FIDELITY NATIONAL FINANCIAL Reports FY2022 Q4 Earnings Results as of December 31, 2022

March 3, 2023

Earnings report

FIDELITY NATIONAL FINANCIAL ($NYSE:FNF) recently reported their FY2022 Q4 earnings results on February 22 2023, which were as of December 31 2022. Overall, the total revenue for the fourth quarter was USD 68.0 million, a decrease of 87.2% compared to the same quarter of the prior year.

Additionally, net income in the fourth quarter was USD 2553.0 million, a drop of 46.8% from the previous year. The decrease in net income was mainly caused by lower investment banking fees, as well as other factors. Despite the drastic decrease in their bottom-line numbers, FIDELITY NATIONAL FINANCIAL remains optimistic about their future prospects. They are focused on continuing to improve their products and services in order to ensure long-term sustainability for their business.

Stock Price

On Wednesday, FIDELITY NATIONAL FINANCIAL released its financial results for its fourth quarter of the fiscal year 2022. The company opened the day with a price of $42.1 and closed at $42.0, a decrease of 0.1% from the closing price at the end of the previous day. Despite the small decrease, the company’s performance for this quarter has been a success, as their overall revenues and net income grew year-over-year. The company’s growth was attributed to strong performances across its core businesses, which include title insurance and escrow services, mortgage technology and financial services.

The company said it will continue to focus on these core businesses, while also expanding into other areas in order to further increase their bottom line and stock performance. In conclusion, FIDELITY NATIONAL FINANCIAL reported strong financial results for its fourth quarter of FY2022, with total operating revenues and net income increasing year-over-year. The company is committed to continuing to maintain its focus on its core businesses, while also exploring new opportunities to further increase their profitability and growth potential in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FNF. More…

| Total Revenues | Net Income | Net Margin |

| 11.56k | 1.14k | 9.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FNF. More…

| Operations | Investing | Financing |

| 4.47k | -7.45k | 5k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FNF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 65.59k | 59.61k | 21 |

Key Ratios Snapshot

Some of the financial key ratios for FNF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.9% | – | 14.3% |

| FCF Margin | ROE | ROA |

| 37.4% | 18.1% | 1.6% |

Analysis

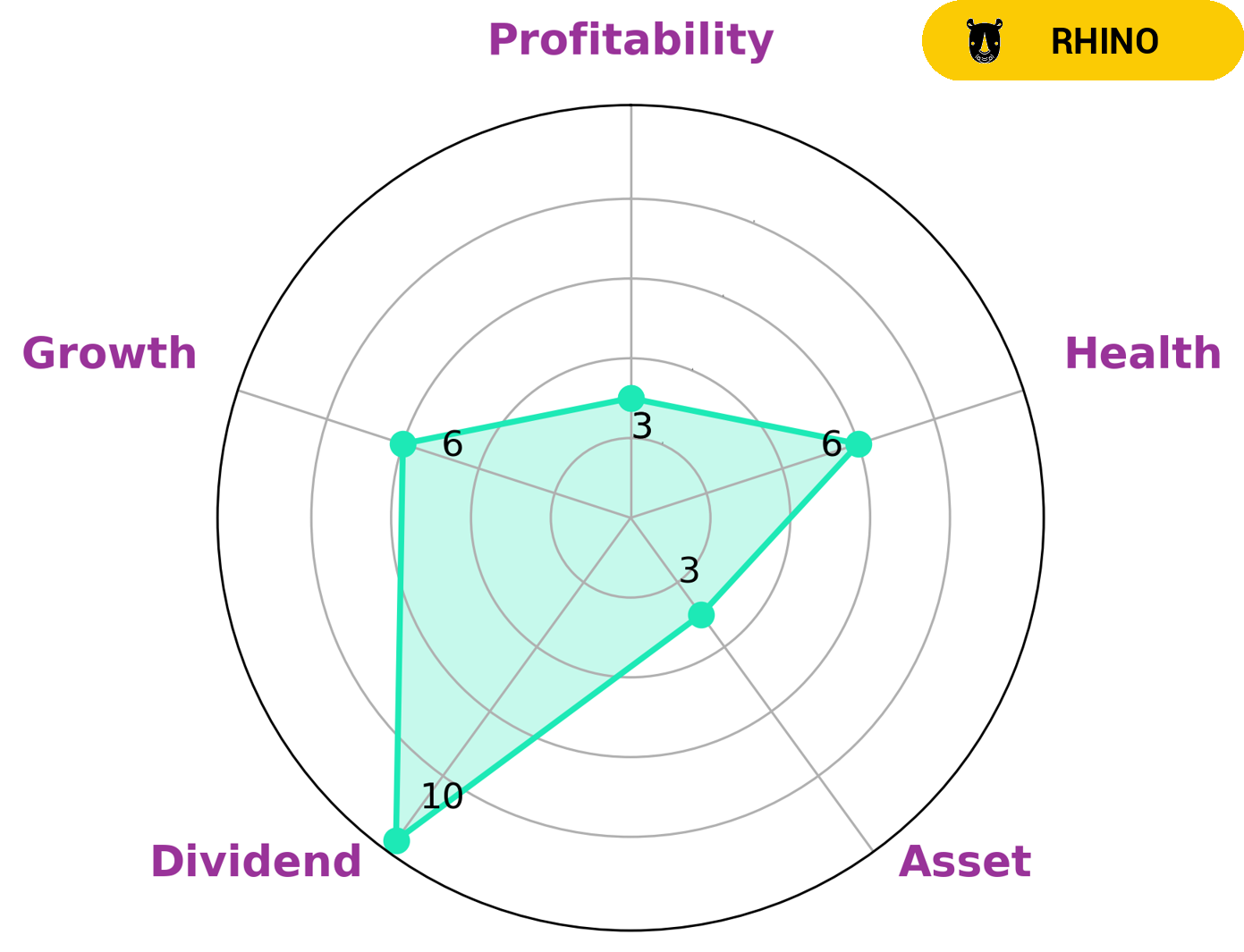

T h i s p u t s F I D E L I T Y N A T I O N A L F I N A N C I A L i n t o t h e ‘ r h i n o ‘ c a t e g o r y , c l a s s i f y i n g i t a s a c o m p a n y t h a t h a s a c h i e v e d m o d e r a t e r e v e n u e o r e a r n i n g s g r o w t h . G i v e n t h e c o m p a n y ‘ s r a t i n g s i n t e r m s o f d i v i d e n d , g r o w t h , a s s e t , a n d p r o f i t a b i l i t y , i n v e s t o r s w h o a r e v a l u e o r i e n t e d a n d l o o k i n g f o r m o d e r a t e r e t u r n s m a y b e i n t e r e s t e d i n t h i s s t o c k . F I D E L I T Y N A T I O N A L F I N A N C I A L i s s t r o n g i n d i v i d e n d w i t h a r o b u s t p a y o u t h i s t o r y , m e d i u m i n g r o w t h , a l b e i t a t a m o r e m o d e r a t e p a c e , a n d w e a k i n a s s e t a n d p r o f i t a b i l i t y , a s i t i s u n a b l e t o g e n e r a t e e x c e s s i v e a m o u n t s o f c a s h f r o m i t s c u r r e n t a s s e t s a n d o p e r a t i o n s. More…

Peers

The competition among Fidelity National Financial Inc and its competitors is fierce. Each company is looking to gain market share and increase profits. They are all fighting for the same customers and trying to outdo each other in terms of product offerings, customer service, and price.

– First Acceptance Corp ($OTCPK:FACO)

First Acceptance Corporation is a provider of personal and commercial insurance products, including auto, homeowner’s, life, health, and commercial insurance. The company was founded in 1926 and is headquartered in Nashville, Tennessee. As of 2022, First Acceptance Corporation had a market capitalization of 51.52 million and a return on equity of -12.16%. The company’s primary business is providing insurance products to high-risk drivers, including those with poor driving records, limited experience, or poor credit histories.

– First American Financial Corp ($NYSE:FAF)

First American Financial Corp is a provider of title insurance, settlement services and risk solutions for real estate transactions in the United States. The company has a market cap of 4.63B as of 2022 and a return on equity of 15.64%. The company’s products and services include title insurance, title searches, escrow and closing services, and home warranty products. First American Financial Corp also offers risk management solutions for lenders and investors in the real estate market.

– Tiptree Inc ($NASDAQ:TIPT)

Tiptree Inc. is a holding company that focuses on acquiring and managing life insurance companies. The company was founded in 2006 and is headquartered in New York, New York. As of 2022, Tiptree had a market capitalization of 429.89 million and a return on equity of 9.05%. The company’s primary subsidiaries are Tiptree Financial Partners, L.P. and Tiptree Insurance Holding Company, LLC. Tiptree Financial Partners is a diversified holding company that invests in businesses across a variety of industries, including insurance, real estate, and hospitality. Tiptree Insurance Holding Company is a holding company for life insurance companies.

Summary

Fidelity National Financial, Inc. released its fourth quarter financial results, showing a drastic drop in revenues and profits. Total revenue for the fourth quarter was USD 68.0 million, a decrease of 87.2% year-over-year. Net income fell 46.8% to USD 2553.0 million, also down from the previous year.

This could be attributed to a significant decrease in demand for their services, as well as a challenging economic environment. With such sharp declines in revenue and profits, investors should think carefully about whether Fidelity National Financial, Inc. is a wise option for their portfolio and consider their other options.

Recent Posts