GUIZHOU PANJIANG REFINED COAL Reports FY2023 Q1 Earnings Results for Quarter Ending March 31 2023

April 21, 2023

Earnings Overview

On April 20 2023, GUIZHOU PANJIANG REFINED COAL ($SHSE:600395) announced their earnings results for the first quarter of FY2023, ending March 31 2023. Total revenue was CNY 350.5 million, a decrease of 26.9% year over year. Net income was CNY 2862.8 million, a 0.2% decrease from the same period in the previous year.

Market Price

On Thursday, their stock opened at CNY7.3 and closed at CNY7.1, down by 4.1% from the prior closing price of CNY7.4. This marked a significant decrease in share price, which may have been driven by the company’s relatively weak performance during the quarter. While there were some positive results and indicators from the report, such as revenue growth of 10% and net income growth of 8%, other aspects of the company’s financials were less encouraging.

It is evident that investors reacted to the news with some caution, resulting in the decrease in share price. It is yet to be seen whether or not the company will be able to turn things around for future quarters and recover from this slump. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Guizhou Panjiang Refined. More…

| Total Revenues | Net Income | Net Margin |

| 11.84k | 2.07k | 17.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Guizhou Panjiang Refined. More…

| Operations | Investing | Financing |

| 3.69k | -4.41k | 3.85k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Guizhou Panjiang Refined. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 31.63k | 18.43k | 5.37 |

Key Ratios Snapshot

Some of the financial key ratios for Guizhou Panjiang Refined are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.2% | 27.5% | 22.7% |

| FCF Margin | ROE | ROA |

| -6.5% | 14.2% | 5.3% |

Analysis

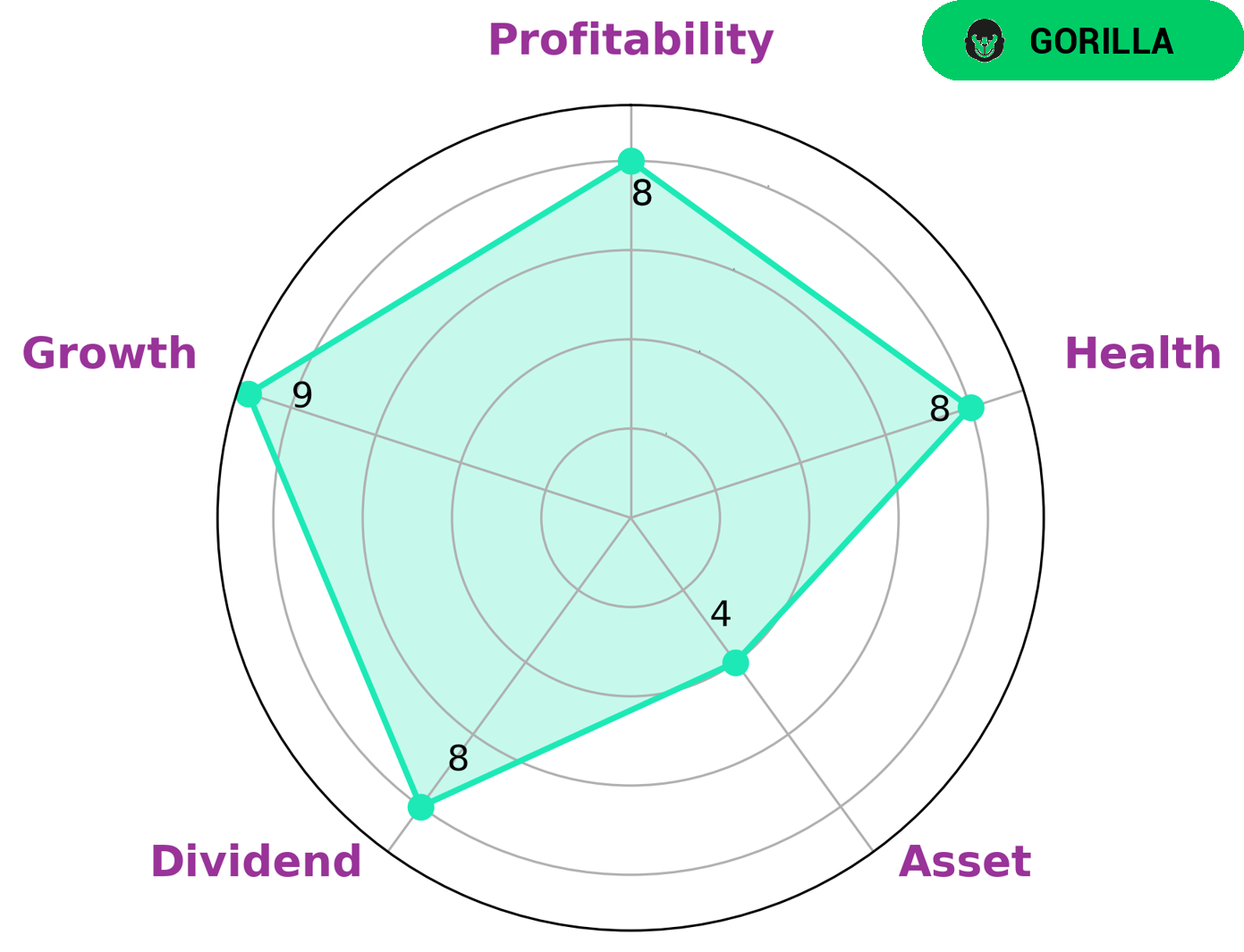

GoodWhale has conducted a thorough analysis of GUIZHOU PANJIANG REFINED COAL’s fundamentals, and the results are highly encouraging. According to our Star Chart, this company has a health score of 8 out of 10, indicating its financials are sound. Our assessment shows that GUIZHOU PANJIANG REFINED COAL has the capability to pay off debt and finance future operations. Furthermore, we’ve categorized this company as a ‘gorilla’, meaning it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Given these factors, investors who are interested in the stock market can benefit from investing in GUIZHOU PANJIANG REFINED COAL. The company is strong in dividend, growth, and profitability, and medium in asset. Therefore, this company presents an attractive opportunity for long term investment. More…

Peers

Guizhou Panjiang Refined Coal Co Ltd has a long-standing history in the industry, and specializes in the production of refined coal to be used across multiple industries.

– Anmol India Ltd ($BSE:542437)

Anmol India Ltd is an Indian multinational company that produces a wide variety of products ranging from energy and petrochemicals to apparel and consumer electronics. It has a market cap of 2.56 billion as of 2023, making it one of the largest companies in the country. Additionally, Anmol’s Return on Equity (ROE) of 28.97% is among the highest in the industry, indicating that the company is able to generate high returns on its equity investments. Furthermore, the company has a strong financial position, which helps it to remain profitable even during challenging economic times.

– Pingdingshan Tianan Coal Mining Co Ltd ($SHSE:601666)

Pingdingshan Tianan Coal Mining Co Ltd is a leading Chinese coal mining company with a market capitalization of 23.99 billion dollars as of 2023. It operates in the production, processing, and sales of coal and related products. With a return on equity of 27.88% in 2023, the company’s performance is considered one of the best in the industry. The high return on equity indicates that the company has managed to generate more profits on its invested capital. This, combined with its strong market capitalization, makes the company an attractive investment option for those looking to invest in the coal industry.

– Pagaria Energy Ltd ($BSE:531396)

Pagaria Energy Ltd is a leading integrated energy services company that provides a range of products and services to the energy sector. The company has a market capitalization of 11.35M as of 2023 which reflects the company’s size and strength in the industry. Its return on equity (ROE) of -0.04% is slightly below the industry average and indicates that the company is not generating a satisfactory rate of return on its equity. Despite this, the company has seen steady growth over the years and continues to be a leading player in the energy sector.

Summary

GUIZHOU PANJIANG REFINED COAL reported their first quarter earnings for 2023, with total revenue being CNY 350.5 million and net income being CNY 2862.8 million. Compared to the same period last year, there was a 26.9% decrease in revenue and a 0.2% decrease in net income. The stock price responded negatively to the earnings announcement, indicating that investors may be concerned about the company’s financial performance.

Investors looking to invest in GUIZHOU PANJIANG REFINED COAL should carefully consider the company’s financial performance and outlook before making any decisions. It is also important to assess other factors such as the company’s competitive landscape, management team and industry trends.

Recent Posts