FOX CORP Reports Positive Earnings Results for Q2 FY 2023

March 30, 2023

Earnings Overview

FOX CORP ($NASDAQ:FOXA) reported their fiscal year 2023 second quarter earnings results on February 8 2023, with total revenue at USD 313.0 million, a remarkable 468.2% year-on-year increase. Net income also rose by 3.7%, amounting to USD 4605.0 million for the quarter, compared to the same period in the previous year.

Transcripts Simplified

FOX Corp delivered strong revenue and earnings growth in the second quarter of the fiscal year, with 4% revenue growth, 71% EBITDA growth, a net income of $330 million, and adjusted EPS of $0.48 per share. Television segment revenue was up 6%, driven by a 5% increase in advertising revenues due to the strong political cycle, World Cup coverage on FOX Sports, and growth at Tubi. Affiliate fee revenues were up 6%, while other revenues increased 26%. EBITDA in the television segment was up $529 million to $256 million.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fox Corp. More…

| Total Revenues | Net Income | Net Margin |

| 14.29k | 1.51k | 11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fox Corp. More…

| Operations | Investing | Financing |

| 2.28k | -438 | -2.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fox Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.13k | 11.45k | 21.65 |

Key Ratios Snapshot

Some of the financial key ratios for Fox Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.8% | 6.2% | 17.3% |

| FCF Margin | ROE | ROA |

| 13.6% | 13.4% | 6.7% |

Market Price

On Wednesday, FOX CORP reported positive earnings results for the second quarter of FY 2023. The company’s stock opened at $36.3 and closed at $35.5, up 4.4% from prior closing price of $34.0. The company attributed its strong performance to strong sales in Europe and Asia, as well as increased digital services for its customers. The company also announced plans to invest $2 billion in capital improvements over the next three years to improve efficiency and customer experience.

The company’s stock saw a 4.4% increase on Wednesday, suggesting investor confidence in the company’s performance. Going forward, FOX CORP looks to be a strong contender in the industry, as it continues to invest in capital improvements and digital services to stay competitive. Live Quote…

Analysis

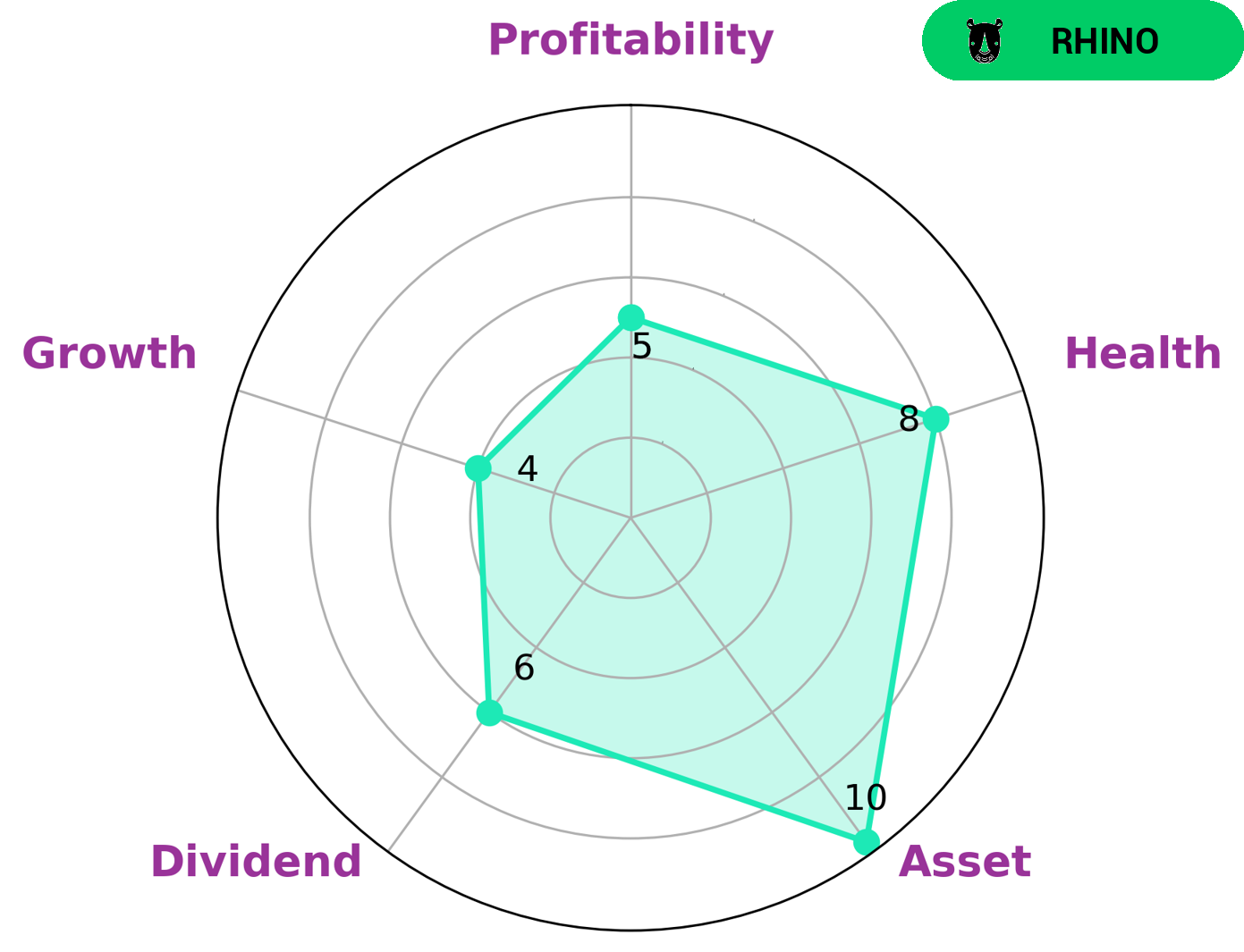

GoodWhale’s Star Chart analysis of FOX CORP reveals that the company is strong in asset, and medium in dividend, growth, profitability. We have also given FOX CORP a high health score of 8/10 with regard to its cashflows and debt, demonstrating that the company is capable to sustain future operations in times of crisis. Based on our analysis, Fox CORP is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given this information, potential investors who may be interested in FOX CORP could include those looking for a reliable, established company with a good track record of growth and profitability, but not necessarily looking for a high-growth opportunity. Additionally, investors who prioritize stability in times of crisis may find FOX CORP to be an attractive opportunity. More…

Peers

Fox Corporation is an American broadcasting company headquartered in New York City. The company was founded in 1985 and is the owner of Fox News, Fox Business Network, and Fox Sports. Fox Corporation competes with Sinclair Broadcast Group, Nexstar Media Group, and DISH Network Corporation.

– Sinclair Broadcast Group Inc ($NASDAQ:SBGI)

Sinclair Broadcast Group is one of the largest television broadcasters in the United States. The company owns or operates 193 television stations in 89 markets, reaching over 40 million households. Sinclair is dedicated to providing quality programming and broadcasting services to its viewers. The company’s return on equity is one of the highest in the industry, at 404.93%. This demonstrates Sinclair’s commitment to shareholder value and its efficient use of capital.

– Nexstar Media Group Inc ($NASDAQ:NXST)

Nexstar Media Group is one of the largest broadcasters in the United States. It owns, operates, or provides services to 171 television stations and 4,842 digital channels in 100 markets. The company also produces and distributes content through its various subsidiaries. Nexstar Media Group is headquartered in Irving, Texas.

– DISH Network Corp ($NASDAQ:DISH)

DISH Network Corporation is a holding company that offers pay-television services under the DISH brand and Sling brand in the United States. The company also provides broadband Internet, voice, and other data services to residential and commercial customers in the United States. As of December 31, 2020, DISH Network Corporation had approximately 13.3 million pay-television subscribers.

The company has a market cap of 7.39B as of 2022 and a Return on Equity of 13.13%. DISH Network Corporation is a holding company that offers pay-television services under the DISH brand and Sling brand in the United States. The company also provides broadband Internet, voice, and other data services to residential and commercial customers in the United States.

Summary

Investors in FOX CORP were pleased with the company’s second quarter results for the fiscal year 2023, ending December 31 2022. Total revenue grew 468.2% year-on-year to USD 313.0 million, and net income was up 3.7% to USD 4605.0 million. Furthermore, the stock price rose the same day on the news. This indicates that investors are positive about the company’s prospects and are confident that it will continue to deliver strong financial performances in the future.

Recent Posts