H.B. FULLER Reports Q4 Earnings: Revenue Down 25.4%, Net Income Rises 6.8% Year-over-Year

January 31, 2023

Earnings report

H.B. FULLER ($NYSE:FUL), a leading chemical and adhesive manufacturing company, reported their fourth quarter earnings results for the period ending November 30 2022 on January 19 2023. The company’s total revenue was USD 48.3 million, a decrease of 25.4% from the same period the year before. Despite this decrease, the company was able to generate a net income of USD 958.2 million, a 6.8% increase year over year. H.B. FULLER is a publically traded company that specializes in adhesives, sealants, and other specialty chemicals. Their products are used in a variety of industries, including construction, transportation, packaging, and healthcare. The company’s portfolio includes products such as construction adhesives, food-grade adhesives, and industrial sealants, among others. The company’s Q4 earnings report is a testament to the resilience of the company and its ability to remain profitable even in difficult market conditions. Their cost-cutting measures, such as layoffs and restructuring, have allowed them to remain competitive despite the financial challenges of the past year.

Additionally, the company’s focus on innovation has allowed them to remain at the forefront of their industry and to continue providing quality products and services to their customers. Overall, H.B. FULLER’s fourth quarter earnings report showed that despite difficult market conditions, the company was able to remain profitable and continue generating revenue. This is a testament to their innovation and cost-cutting measures, which have enabled them to remain competitive in a challenging market environment.

Stock Price

H.B. FULLER reported their fourth quarter earnings on Thursday and the results were mixed. Revenue was down 25.4% from the same period last year, but net income rose 6.8%. H.B. FULLER stock opened at $71.5 and closed at $69.1, down by 3.8% from its previous closing price of 71.8. The decline in revenue can be attributed to the current global health crisis, which has had a major impact on the company’s operations and sales. H.B. FULLER saw a significant decrease in demand for their products, as well as higher costs due to decreased efficiency in their production process. Despite these challenges, the company managed to increase their net income due to cost-cutting measures and other financial initiatives. Overall, H.B. FULLER is optimistic about their future prospects and is looking to invest more in research and development in order to drive growth in the coming quarters. The company has also announced plans to expand their portfolio of products and services in order to better meet customer needs.

In addition, they are looking to increase their presence in emerging markets and improve their efficiency to reduce costs. Overall, it’s clear that H.B. FULLER is taking the necessary steps to weather the storm of this global health crisis and emerge stronger than ever before. With a focus on cost-cutting measures, product innovation, and increased efficiency, the company is well-positioned for success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for H.b. Fuller. More…

| Total Revenues | Net Income | Net Margin |

| 3.75k | 180.31 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for H.b. Fuller. More…

| Operations | Investing | Financing |

| 256.51 | -375.29 | 160.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for H.b. Fuller. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.46k | 2.85k | 30 |

Key Ratios Snapshot

Some of the financial key ratios for H.b. Fuller are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.0% | 12.6% | 9.2% |

| FCF Margin | ROE | ROA |

| 3.4% | 13.5% | 4.8% |

VI Analysis

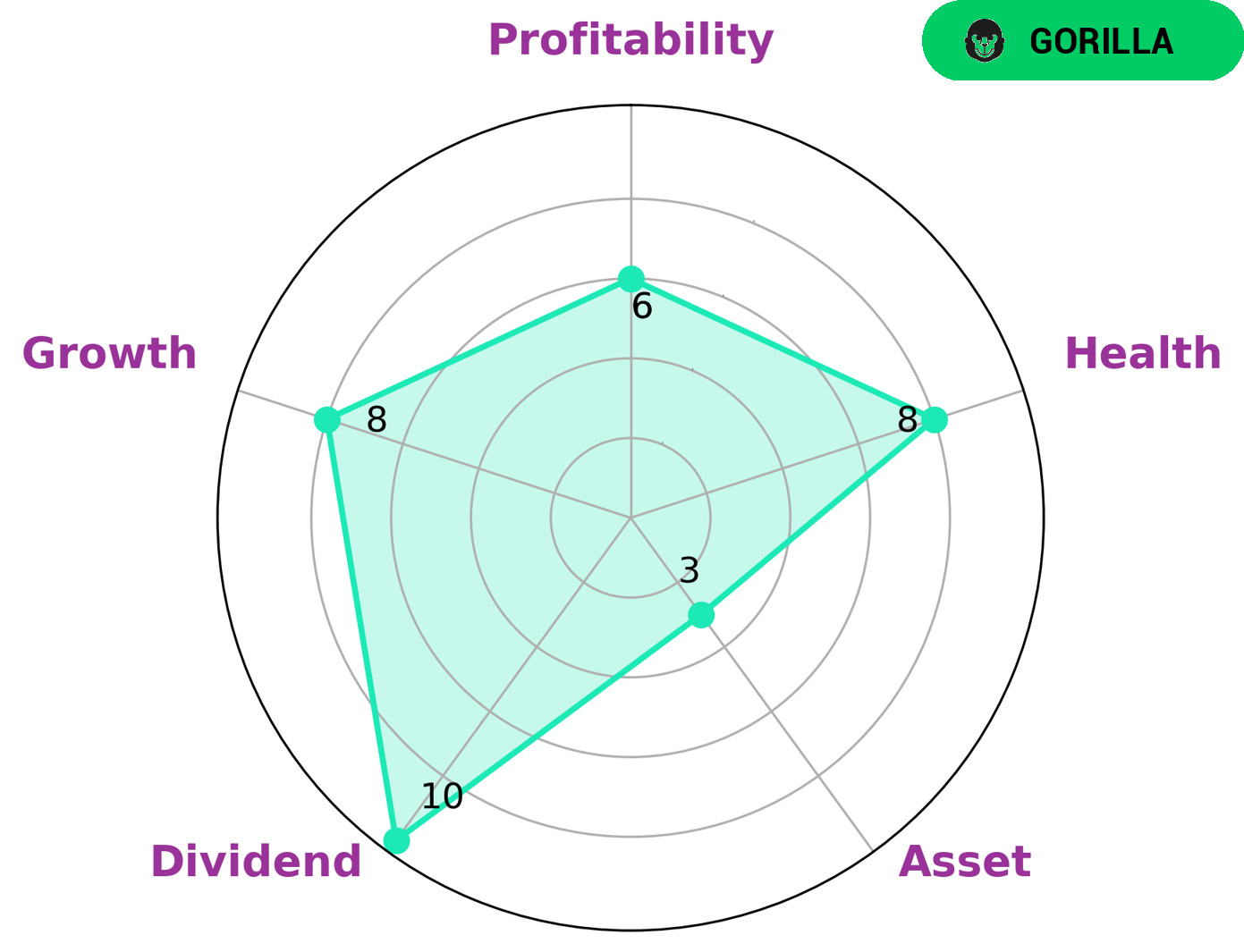

Company fundamentals are a good indicator of its long-term potential. The VI app makes it easier to assess the health of a company, like H.B. FULLER, which has a high health score of 8/10. This score is based on the company’s cashflows and debt and it means that H.B. FULLER is equipped to handle a crisis and sustain future operations. It is also classified as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earning growth due to its competitive advantage. Investors interested in H.B. FULLER may be attracted to its dividend potential, growth potential, and medium profitability. However, it’s weaker when it comes to assets. Such investors could include those who are looking for long-term investments with high returns, or those looking for more short-term gains through capital appreciation. Overall, H.B. FULLER is a company with good fundamentals and a strong competitive advantage. It is well-equipped to handle times of crisis and maintain its long-term potential for investors. More…

VI Peers

H.B. Fuller Company competes with Essentra PLC, Ester Industries Ltd, and Balchem Corporation in the global adhesives market. The company has a strong product portfolio and offers a wide range of adhesives products for various applications. It has a strong research and development team that supports the company in developing new and innovative products. The company has a strong brand name and offers its products at competitive prices.

– Essentra PLC ($LSE:ESNT)

Essentra PLC is a multinational company that manufactures and sells small plastic and fibre products. Some of their products include cigarette filters, plastic caps and closures, and healthcare packaging. The company has a market cap of 636.57M as of 2022 and a Return on Equity of 5.25%.

– Ester Industries Ltd ($BSE:500136)

Ester Industries Ltd is a publicly traded company with a market capitalization of 14.81 billion as of 2022. The company has a return on equity of 23.17%. Ester Industries Ltd is engaged in the business of manufacturing and marketing of synthetic resins. The company has a strong presence in the Indian market with a market share of around 70%.

– Balchem Corp ($NASDAQ:BCPC)

Balchem Corporation, together with its subsidiaries, develops, manufactures, and markets specialty performance ingredients and products for the food, nutritional, feed, pharmaceutical, and medical sterilization industries in the United States and internationally. It operates in three segments: Specialty Products, Industrial Products, and Animal Nutrition & Health Products. The company was founded in 1967 and is headquartered in New Hampton, New York.

Summary

H.B. FULLER reported its fourth quarter earnings for the period ending November 30, 2022 on January 19, 2023. While total revenue decreased 25.4% year over year, net income rose 6.8% from the previous year to USD 958.2 million. Despite this, the stock price moved down the same day. Investors in H.B. FULLER should consider the company’s performance when determining their investment strategy. Generally, investors are looking for companies that demonstrate strong financial performance and have consistent revenue growth. While H.B. FULLER experienced a decrease in total revenue, its net income rose, indicating that the company is still generating profits.

This suggests that the company has implemented strategies to reduce costs and increase efficiency, which could be beneficial in the long run. In addition to the financial performance, investors should also look at the company’s management, products and services, and competitive landscape. Understanding these aspects of the business can help investors decide if H.B. FULLER is a good investment option. Further research into the company’s operations and strategies can help investors make informed decisions when investing in H.B. FULLER.

Recent Posts