GLOBAL-E ONLINE Reports Q4 FY2022 Earnings with Total Revenue Decrease of 26.6% Year-on-Year

April 1, 2023

Earnings Overview

GLOBAL-E ONLINE ($NASDAQ:GLBE) announced their Q4 FY2022 earnings results on February 22 2023, with total revenue of -28.5 million USD, a decrease of 26.6% compared to the same period in the prior year. Net income was reported as 139.9 million USD, which is an increase of 69.1% from the same quarter in the previous year.

Transcripts Simplified

Q4 was another strong quarter of fast growth and strong cash generation as we continue to execute well on all fronts. We generated $839 million of GMV, an increase of 66% year-over-year. Total revenue of $139.9 million, up 69% year-over-year. Service revenues were $62.8 million, up 77%, and fulfillment services revenue were up 63% to $77 million.

Non-GAAP gross profit was $57.8 million, up 77% year-over-year, representing a gross margin of 41.3% compared to 39.5% in the same period last year. R& D expense in Q4, excluding stock-based compensation was $17.8 million or 12.8% of revenue compared to $8.4 million or 10.2% in the same period last year. Sales and marketing expense, excluding Shopify-related amortization expenses, stock-based compensation and acquisition-related intangibles amortization was $8 million or 5.7% of revenue compared to $6.7 million or $8.1 of revenue in the same period last year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Global-e Online. More…

| Total Revenues | Net Income | Net Margin |

| 409.05 | -195.41 | -47.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Global-e Online. More…

| Operations | Investing | Financing |

| 81.48 | -330.1 | 1.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Global-e Online. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.16k | 234.48 | 6.02 |

Key Ratios Snapshot

Some of the financial key ratios for Global-e Online are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 83.8% | – | -46.3% |

| FCF Margin | ROE | ROA |

| 17.9% | -12.9% | -10.2% |

Stock Price

The stock opened at $27.5 and closed at $29.5, soar by 13.0% from its previous closing price of 26.1. Revenue was mainly driven by the increase in digital products and digital services. Overall, GLOBAL-E ONLINE had a successful fourth quarter and their stock was able to soar by 13.0%. The company is currently in a good position to move forward with their plans and continue to expand their business. Live Quote…

Analysis

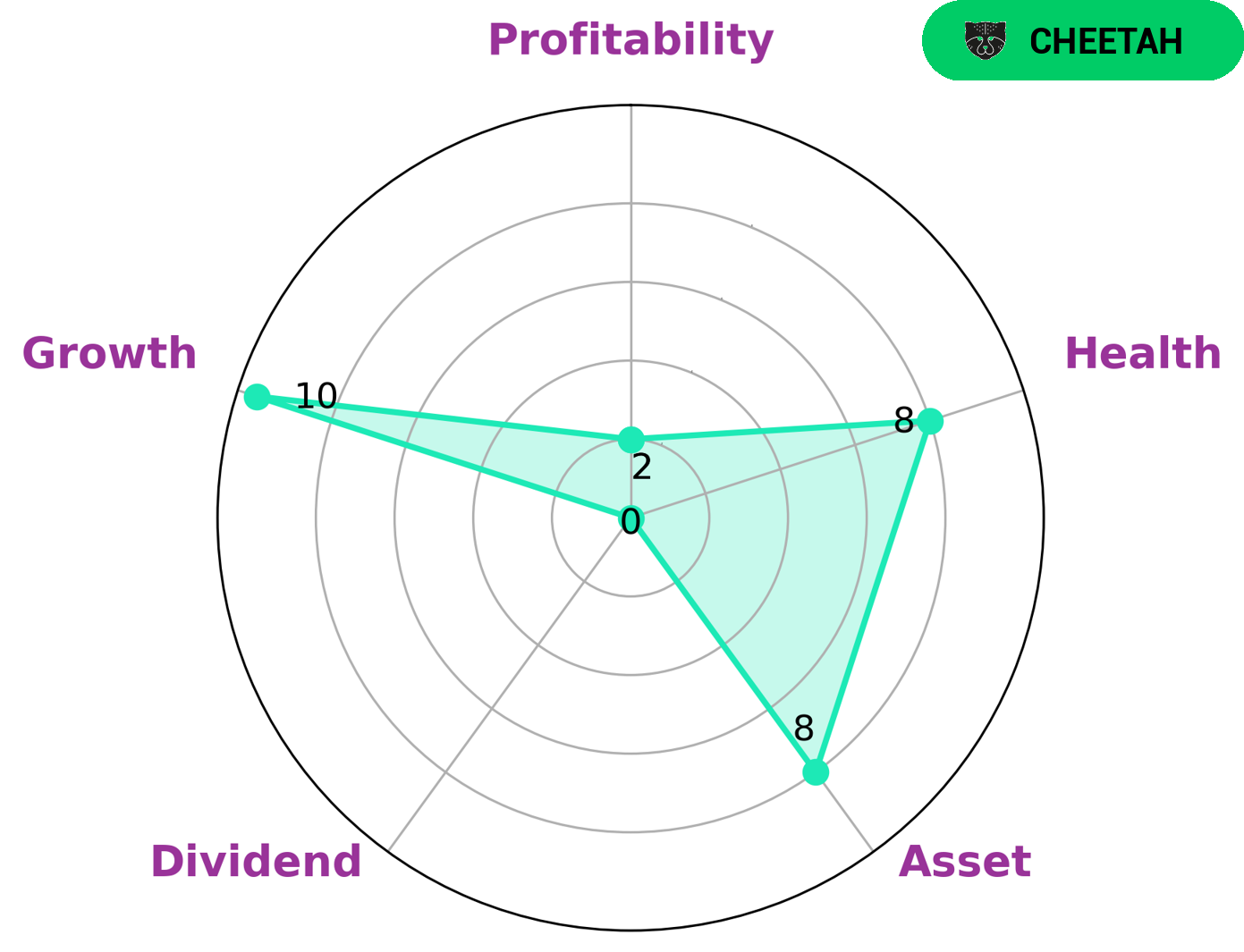

As GoodWhale, we analyzed the fundamentals of GLOBAL-E ONLINE and classified it as a ‘cheetah’ according to its Star Chart. This type of company generally has a high revenue or earnings growth, but is considered less stable due to lower profitability. Investors that may be interested in such company are those that are looking for a high growth potential investment despite more risks. Furthermore, GLOBAL-E ONLINE has a high health score of 8/10, meaning that it is capable to pay off debt and fund future operations. On the other hand, while it is strong in asset and growth, it is weak in dividend and profitability. More…

Peers

The competition between Global E Online Ltd and its competitors is fierce. Each company is trying to gain market share and increase profits. Global E Online Ltd has a strong presence in the online market, but its competitors are also very active.

– Shinsegae International Co Ltd ($KOSE:031430)

As of 2022, Shinsegae International Co Ltd has a market capitalization of 901.42 billion dollars and a return on equity of 58.75%. The company is involved in a variety of businesses, including retail, department stores, food and beverages, and more. It is one of the largest companies in South Korea and is headquartered in Seoul.

– PChome Online Inc ($TPEX:8044)

PChome Online Inc is a Taiwan-based company principally engaged in the provision of online services. The Company operates its business through three segments. Its first segment is the operation of PChome Online, an online platform in Taiwan. PChome Online’s main businesses include online marketplace, which offers products in categories, including consumer electronics, books, digital content, fashion and beauty, home and living, food and beverage, and others; online shopping mall, which offers products in categories, including 3C products, home appliances, books, fashion and beauty, furniture, food and beverage, mother and baby care products, digital content and others; and payment and logistics services. Its second segment is the operation of e-commerce platforms outside Taiwan, which is engaged in the operation of e-commerce platforms in Hong Kong and the United States. Its third segment is the provision of software development services.

– Allegro.EU SA ($LTS:0A5O)

Allegro.EU SA is a Polish e-commerce company with a market cap of 26.95B as of 2022. The company has a Return on Equity of 7.15%. Allegro.EU SA operates an online marketplace in Poland, which offers a wide range of products in categories including books, media, electronics, and fashion.

Summary

GLOBAL-E ONLINE reported their earnings for Q4 FY2022, showing a 26.6% year-over-year decrease in total revenue but a 69.1% increase in net income. The stock price reacted positively to this news, as investors likely saw the improved financial results as a sign of progress. It remains to be seen how this affects the company’s long-term outlook, but in the short-term, investors seem optimistic. Analysts will be closely watching the company’s upcoming guidance and developments in the industry to determine if GLOBAL-E ONLINE is a good investment opportunity.

Recent Posts