Genworth Financial Reports Record-Breaking Earnings Results for FY2022 Q4

February 13, 2023

Earnings report

Genworth Financial ($NYSE:GNW), Inc., a leading U.S. financial services provider, reported its earnings results for the fourth quarter of Fiscal Year 2023 on February 6, 2023. The company’s total revenue for the quarter was USD 175.0 million, representing a 7.4% increase from the same quarter of the previous year. Net income for the quarter was USD 1895.0 million, an increase of 9.2% year over year. Genworth Financial is a publicly traded company listed on the New York Stock Exchange (NYSE: GNW). The company offers a wide range of financial services including life and health insurance, mortgage insurance, long-term care insurance and investment products.

In addition, the company provides retirement and annuity products to individuals. Genworth Financial also serves as an underwriter and administrator of group annuities and reinsurance products. The strong performance in Q4 of FY2022 resulted from the company’s financial strength and diversified operations. The company also achieved positive results in its life and long-term care segments. Overall, Genworth Financial achieved strong results in the fourth quarter of its fiscal year 2023. The company’s net income rose 9.2% year over year, while its total revenue saw a 7.4% increase from the same quarter of the previous year. This is a testament to the company’s financial strength and its ability to provide quality products and services to its customers.

Price History

On Monday, GENWORTH FINANCIAL reported record-breaking earnings results for the fourth quarter of their fiscal year 2022. The company’s stock opened on Monday at $5.7 and closed at $5.7, down by 1.0% from the last closing price of $5.8. Nevertheless, the company had a positive overall fiscal year, with record-breaking financial results. The increase in revenues was primarily driven by higher operating income across all segments of the business. This further highlighted the success of the company’s strategies for identifying and pursuing profitable growth opportunities.

Additionally, GENWORTH FINANCIAL reported a strong performance in their insurance segment, with higher operating income from both the annuity and life insurance businesses. This was partially offset by a decline in premium revenues, which were lower than during the same period last year. Their record-breaking financial results show that the company is well-positioned to continue to deliver strong results in the coming quarters and years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Genworth Financial. More…

| Total Revenues | Net Income | Net Margin |

| 7.51k | 609 | 8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Genworth Financial. More…

| Operations | Investing | Financing |

| 792 | 896 | -2.42k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Genworth Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 86.44k | 75.7k | 20.15 |

Key Ratios Snapshot

Some of the financial key ratios for Genworth Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.4% | – | 14.4% |

| FCF Margin | ROE | ROA |

| 10.6% | 7.0% | 0.8% |

Analysis

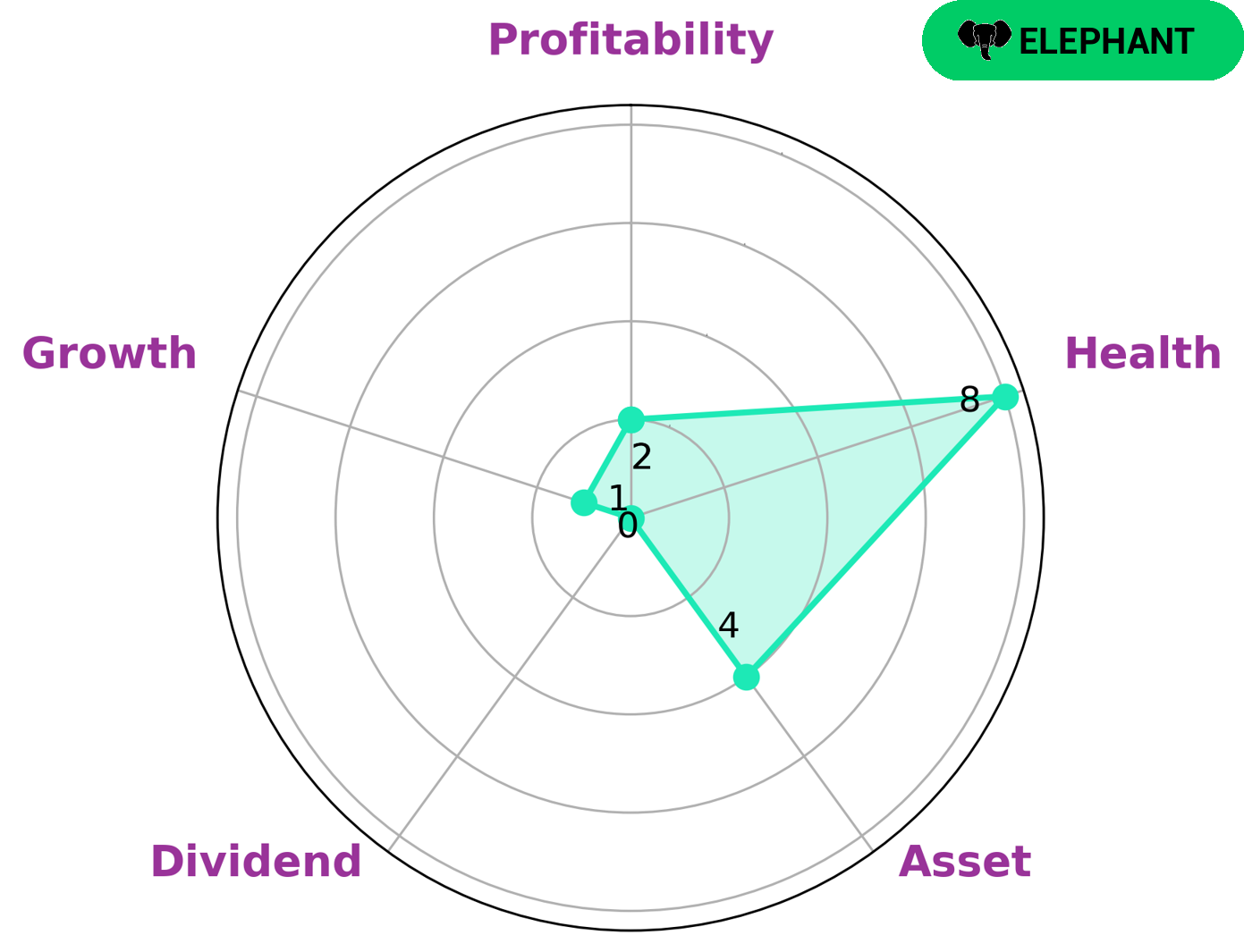

GoodWhale’s analysis of GENWORTH FINANCIAL‘s financials shows that the company has a high health score of 8/10 when it comes to its cashflows and debt, which indicates that it is capable of riding out almost any crisis without the risk of bankruptcy. In terms of other financial metrics, GENWORTH FINANCIAL is strong in cashflows, medium in assets, and weak in dividends, growth, and profitability. This classification as an ‘elephant’ type of company, which has a large amount of assets after subtracting liabilities, makes it attractive to a variety of investors. Those who are seeking stability and low risk may be particularly interested in GENWORTH FINANCIAL due to its high health score. Additionally, those looking for a more speculative investment may consider GENWORTH FINANCIAL for its strong cashflows, medium asset base, and potential for growth. Finally, those investors looking for a steady dividend income may be less keen on GENWORTH FINANCIAL due to its weak dividend yield. However, with its low risk profile, it may still be considered an attractive option for conservative investors. More…

Peers

In the insurance market, there are a few major competitors that stand out among the rest. Genworth Financial Inc is one such company that has been in competition with Great Eastern Holdings Ltd, Mercuries Life Insurance Co Ltd, and CIG Pannonia Life Insurance OJSC for quite some time now. All these companies are striving to provide the best possible products and services to their customers.

– Great Eastern Holdings Ltd ($SGX:G07)

Great Eastern Holdings Ltd is a holding company that provides life insurance and asset management products and services. The company has a market cap of 8.59B as of 2022 and a Return on Equity of 7.45%. Great Eastern Holdings Ltd is headquartered in Singapore.

– Mercuries Life Insurance Co Ltd ($TWSE:2867)

Mercuries Life Insurance Co Ltd is a life insurance company with a market cap of 17.14B as of 2022. The company has a Return on Equity of -13.78%. The company offers life insurance products and services to individuals and businesses.

– CIG Pannonia Life Insurance OJSC ($LTS:0P2E)

CIG Pannonia Life Insurance OJSC is a Romania-based company engaged in the insurance sector. The Company provides a range of life insurance products, including saving plans, unit-linked products, pension plans and health insurance.

Summary

GENWORTH FINANCIAL’s fourth quarter of FY2022 saw strong growth in both revenue and net income year over year. Total revenue for the quarter was USD 175.0 million, a 7.4% increase from the same quarter of the previous year, and net income was USD 1895.0 million, representing a 9.2% year-over-year increase. This performance reflects the company’s ability to effectively manage its operations and better align with current market conditions. Investors should look at GENWORTH FINANCIAL’s long-term track record to get an understanding of the company’s overall performance. Over the past three years, total revenue has grown steadily, while net income has seen more volatility.

Additionally, investors should consider the company’s financial position when evaluating potential investments in GENWORTH FINANCIAL. The company’s balance sheet is very healthy, with cash and cash equivalents accounting for a large percentage of assets. This provides GENWORTH FINANCIAL with strong liquidity and flexibility to pursue strategic initiatives. All in all, GENWORTH FINANCIAL’s recent performance indicates that it is well positioned for further growth in FY2023. The company’s strong financial position, combined with its reliable revenue growth, makes it an attractive option for investors looking for a stable long-term investment.

Recent Posts