GITLAB INC Reports Financial Results for Fourth Quarter of 2023

March 23, 2023

Earnings Overview

GITLAB INC ($NASDAQ:GTLB) reported on March 13 2023 that total revenue for their fourth quarter ending January 31 2023 had increased by 15.4% from the same quarter the previous year, amounting to USD -38.7 million. Furthermore, their net income had risen 58.0% year over year, reaching USD 122.9 million.

Transcripts Simplified

Joining us for today’s discussion are Sid Sijbrandij, Chief Executive Officer; Charles Daubert, Chief Financial Officer; and Ray Blum, Chief Operating Officer. Sid: Thank you, everyone, for joining us today and thank you for your interest in GitLab. This is our first earnings call as a public company and we’re excited to share our first quarter results with you. We are extremely pleased with our first quarter performance and believe we are well-positioned to continue to deliver best-in-class value to customers. Ray: Our focus on customer success drove continued growth in our customer satisfaction metrics this quarter.

Sid: As we move forward, we remain focused on expanding our reach and delivering value to our customers. We will continue to invest in product innovation, go-to-market initiatives, and customer success programs to ensure that we remain the best choice for the long term. Thank you for joining us today, and we look forward to updating you on our progress in the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gitlab Inc. More…

| Total Revenues | Net Income | Net Margin |

| 424.34 | -172.31 | -40.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gitlab Inc. More…

| Operations | Investing | Financing |

| -77.41 | -605.69 | 97.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gitlab Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.17k | 344.48 | 5.1 |

Key Ratios Snapshot

Some of the financial key ratios for Gitlab Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 73.5% | – | -49.8% |

| FCF Margin | ROE | ROA |

| -19.7% | -17.2% | -11.3% |

Price History

GITLAB INC reported their financial results for the fourth quarter of 2023 on Monday. The stock opened at $42.8 and closed at $44.6, up by 0.6% from the last closing price of 44.4. This marks an increase in the company’s stock price from previous quarters.

This is the fourth consecutive quarter of revenue growth for GITLAB INC. Investors seem to be responding positively to these results and the stock price is up 0.6% from the last closing price. Live Quote…

Analysis

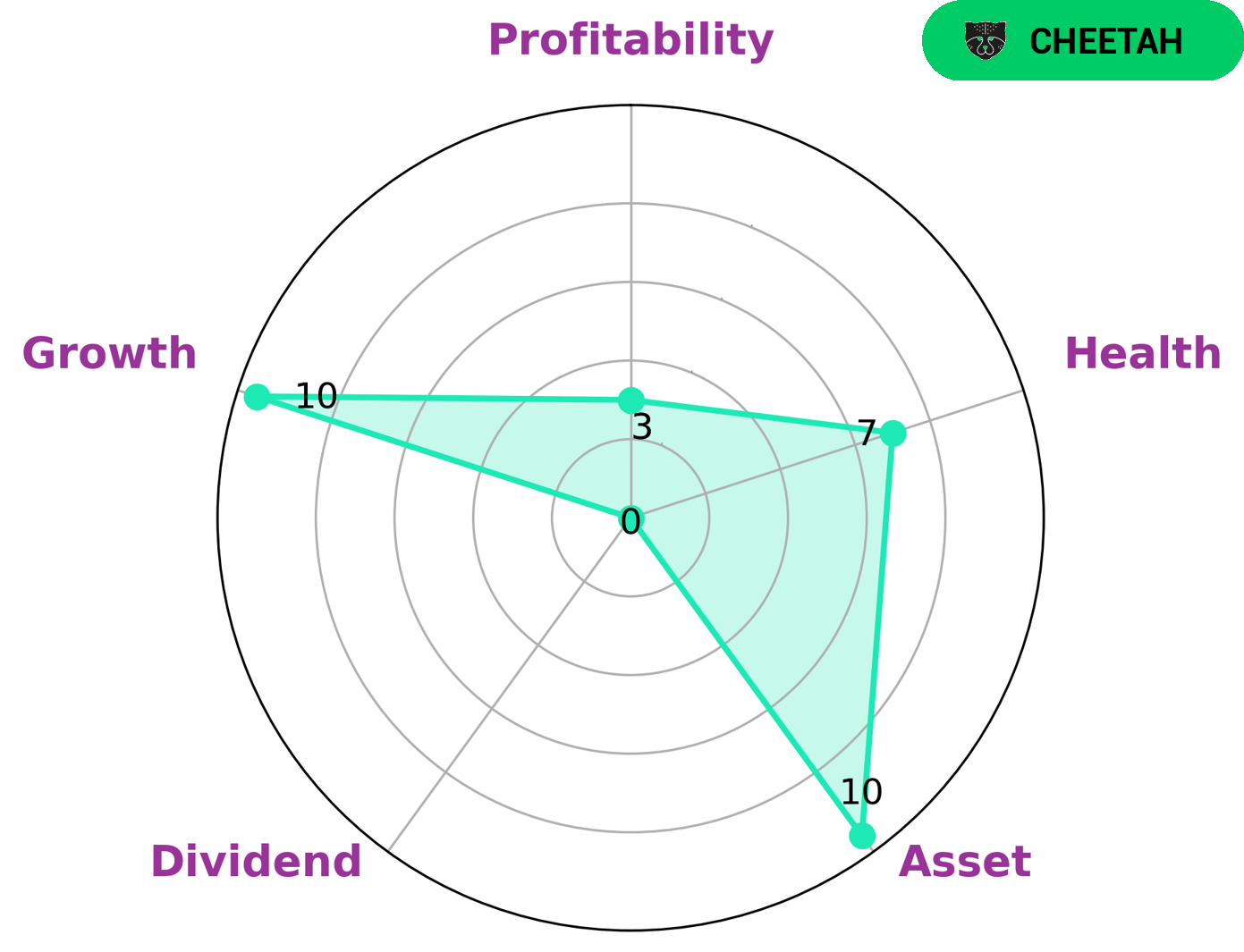

GoodWhale conducted an analysis of GITLAB INC‘s wellbeing and determined that according to Star Chart, GITLAB INC is strong in asset and growth and weak in dividend and profitability. We gave GITLAB INC a high health score of 7/10 with regard to its cashflows and debt, meaning it is capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, we classified GITLAB INC as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this information, we believe that investors interested in higher risk and higher return portfolios may be interested in such a company. These investors are likely looking for short-term gains in the stock market, and GITLAB INC may provide them with the opportunity to reap greater rewards than a lower-risk investment would. Additionally, these investors may be comfortable with the notion that their investments may be more volatile and may not be as stable as those of lower-risk businesses. More…

Peers

Its competitors are ATTRAQT Group PLC, UserTesting Inc, and Tymlez Group Ltd.

– ATTRAQT Group PLC ($LSE:ATQT)

FATRAQT Group PLC is a publicly traded company with a market capitalization of 60.47 million as of 2022. The company has a return on equity of -7.65%. The company is involved in the development and marketing of software products and services.

– UserTesting Inc ($NYSE:USER)

UserTesting Inc is a publicly traded company with a market capitalization of 1.07 billion as of 2022. The company has a return on equity of -27.62%. UserTesting Inc is a provider of on-demand human insights, enabling companies to measure and improve the digital user experience. The company was founded in 2007 and is headquartered in San Francisco, California.

– Tymlez Group Ltd ($ASX:TYM)

Tymlez Group Ltd is a technology company that provides enterprise software solutions. The company has a market cap of 19.79M and a Return on Equity of -82.23%. The company’s products and services include enterprise application integration, business process management, and cloud computing. Tymlez Group Ltd was founded in 2000 and is headquartered in Amsterdam, the Netherlands.

Summary

GITLAB INC reported strong financial results for their fourth quarter of 2023, with total revenue increasing 15.4% year over year and net income increasing 58.0% year over year. Investors should be impressed with these results, particularly given the challenging economic conditions in which the company was operating. Despite a challenging period, GITLAB INC was able to increase their revenue and profit significantly, indicating a strong and resilient business model. Going forward, investors should watch for signs of continued momentum in the company’s financial performance.

Recent Posts