Fiverr International Intrinsic Value – FIVERR INTERNATIONAL Reports Record Third Quarter Earnings for FY2023

November 27, 2023

🌥️Earnings Overview

FIVERR INTERNATIONAL ($NYSE:FVRR) released their financial results for the third quarter of FY2023 on November 9, 2023. Their total revenue for the three months ending September 30, 2023, amounted to USD 92.5 million, showing a 12.1% growth compared to the same period in the previous year. The company’s net income for the quarter rose by 126.6%, reaching USD 3.0 million.

Share Price

These earnings demonstrate a significant milestone in the company’s history as the company continues to expand its global presence and expand its customer base. Stronger than expected sales figures coupled with reduced operating costs contributed to the company’s record performance for the quarter. Several new initiatives were implemented by FIVERR INTERNATIONAL to enhance customer experience and increase revenue streams, most notably the launch of its new international marketplace. This platform has enabled customers from all over the world to access the company’s services, allowing FIVERR INTERNATIONAL to reach a larger audience and expand its reach beyond the US market. In addition to increased sales, FIVERR INTERNATIONAL also reported a reduction in costs of goods sold, which helped to boost profits for the quarter.

The company has implemented cost-control measures to ensure that it remains competitively priced in a saturated market. This has resulted in improved margins and ultimately a higher return on investment for shareholders. Overall, FIVERR INTERNATIONAL’s record third-quarter performance serves as a testament to the company’s commitment to innovation and expansion. Looking ahead, the company is well positioned to continue to grow and expand in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fiverr International. More…

| Total Revenues | Net Income | Net Margin |

| 353 | -2.32 | -0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fiverr International. More…

| Operations | Investing | Financing |

| 65.24 | -92.23 | 4.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fiverr International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1k | 678.07 | 8.4 |

Key Ratios Snapshot

Some of the financial key ratios for Fiverr International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.3% | – | -10.5% |

| FCF Margin | ROE | ROA |

| 18.2% | -7.4% | -2.3% |

Analysis – Fiverr International Intrinsic Value

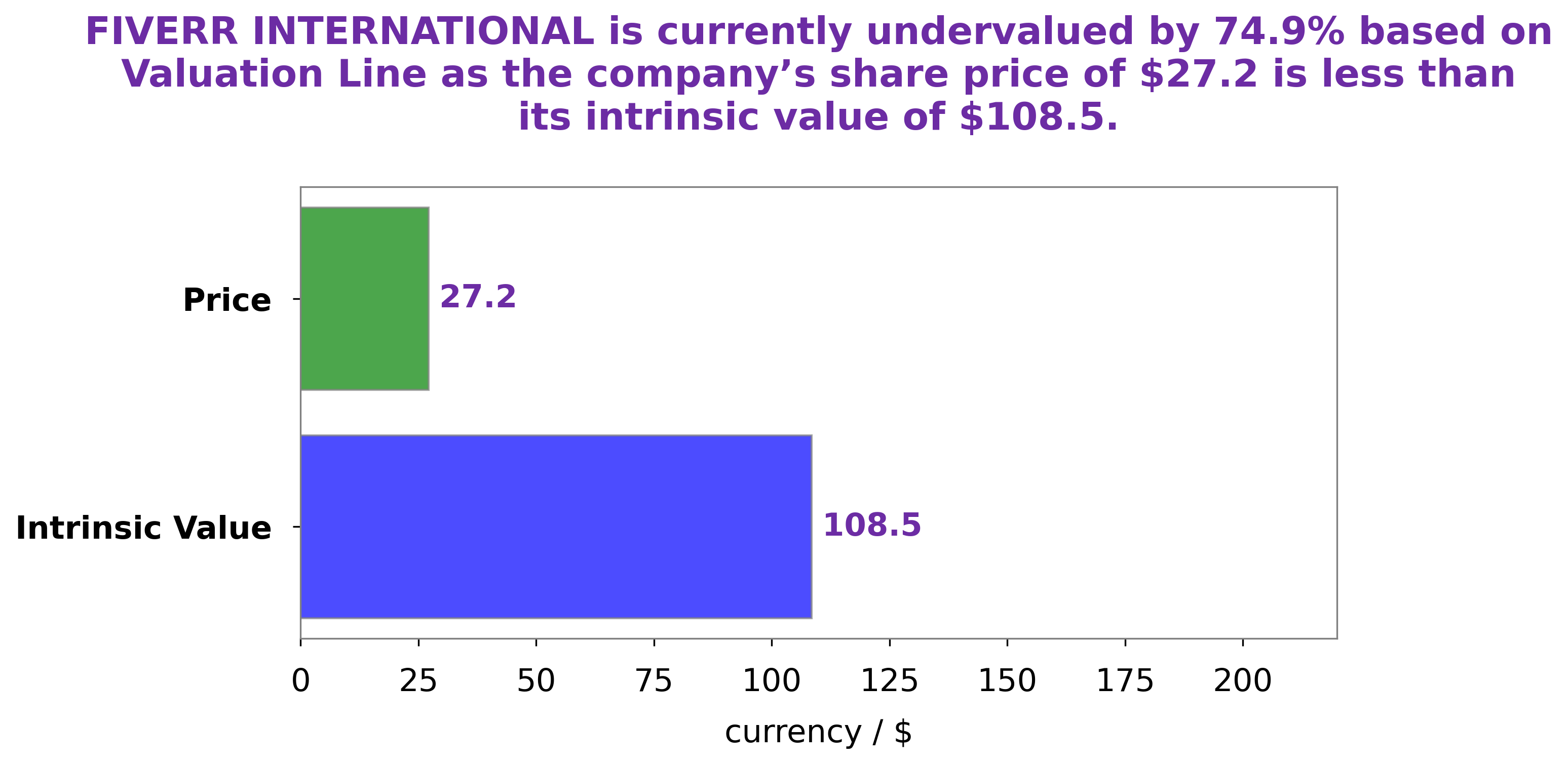

At GoodWhale, we conducted a comprehensive analysis of FIVERR INTERNATIONAL‘s fundamentals. After our analysis, we determined that the intrinsic value of FIVERR INTERNATIONAL’s shares is approximately $123.1, calculated using our proprietary Valuation Line. Currently, FIVERR INTERNATIONAL’s stock is trading at $22.8, significantly undervaluing the company by 81.5%. More…

Peers

In the online marketplace, there is intense competition between Fiverr International Ltd and its competitors Newretail Co Ltd, Similarweb Ltd, and PT NFC Indonesia Tbk. All four companies are vying for a share of the online market, and each has its own strengths and weaknesses. Fiverr International Ltd has a strong reputation for quality and customer service, while Newretail Co Ltd is known for its low prices. Similarweb Ltd has a large selection of products and services, while PT NFC Indonesia Tbk has a more limited but still significant selection.

– Newretail Co Ltd ($TPEX:3085)

Newretail Co Ltd is a company that operates in the retail industry. It has a market cap of 603.61M as of 2022 and a Return on Equity of 5.63%. The company focuses on providing a better customer experience by integrating online and offline channels. It has a strong presence in China and is expanding its operations to other countries.

– Similarweb Ltd ($NYSE:SMWB)

As of 2022, Similarweb Ltd has a market cap of 488.21M. The company has a Return on Equity of -103.2%. Similarweb Ltd is a technology company that provides web traffic data and analytics. The company was founded in 2007 and is headquartered in Tel Aviv, Israel.

– PT NFC Indonesia Tbk ($IDX:NFCX)

PT NFC Indonesia Tbk is a leading provider of mobile payment and financial services in Indonesia. The company has a market cap of 7.95T as of 2022 and a Return on Equity of 21.4%. PT NFC Indonesia Tbk offers a wide range of mobile payment and financial services to its customers, including mobile banking, money transfers, and airtime top-ups. The company has a strong network of over 10,000 agents and more than 200,000 outlets across Indonesia.

Summary

FIVERR INTERNATIONAL recently reported its earnings results for the third quarter of FY2023, with total revenue up 12.1% year-on-year to USD 92.5 million and net income rising 126.6% to USD 3.0 million. Although the company’s stock price moved down on the news, investors should be encouraged by the strong performance in both revenue and profitability. Looking ahead, FIVERR INTERNATIONAL has demonstrated a commitment to innovation and growth, and is well-positioned for continued success in the coming quarters.

Recent Posts