GENWORTH FINANCIAL Reports FY2022 Q4 Earnings Results on February 6, 2023

March 20, 2023

Earnings Overview

GENWORTH FINANCIAL ($NYSE:GNW) announced their earnings results for FY2022 Q4 on February 6 2023, reporting total revenue of USD 175.0 million, a 7.4% rise from the same period in the previous year, and a net income of USD 1895.0 million, a 9.2% year-over-year increase from December 31 2022.

Transcripts Simplified

Genworth Financial had a strong fourth quarter and full year 2022, achieving important milestones such as debt target, capital return to shareholders, and ratings upgrades. These achievements have improved Genworth’s financial strength and allowed them to enter 2023 with more flexibility to invest in growth and continue returning capital to shareholders. The Board of Genworth authorized a share repurchase program of up to $350 million and has since repurchased $64 million worth of outstanding shares at an average price of less than $4 per share.

Genworth achieved their holding company debt target of $1 billion or less and ended the year with holding company debt under $900 million. They are working with the GSEs to remove the restrictions that were placed on an act, which should occur in the first quarter of this year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Genworth Financial. More…

| Total Revenues | Net Income | Net Margin |

| 7.51k | 609 | 8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Genworth Financial. More…

| Operations | Investing | Financing |

| 1.05k | 733 | -1.55k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Genworth Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 86.44k | 75.7k | 20.17 |

Key Ratios Snapshot

Some of the financial key ratios for Genworth Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.4% | – | 14.4% |

| FCF Margin | ROE | ROA |

| 14.0% | 7.0% | 0.8% |

Share Price

The company’s stock opened at $5.7 and closed at $5.7, representing a decrease of 1.0% from the previous closing price of $5.8. As one of America’s leading providers of life and long-term care insurance, GENWORTH FINANCIAL provides consumers with financial security and protection against future health care expenses. The company’s fourth quarter earnings report revealed that the company experienced higher net premiums and operating income compared to the same quarter in the previous year. This indicates that the company’s management has been effective in utilizing its resources for enhancing profitability.

In addition, GENWORTH FINANCIAL had a decrease in corporate expenses and taxes, resulting in an overall improvement in its operational performance. With the company’s strong fourth quarter performance, investors may be encouraged that GENWORTH FINANCIAL is on track to meet its long-term goals. Live Quote…

Analysis

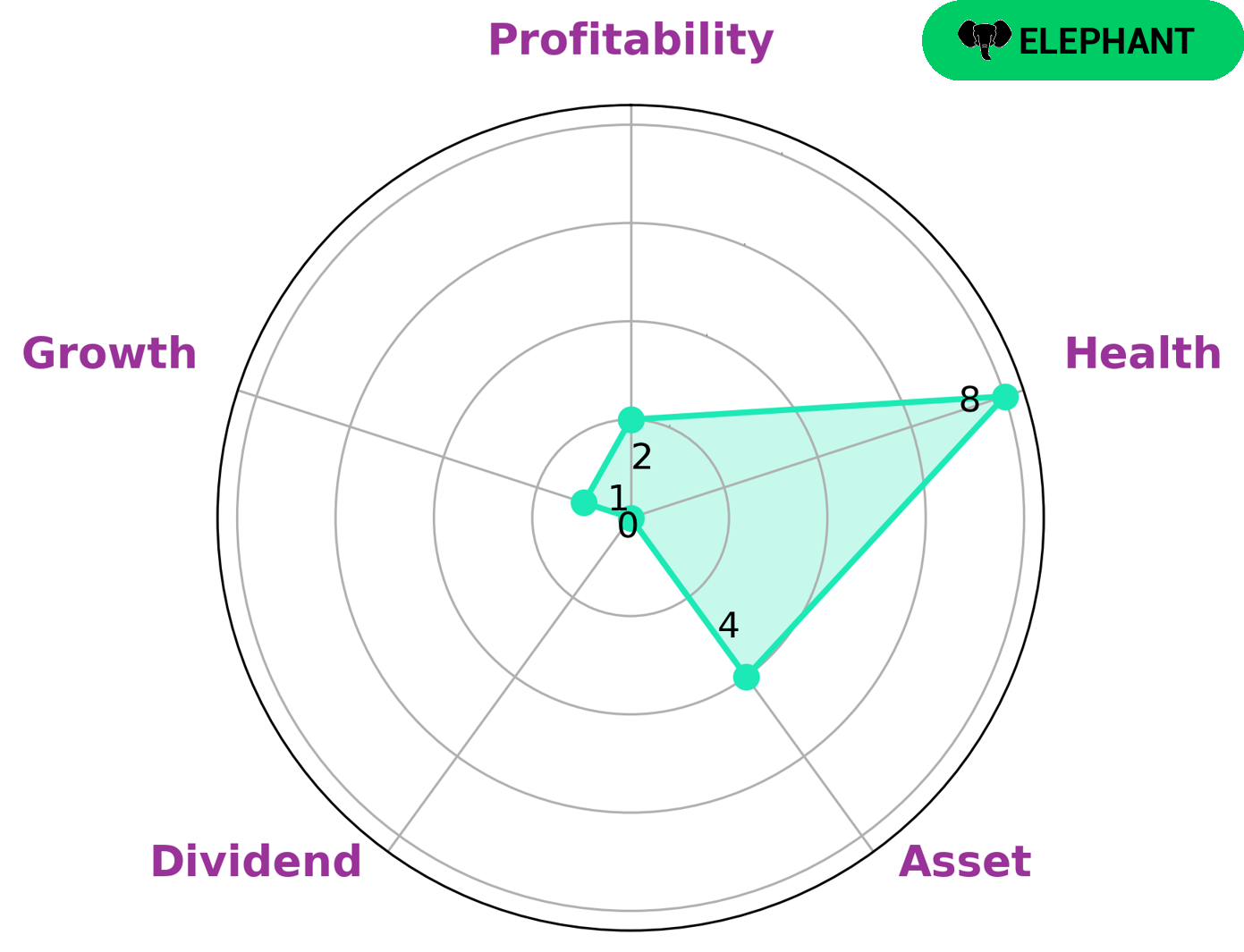

GoodWhale recently conducted an analysis of GENWORTH FINANCIAL‘s fundamentals. Our findings indicate that GENWORTH FINANCIAL has a high health score of 8/10 with regard to its cashflows and debt, making it capable of safely riding out any crisis without the risk of bankruptcy. Further analysis also revealed that GENWORTH FINANCIAL is strong in medium in asset and weak in dividend, growth, and profitability. Based on these findings, we have classified GENWORTH FINANCIAL as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. We believe this type of company could be attractive to investors who are seeking stability and long-term investments. Those looking for higher yields and quicker returns may find this type of company less suitable. More…

Peers

In the insurance market, there are a few major competitors that stand out among the rest. Genworth Financial Inc is one such company that has been in competition with Great Eastern Holdings Ltd, Mercuries Life Insurance Co Ltd, and CIG Pannonia Life Insurance OJSC for quite some time now. All these companies are striving to provide the best possible products and services to their customers.

– Great Eastern Holdings Ltd ($SGX:G07)

Great Eastern Holdings Ltd is a holding company that provides life insurance and asset management products and services. The company has a market cap of 8.59B as of 2022 and a Return on Equity of 7.45%. Great Eastern Holdings Ltd is headquartered in Singapore.

– Mercuries Life Insurance Co Ltd ($TWSE:2867)

Mercuries Life Insurance Co Ltd is a life insurance company with a market cap of 17.14B as of 2022. The company has a Return on Equity of -13.78%. The company offers life insurance products and services to individuals and businesses.

– CIG Pannonia Life Insurance OJSC ($LTS:0P2E)

CIG Pannonia Life Insurance OJSC is a Romania-based company engaged in the insurance sector. The Company provides a range of life insurance products, including saving plans, unit-linked products, pension plans and health insurance.

Summary

Investors in GENWORTH FINANCIAL were pleased to see strong results for the fourth quarter of FY 2022. Revenue increased by 7.4% year-over-year, reaching USD 175.0 million, and net income increased by 9.2%, reaching USD 1895.0 million. This was a positive sign for shareholders, as the company continues to invest in its services and products. With a steady growth rate, GENWORTH FINANCIAL is proving that it can remain competitive and profitable in a challenging economic environment.

Recent Posts