FERROGLOBE PLC Reports Fourth Quarter Earnings Results for Fiscal Year Ending Feb 22 2023

March 21, 2023

Earnings Overview

FERROGLOBE PLC ($NASDAQ:GSM) reported earnings results for the fourth quarter of its fiscal year ending February 22 2023 on December 31 2022. Total revenue for the quarter was USD 25.3 million, a 61.8% decrease from the same period in the previous year. Net income decreased 21.3% year over year, amounting to USD 448.6 million.

Transcripts Simplified

Revenue for the fourth quarter was $449 million, down 24% from the third quarter. Raw materials and energy consumption remained flat from the third quarter, resulting in raw materials and energy consumption as a percentage of sales increasing to 63%. An impairment charge of $44 million related to tolling agreements was recognized in Q4. Adjusted EBITDA margins remained strong at 29%, while net profit for the full year was an extraordinary $462 million.

Adjusted EBITDA for the fourth quarter was $130 million and Adjusted EBITDA for the full year was $860 million with an adjusted EBITDA margin of 30%. Average selling price across the portfolio was down 11% for the fourth quarter but up 59% for the full year. Cash balance at the end of Q4 was $323 million, up from $237 million in the prior quarter.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ferroglobe Plc. More…

| Total Revenues | Net Income | Net Margin |

| 2.6k | 459.46 | 19.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ferroglobe Plc. More…

| Operations | Investing | Financing |

| 405.02 | -61.68 | -130.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ferroglobe Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.98k | 1.21k | 1.14 |

Key Ratios Snapshot

Some of the financial key ratios for Ferroglobe Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | -39.1% | 28.1% |

| FCF Margin | ROE | ROA |

| 13.5% | 213.4% | 23.0% |

Market Price

The company’s stock opened at $4.3, and closed at $4.3, representing a 1.6% decrease from the last closing price of $4.4. Net income decreased by 6% compared to the same period last year due to weaker pricing conditions in Europe, Asia and the Americas. The company is looking to stay ahead in the industry by investing in new technology and expanding its product range.

FERROGLOBE is focused on increasing its production capacity to meet demand and diversifying into different markets. The company’s focus on cost savings and operational efficiency improvements helped it overcome the negative impacts of the market downturn. Live Quote…

Analysis

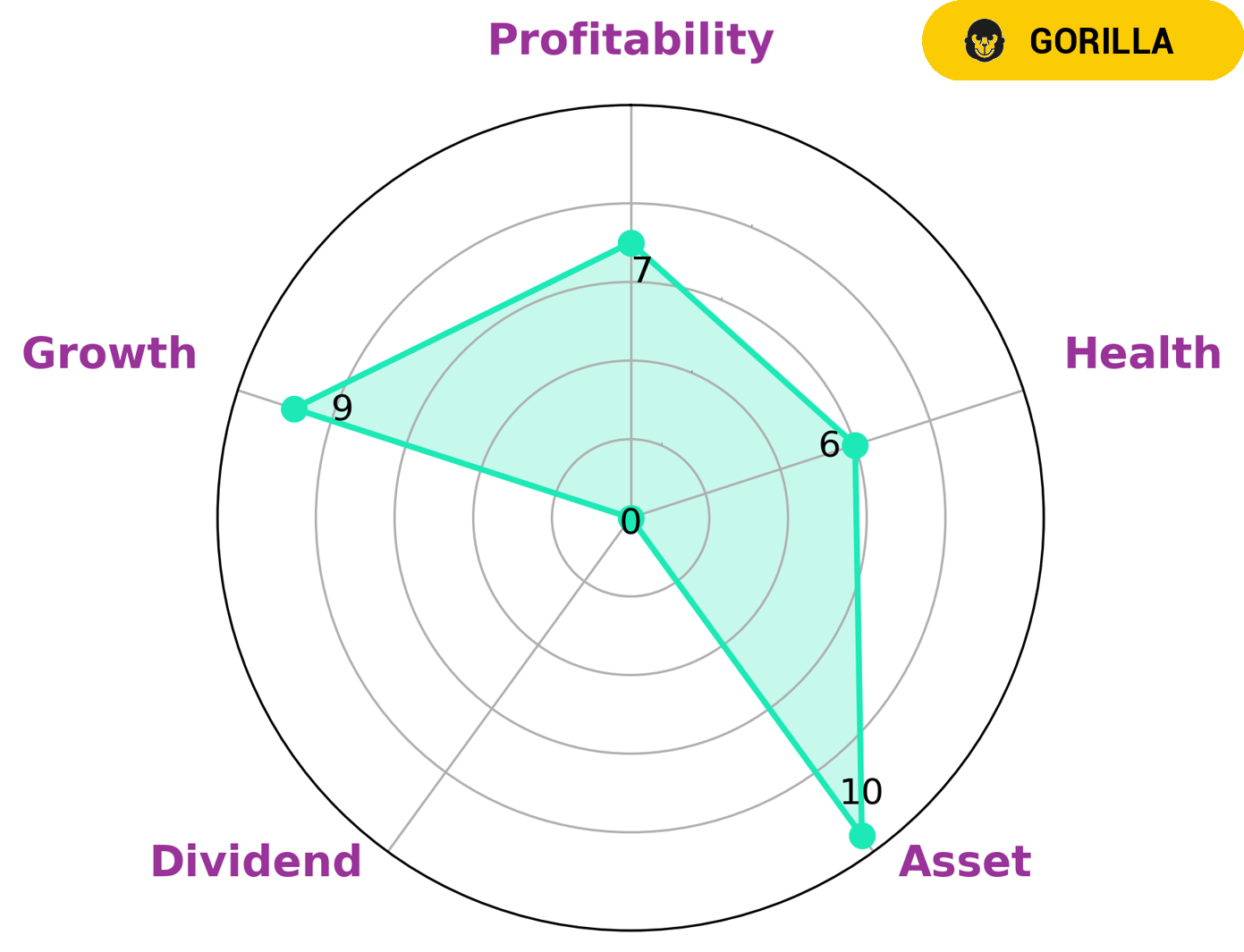

GoodWhale’s analysis of FERROGLOBE PLC‘s financials shows that the company is in a strong position. Our star chart reveals that it is strong in asset, growth, and profitability, and weak in dividend. Based on this assessment, our system classifies FERROGLOBE PLC as a ‘gorilla’, a type of company with strong competitive advantage and stable and high revenue or earning growth. These characteristics make FERROGLOBE PLC an interesting proposition for value investors who are seeking steady returns over long-term investments. Additionally, with an intermediate health score of 6/10 with regard to its cashflows and debt, FERROGLOBE PLC might be able to sustain future operations in times of crisis. More…

Peers

Ferroglobe PLC is one of the leading players in the ferroalloys industry, facing stiff competition from established players such as Eramet SA, Hangzhou Yitong New Material Co Ltd, and Sichuan Hongda Co Ltd. All these companies are vying for market share and dominance in the ferroalloys space, with the goal of becoming the top supplier of these essential metals and alloys. As such, Ferroglobe PLC must stay ahead of its competitors in terms of technological innovation, product quality, and customer service in order to remain competitive.

– Eramet SA ($LTS:0MGV)

Eramet SA is a French mining and metallurgical company with interests in the extraction, production and processing of manganese and nickel ore. The company has a market capitalization of 2.69 billion Euros as of 2023 and a Return on Equity of 80.99%. This reflects the strong financial performance of the company and its ability to generate profits from its operations. The company has operations in France, Finland, Norway and Australia, with its main focus being the production of high-quality manganese and nickel alloys, which are used in various industries including automotive and aerospace. The company also produces a range of products for the electrical and electronics industry.

– Hangzhou Yitong New Material Co Ltd ($SZSE:300930)

Hangzhou Yitong New Material Co Ltd is a Chinese industrial enterprise that specializes in the production of polymer materials. The company has a market capitalization of 3.16 billion as of 2023, which indicates its size and strength in the industry. Furthermore, its return on equity (ROE) stands at 7.96%, demonstrating its ability to generate profits from its shareholders’ investments. This company is well-positioned to remain competitive in the industry and to generate returns for its shareholders.

– Sichuan Hongda Co Ltd ($SHSE:600331)

S i c h u a n H o n g d a C o L t d i s a C h i n e s e c h e m i c a l c o m p a n y f o c u s e d o n t h e p r o d u c t i o n a n d s a l e o f c h e m i c a l p r o d u c t s , i n c l u d i n g a m m o n i u m s u l f a t e , c a l c i u m c h l o r i d e , a n d m a g n e s i u m h y d r o x i d e . T h e c o m p a n y h a s a m a r k e t c a p o f 7 . 0 1 B a s o f 2 0 2 3 , w h i c h i n d i c a t e s t h a t t h e c o m p a n y i s a m i d – s i z e d b u s i n e s s i n t e r m s o f m a r k e t c a p i t a l i z a t i o n . A d d i t i o n a l l y , t h e c o m p a n y h a s a n i m p r e s s i v e R e t u r n o n E q u i t y o f 2 4 . 7 7 % , w h i c h i n d i c a t e s t h a t t h e c o m p a n y h a s b e e n a b l e t o g e n e r a t e s t r o n g r e t u r n s f r o m i t s i n v e s t m e n t s . T h i s s u g g e s t s t h a t S i c h u a n H o n g d a C o L t d i s a s u c c e s s f u l a n d w e l l – m a n a g e d b u s i n e s s

Summary

FERROGLOBE PLC reported fourth quarter earnings results for the fiscal year ending February 2022, with total revenue of USD 25.3 million and a net income of USD 448.6 million. This was a substantial decrease in comparison to the same period the previous year, with a 61.8% drop in revenue and 21.3% drop in net income. As such, investors may be cautious when considering investing in FERROGLOBE PLC, due to its declining profitability. It is recommended to further research the company’s financial situation and operations in order to make an informed decision when investing.

Recent Posts