GAMBLING.COM GROUP Releases Earnings Report for FY2023 Q2 Ending June 30 2023

August 19, 2023

🌥️Earnings Overview

On August 17 2023, GAMBLING.COM GROUP ($NASDAQ:GAMB) released their earnings report for the second quarter of FY2023, ending June 30 2023. Total revenue had increased 63.1% year over year, reaching USD 26.0 million. Net income also grew, with 0.28 million reported compared to 0.06 million in the same period the previous year.

Market Price

The report revealed a 15.7% increase in stock price from the prior closing of 12.7, opening at $13.4 and closing at $14.7. This increase in mobile gaming revenue is attributed to the launch of new e-sports games, as well as an increase in mobile game downloads. This increase as well as the observed sales growth are both seen as highly positive signs for the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gambling.com Group. More…

| Total Revenues | Net Income | Net Margin |

| 93.66 | 4.72 | 17.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gambling.com Group. More…

| Operations | Investing | Financing |

| 23.48 | -16.04 | -8.09 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gambling.com Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 147.47 | 51.6 | 2.56 |

Key Ratios Snapshot

Some of the financial key ratios for Gambling.com Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 58.4% | 111.6% | 7.6% |

| FCF Margin | ROE | ROA |

| 16.4% | 4.6% | 3.0% |

Analysis

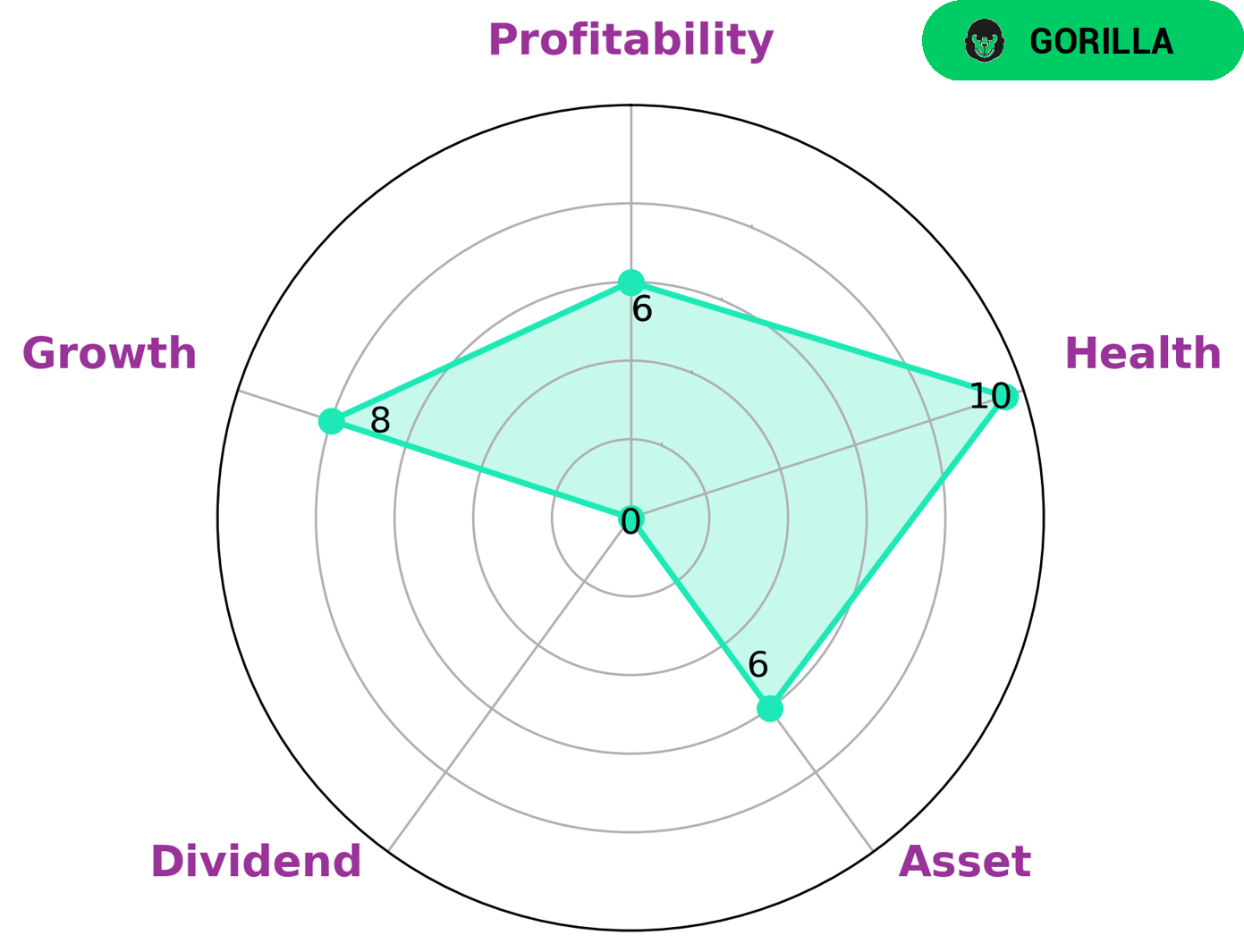

As a GoodWhale analyst, I have conducted an analysis of GAMBLING.COM GROUP‘s wellbeing. According to the Star Chart, GAMBLING.COM GROUP is strong in its growth, medium in asset, profitability and weak in dividend. It has a health score of 10/10 with regards to its cashflows and debt, which means it is capable of paying off debt and funding future operations. Further analysis also classified GAMBLING.COM GROUP as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Such a company would attract investors who are looking for long-term growth opportunities and stability, such as mutual funds, institutional investors, venture capitalists, and private equity investors. These investors generally look for companies that have proven business models and competitive advantages that will help them increase their return on investments over the long term. More…

Peers

The company is engaged in the online gambling and sports betting industry. The company operates a number of websites and brands, including Gambling.com, Bettingexpert.com, and Casinopedia.org. The company’s main competitors are B90 Holdings PLC, Kindred Group PLC, and Super Group (SGHC) Ltd.

– B90 Holdings PLC ($LSE:B90)

SSE plc, commonly known as SSE, is a British energy company headquartered in Perth, Scotland. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. SSE operates in the United Kingdom and Ireland.

The company has a market cap of 10.58M as of 2022 and a Return on Equity of -43.3%. The company operates in the United Kingdom and Ireland. SSE is involved in the generation, transmission, distribution and supply of electricity and in the storage, distribution and supply of gas. The company also provides other energy-related services, including energy efficiency and telecommunication services.

– Kindred Group PLC ($LTS:0RDS)

Kindred Group PLC is a gambling company with operations in Europe and Australia. The company has a market cap of 20.47B as of 2022 and a ROE of 17.97%. The company’s main products are online casino games, sports betting, and poker. The company also offers land-based casino services in some countries.

– Super Group (SGHC) Ltd ($NYSE:SGHC)

The company’s market cap is 1.98B as of 2022 and its ROE is 66.12%. The company is a leading provider of integrated logistics solutions in China. It provides a comprehensive range of services, including express delivery, warehousing, transportation, cross-border e-commerce logistics, and other value-added services. The company has a strong network of over 4,000 service outlets and a fleet of over 30,000 vehicles. It has a strong market presence in China, with a market share of over 20%.

Summary

GAMBLING.COM GROUP recently reported impressive results for its fiscal second quarter of 2023. Total revenue grew 63.1% year over year to USD 26.0 million, while net income increased fourfold to 0.28 million. The positive news was reflected in the stock price which surged on the same day.

Investors should watch out for the company’s upcoming performance, as well as its long-term prospects, when considering an investment in GAMBLING.COM GROUP. Its strong fundamentals and impressive growth make it a good option for investors looking to diversify their portfolio.

Recent Posts