GLP Intrinsic Stock Value – Global Partners LP Reports Strong Earnings Results for Q3 2023

November 26, 2023

☀️Earnings Overview

On November 9th, 2023, GLOBAL PARTNERS LP ($NYSE:GLP) announced their earnings results for the 3rd quarter of 2023, ending on September 30th, 2023. Total revenue for the quarter decreased year-on-year by 8.8%, reaching USD 4221.0 million. Unfortunately, there was a substantial decrease in net income as well, totalling at USD 26.8 million, falling by 75.9% compared to the same quarter in the previous year.

Price History

GLOBAL PARTNERS LP reported strong earnings for the third quarter of 2023 on Thursday. The company’s stock opened at $31.4 and closed at $31.8, signaling a 1.1% increase from the previous closing price of $31.5. The company attributed its strong earnings to strong demand for its products and services in the energy sector. GLOBAL PARTNERS LP specializes in the transportation, storage, and marketing of petroleum and energy products, which have seen a surge in demand due to the resurgence of the global economy.

The company also reported that its strategic investments in the energy industry have paid off, allowing it to capitalize on the growing demand for its products and services. Overall, GLOBAL PARTNERS LP reported a successful quarter of strong earnings and stock performance, signaling a positive outlook for the company in the coming months. The strong results suggest that GLOBAL PARTNERS LP is continuing to capitalize on the growth of the energy sector and is well-positioned to benefit from continued growth in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GLP. More…

| Total Revenues | Net Income | Net Margin |

| 16.51k | 132.15 | 0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GLP. More…

| Operations | Investing | Financing |

| 246.12 | -163.3 | -87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GLP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.05k | 2.28k | 22.8 |

Key Ratios Snapshot

Some of the financial key ratios for GLP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.3% | 9.8% | 1.5% |

| FCF Margin | ROE | ROA |

| 0.9% | 19.6% | 5.0% |

Analysis – GLP Intrinsic Stock Value

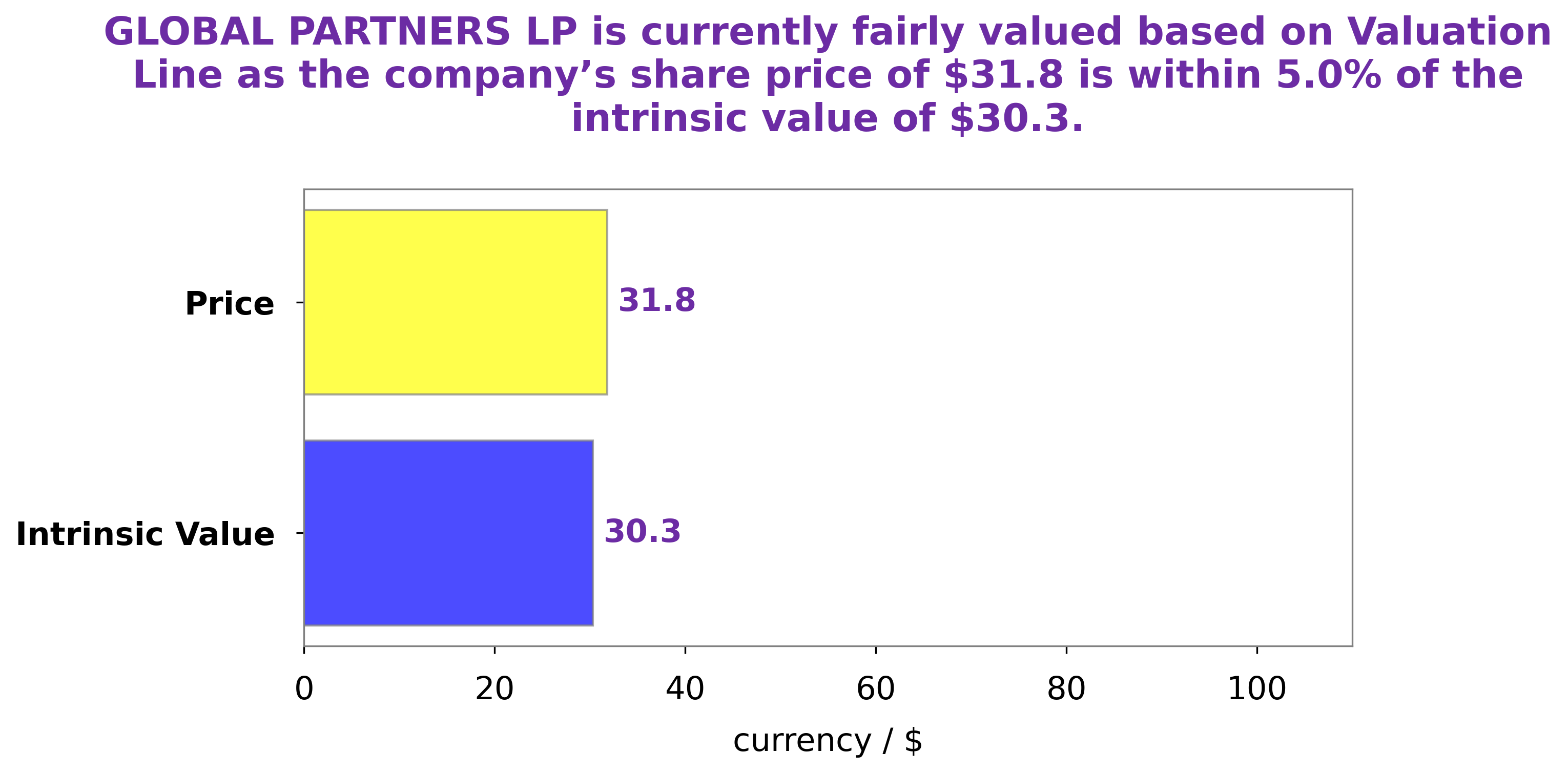

Our proprietary Valuation Line gives investors an accurate picture of a company’s fair value. After analyzing the financials of GLOBAL PARTNERS LP, we determined that the fair value of each share to be around $30.3. Currently, GLOBAL PARTNERS LP stock is trading at $31.8, making it a fair price that is overvalued by 4.9%. This could mean that investors are expecting the stock to perform better than the current fair value would suggest. It’s important for investors to take into account all factors before making their decision to buy or sell a stock. More…

Peers

Global Partners LP is one of the largest publicly traded partnerships and a leading independent owner, operator, and developer of midstream energy assets in North America. The company owns, controls, or has access to one of the largest terminal networks of refined petroleum products and renewable fuels in the Northeast. Global Partners competes with Martin Midstream Partners LP, YPF SA, and PBF Logistics LP.

– Martin Midstream Partners LP ($NASDAQ:MMLP)

Midstream Partners LP is a publicly traded partnership that owns, operates, and develops midstream assets in the United States. The company’s assets include crude oil and refined products pipelines, terminals, and storage facilities. Midstream Partners LP is headquartered in Houston, Texas.

– YPF SA ($NYSE:YPF)

YPF SA is an Argentine oil company with a market cap of 2.91B as of 2022. The company has a return on equity of 22.03%. YPF SA is engaged in the exploration, development, and production of oil and gas in Argentina. The company also produces and markets natural gas, electricity, and petrochemicals.

– PBF Logistics LP ($NYSE:PBFX)

PBF Logistics LP is a master limited partnership that owns, leases, operates and develops crude oil and refined petroleum products terminals, pipelines, storage tanks and trucks. As of December 31, 2020, the company’s assets included 27 terminals, six pipelines and two trucking fleets with a total capacity of approximately 33.5 million barrels.

PBF Logistics LP has a market cap of 1.33B as of December 31, 2020. The company’s Return on Equity for 2020 was 43.63%.

PBF Logistics LP is engaged in the business of owning, leasing, operating and developing crude oil and refined petroleum products terminals, pipelines, storage tanks and trucks. The company’s terminals are located in California, Louisiana, New Jersey, Ohio and Texas. The company’s pipelines transport crude oil and refined products in Ohio and Texas. The company’s trucking fleet delivers crude oil and refined products to customers in Ohio and Texas.

Summary

GLOBAL PARTNERS LP reported their third quarter earnings ending September 30 2023 on November 9 2023. The company’s total revenue for the quarter was USD 4221.0 million, representing an 8.8% decrease year-on-year.

Additionally, net income declined by 75.9% to USD 26.8 million from the same quarter in the prior year. Investors should assess current financial performance and market trends when considering an investment in GLOBAL PARTNERS LP and compare it to the company’s long-term goals and objectives. Additionally, investors should look at the company’s strategy for mitigating risks and look at how this might affect their return on investment.

Recent Posts