FLOWSERVE CORPORATION Reports FY2022 Q4 Earnings Results for December 31 2022

March 29, 2023

Earnings Overview

On February 21 2023, FLOWSERVE CORPORATION ($NYSE:FLS) announced their financial results for the fourth quarter of FY2022, which ended on December 31 2022. An impressive 625.2% year-over-year rise in total revenue saw it reach USD 121.3 million, while net income was up 13.0%, amounting to USD 1039.0 million.

Transcripts Simplified

Flowserve Corporation reported strong fourth quarter financial results, with adjusted EPS of $0.63 and reported EPS of $0.92, driven by improved operating performance, shipping cadence, and sales leverage. Revenues totaled over $1 billion, marking the highest quarterly revenue level since 2019. Margins decreased 40 basis points to 28.8%, and SG&A was roughly flat compared to the prior year, but down 200 basis points as a percentage of sales to 18.4%. The report also included charges of $8.1 million due to their Russia exit partially offset by a $4.5 million settlement on previously written down assets.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Flowserve Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 3.62k | 188.69 | 5.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Flowserve Corporation. More…

| Operations | Investing | Financing |

| -40.01 | -6.09 | -150.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Flowserve Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.79k | 2.93k | 13.99 |

Key Ratios Snapshot

Some of the financial key ratios for Flowserve Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.9% | -23.3% | 5.5% |

| FCF Margin | ROE | ROA |

| -3.2% | 7.2% | 2.6% |

Share Price

On Tuesday, FLOWSERVE CORPORATION reported their fourth quarter earnings results for the fiscal year 2022 ending on December 31, 2022. Overall, their stock opened at $35.4 and closed at $34.9, down by 2.9% from the prior closing price of $35.9. Overall, FLOWSERVE CORPORATION’s performance in the fourth quarter of 2022 was slightly below analysts’ expectations, which may have contributed to their stock’s decline on Tuesday. However, despite the current situation, the company is still optimistic about their prospects in the future and is confident that they will be able to bounce back soon. Live Quote…

Analysis

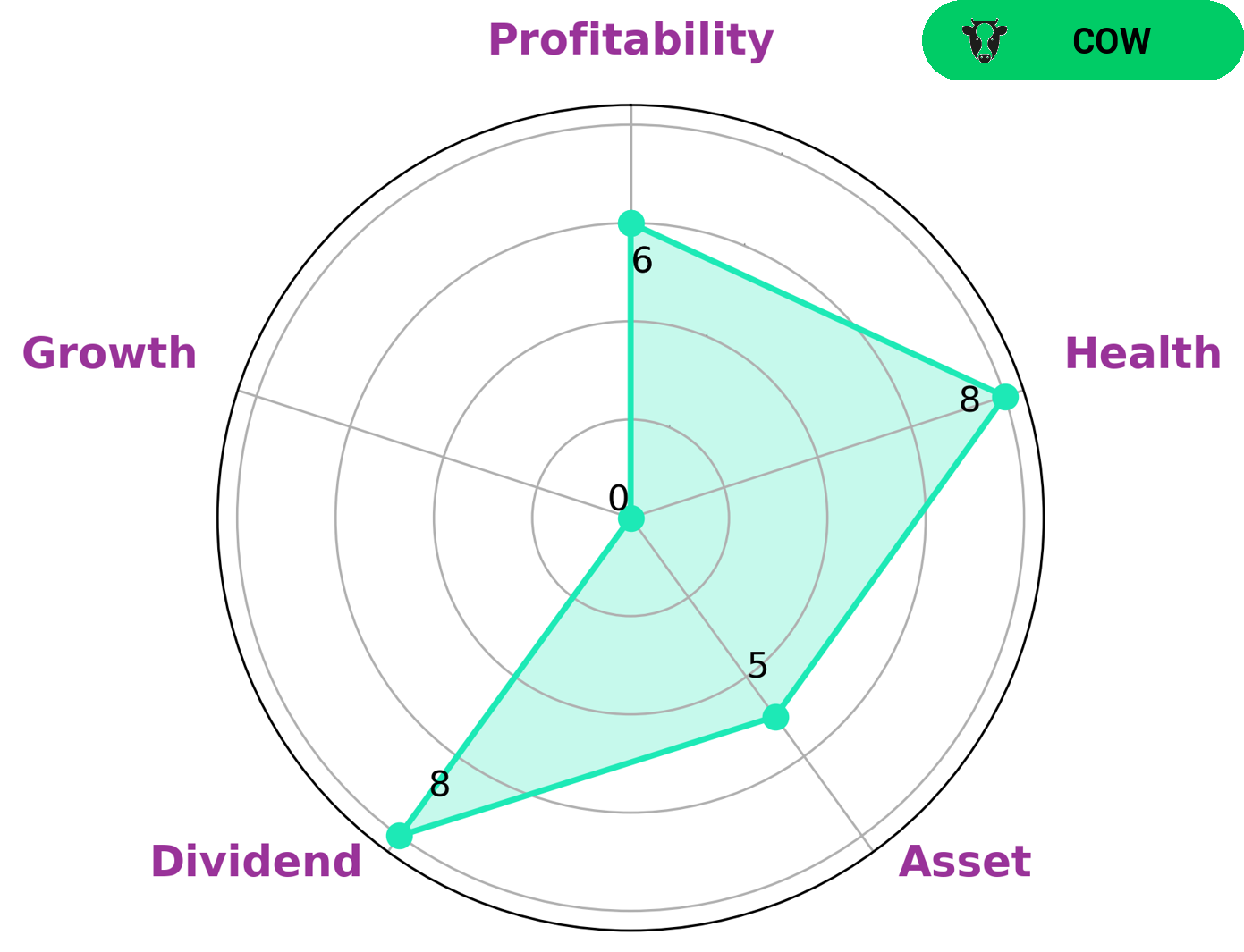

GoodWhale has conducted an extensive analysis of FLOWSERVE CORPORATION‘s wellbeing. This means that FLOWSERVE CORPORATION is strong in dividend, medium in asset, profitability and weak in growth. Furthermore, FLOWSERVE CORPORATION has a high health score of 8/10, considering its cashflows and debt. This indicates that FLOWSERVE CORPORATION is capable of safely riding out any crisis without the risk of bankruptcy. Therefore, investors who are looking for stable dividend income with a lower risk of capital loss may be interested in investing in FLOWSERVE CORPORATION. More…

Peers

Its competitors include ITT Inc, Shanghai Zhenhua Heavy Industries Co Ltd, Sintokogio Ltd.

– ITT Inc ($NYSE:ITT)

3M’s market cap as of 2022 is 5.86B. The company has a return on equity of 12.81%. 3M is a diversified technology company that operates in a variety of industries, including healthcare, industrial, and consumer markets. The company’s products include adhesives, abrasives, laminates, and electro- and optical materials.

– Shanghai Zhenhua Heavy Industries Co Ltd ($SHSE:600320)

Shanghai Zhenhua Heavy Industries Co Ltd is a heavy industries company with a market cap of 14.22B as of 2022. The company has a return on equity of 7.11%. The company manufactures a range of products including cranes, construction machinery, and railway equipment. Shanghai Zhenhua Heavy Industries Co Ltd is a publicly traded company listed on the Shanghai Stock Exchange.

– Sintokogio Ltd ($TSE:6339)

Sintokogio Ltd is a Japanese company that manufactures automotive parts. As of 2022, the company has a market capitalization of 35.83 billion dollars and a return on equity of 2.76%. The company’s products include engine parts, suspension parts, and body parts.

Summary

FLOWSERVE CORPORATION reported strong financial results for Q4 of FY2022, with total revenue increasing 625.2% year over year to USD 121.3 million and net income rising 13.0% to USD 1039.0 million. This demonstrates the potential for FLOWSERVE CORPORATION as a stable, long-term investment. The company has the potential for further growth, especially as the global economy rebounds from recent events.

Furthermore, the company’s strong financials are indicative of a solid management team that is able to manage and navigate a challenging environment. Investing in FLOWSERVE CORPORATION could be a wise decision for any investor looking for a strong and reliable return.

Recent Posts