GENWORTH FINANCIAL Announces Financial Results for Fourth Quarter of FY2022

March 6, 2023

Earnings report

GENWORTH FINANCIAL ($NYSE:GNW) announced their financial results for the fourth quarter of FY2022, ending December 31, 2022 on February 6, 2023. Total revenue for the period was reported at USD 175.0 million, representing a 7.4% increase from the same quarter the previous year. Net income for the quarter was USD 1895.0 million, signifying an increase of 9.2% from the same period in the preceding year. The increased revenue and net income demonstrate that GENWORTH FINANCIAL continues to be a profitable and growing enterprise. The company has implemented various strategies to maximize their profits and position themselves well in the market.

They have also taken measures to minimize their risk profile, while still providing quality services to their customers. GENWORTH FINANCIAL is optimistic about the future and will continue to explore opportunities for growth and expansion. The company’s financial performance during this quarter is further evidence of their commitment to delivering excellence in all aspects of their business. Investors are encouraged by these strong financial results and are looking forward to further development in the coming quarters.

Share Price

The stock opened at $5.7 and closed at the same level, a decrease of 1.0% from the prior closing price of $5.8. This was partially offset by a decrease in the mortgage segment’s revenue, which decreased 3% year-over-year. The company has stated that it will continue to repurchase stocks in FY2023 to improve its capital position. It is expected that these positive results will continue in the future as well. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Genworth Financial. More…

| Total Revenues | Net Income | Net Margin |

| 7.51k | 609 | 8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Genworth Financial. More…

| Operations | Investing | Financing |

| 792 | 896 | -2.42k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Genworth Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 86.44k | 75.7k | 20.15 |

Key Ratios Snapshot

Some of the financial key ratios for Genworth Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.4% | – | 14.4% |

| FCF Margin | ROE | ROA |

| 10.6% | 7.0% | 0.8% |

Analysis

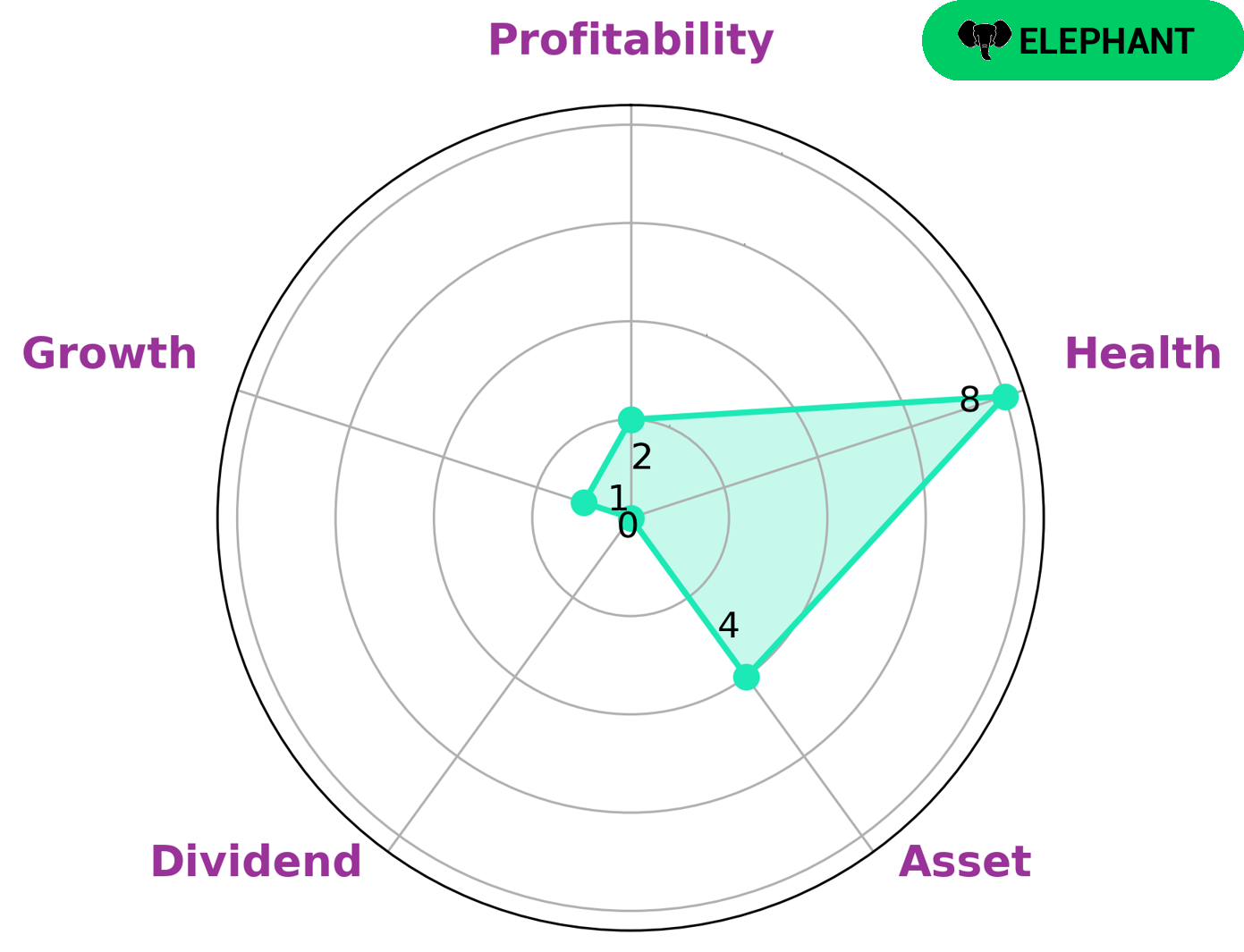

At GoodWhale, we have conducted an analysis of GENWORTH FINANCIAL‘s fundamentals. Based on our Star Chart, GENWORTH FINANCIAL is classified as an ‘elephant’, meaning it is rich in assets after deducting off liabilities. Considering its strengths, weak points, and financial health we anticipate that investors looking for a stable source of income and robust asset base would find GENWORTH FINANCIAL attractive. GENWORTH FINANCIAL has a medium score for asset utilization and weak scores for dividend, growth and profitability, but has a very strong financial health score of 8/10 in terms of cashflows and debt. This indicates that the company is likely to be able to ride out any financial crisis without the risk of bankruptcy. Overall, GENWORTH FINANCIAL has a solid financial foundation and offers investors an opportunity to benefit from its reliable income and robust asset base. More…

Peers

In the insurance market, there are a few major competitors that stand out among the rest. Genworth Financial Inc is one such company that has been in competition with Great Eastern Holdings Ltd, Mercuries Life Insurance Co Ltd, and CIG Pannonia Life Insurance OJSC for quite some time now. All these companies are striving to provide the best possible products and services to their customers.

– Great Eastern Holdings Ltd ($SGX:G07)

Great Eastern Holdings Ltd is a holding company that provides life insurance and asset management products and services. The company has a market cap of 8.59B as of 2022 and a Return on Equity of 7.45%. Great Eastern Holdings Ltd is headquartered in Singapore.

– Mercuries Life Insurance Co Ltd ($TWSE:2867)

Mercuries Life Insurance Co Ltd is a life insurance company with a market cap of 17.14B as of 2022. The company has a Return on Equity of -13.78%. The company offers life insurance products and services to individuals and businesses.

– CIG Pannonia Life Insurance OJSC ($LTS:0P2E)

CIG Pannonia Life Insurance OJSC is a Romania-based company engaged in the insurance sector. The Company provides a range of life insurance products, including saving plans, unit-linked products, pension plans and health insurance.

Summary

GENWORTH FINANCIAL reported strong financial performance for their latest quarter, with total revenue of USD 175.0 million, representing an increase of 7.4% year-over-year. Net income also saw a 9.2% increase, coming in at USD 1895.0 million. This is a positive sign for investors, showing that the company is performing well and is likely to continue doing so for the foreseeable future. Overall, GENWORTH FINANCIAL is a great investment opportunity for those looking for a reliable and profitable company.

Recent Posts