionally, HARSCO CORP remained competitive with its peers during the quarter and has positioned itself for long-term growth by investing in new technologies and acquiring complementary businesses. Overall, HARSCO CORP experienced a decrease in profits and revenue during its fourth quarter fiscal year 2022 earnings report, however, the company remains committed to long-term growth and efficiency. Investors should look for potential cost savings opportunities as well as acquisitions and investments in new technologies as HARSCO CORP moves forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Harsco Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.89k | -180.07 | -3.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Harsco Corp. More…

| Operations | Investing | Financing |

| 150.53 | -99.06 | -42.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Harsco Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.79k | 2.17k | 7.16 |

Key Ratios Snapshot

Some of the financial key ratios for Harsco Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.9% | -13.0% | -2.5% |

| FCF Margin | ROE | ROA |

| 0.7% | -5.2% | -1.1% |

Analysis

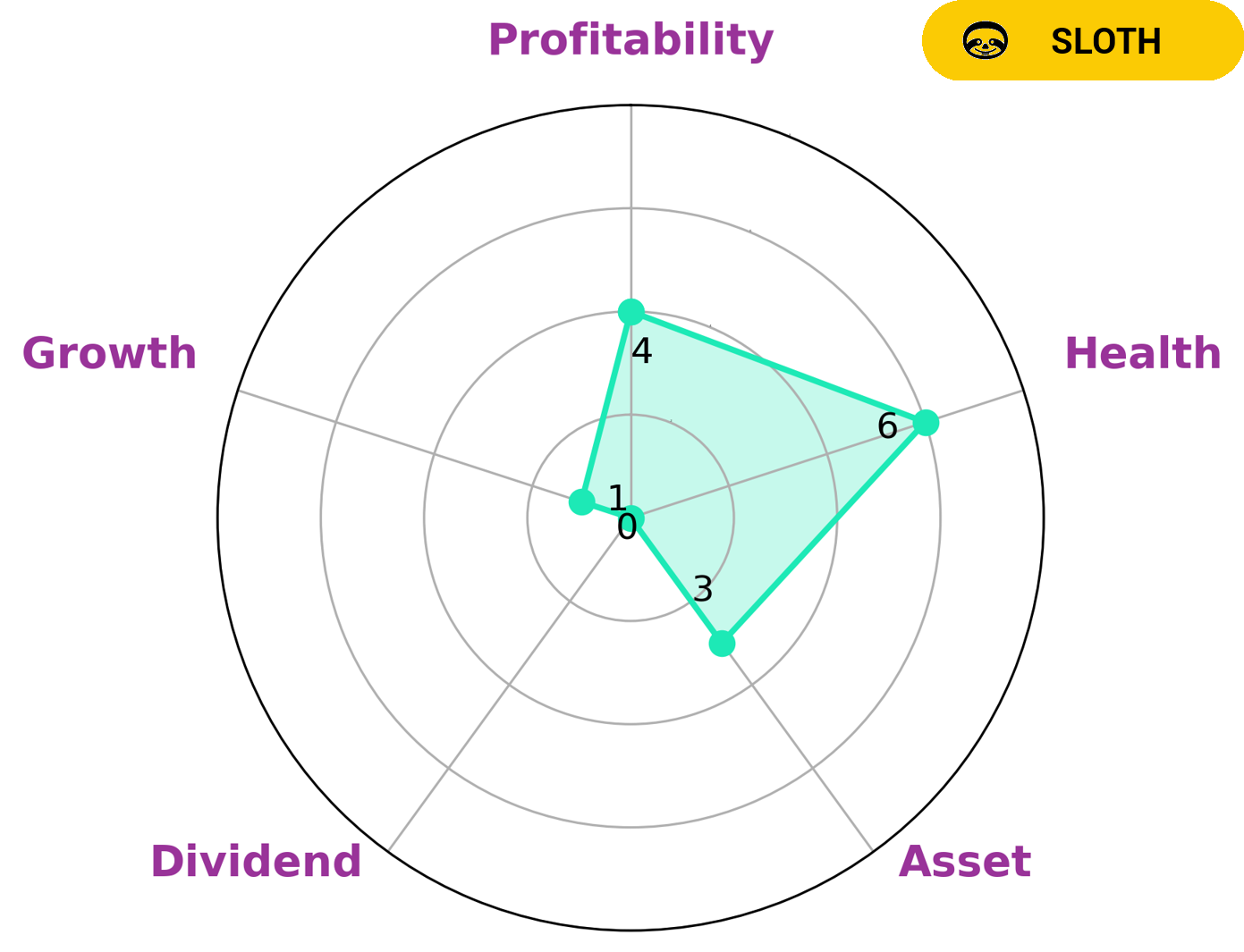

GoodWhale’s analysis of HARSCO CORP‘s financials shows that the firm has an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that it will be able to pay off its debt and fund future operations. The company is relatively strong in liquidity, medium in profitability, and weak in asset, dividend, and growth. Based on this data, we classify HARSCO CORP as a ‘sloth’ – a type of company which has achieved revenue or earnings growth slower than the overall economy. Investors who prioritize steady and reliable growth may be interested in such companies, as they may provide stability and a consistent return. More…

Summary

HARSCO CORP reported its Q4 FY 2022 earnings on February 27 2023, with total revenue of USD -36.7 million, a 50.9% decrease compared to the same period of the previous year. Net income was reported at USD 468.3 million, a 1.3% growth year over year. Despite this positive growth in net income, investors responded negatively to the financial results and the stock price dropped on the same day. Analysts may be hesitant to invest in the company given its current financial situation, but a more in-depth analysis of HARSCO CORP’s financial performance and future outlook can provide a better understanding of the potential investment opportunities.

Recent Posts