FD Technologies Plc Shares Dip 12% This Week, Despite Five-Year Losses, Earnings Continue to Decline in 2023.

March 21, 2023

Trending News ☀️

Despite the five-year losses and FD ($LSE:FDP) Technologies’ 12% dip this week, investors should take comfort in the fact that the company’s share price has remained largely consistent over the longer term. This stability is especially impressive considering that FD Technologies‘ earnings have continued to decline in 2023. It is expected that this trend will continue over the next few years unless the company can manage to turn around its fortunes.

However, some analysts are predicting that the share price could rebound quickly should the company manage to make some key investments or find ways to cut costs and increase efficiency. Considering that FD Technologies has managed to stay afloat for this long, there is certainly reason for optimism about the future of the company. While the immediate outlook may be bleak, there is still hope that the firm can pull through and return to profitability in the near future.

Stock Price

On Friday, the stock opened at £17.5 and closed at £16.2, marking a 7.1% drop from the previous closing price of 17.4. This slump is despite the losses accruing to the company over the last five years and the continued downward trend in earnings in 2023. The only media exposure surrounding the company has been negative, amplifying investor concerns going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fd Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 282.92 | 9.36 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fd Technologies. More…

| Operations | Investing | Financing |

| 25.33 | -12.43 | -22.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fd Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 374.36 | 166.97 | 7.4 |

Key Ratios Snapshot

Some of the financial key ratios for Fd Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.4% | -51.9% | 5.1% |

| FCF Margin | ROE | ROA |

| 0.3% | 4.5% | 2.4% |

Analysis

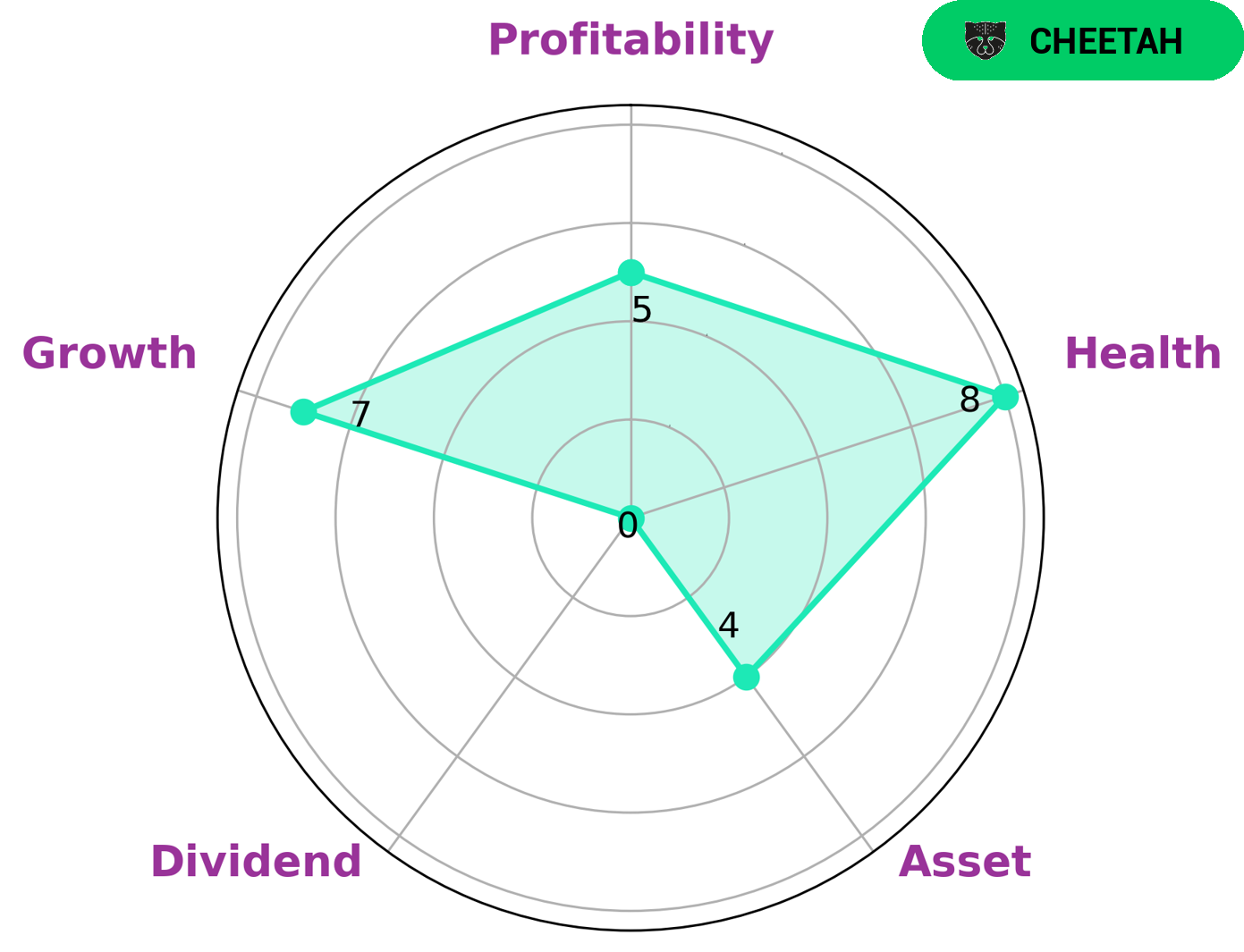

We, at GoodWhale, have conducted an in-depth analysis of FD TECHNOLOGIES‘ financials and concluded that the company has a high health score of 8/10 based on Star Chart. This means that FD TECHNOLOGIES is capable of safely riding out any crisis without the risk of bankruptcy. Additionally, FD TECHNOLOGIES is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. As such, FD TECHNOLOGIES is strong in growth, medium in asset, profitability and weak in dividend. Given its strong growth profile, FD TECHNOLOGIES may be of particular interest to investors seeking high returns over the relatively short-term. Such investors may include venture capitalists, private equity firms, and active angel investors. More…

Peers

The company’s products and services are used by major corporations and government agencies around the world. FD Technologies PLC is a publicly traded company on the London Stock Exchange (LSE: FD). The company’s major competitors are Appier Group Inc, Pci Technology Group Co Ltd, Merit Group PLC.

– Appier Group Inc ($TSE:4180)

Appier Group Inc is a global technology company that provides artificial intelligence (AI) services to businesses. The company has a market cap of $152.74 billion as of 2022 and a return on equity of -0.89%. Appier Group Inc provides a range of AI services including data analysis, predictive modelling, and decision-making support. The company’s AI services are used by businesses in a variety of industries including retail, healthcare, financial services, and manufacturing.

– Pci Technology Group Co Ltd ($SHSE:600728)

Pci Technology Group Co Ltd is a technology company that provides solutions for the banking and financial services industry. It has a market cap of 10.61B as of 2022 and a return on equity of 5.32%. The company offers a range of products and services including payment processing, fraud prevention, and compliance management. It serves customers in the United States, Europe, Asia, and Africa.

– Merit Group PLC ($LSE:MRIT)

Intermec Technologies PLC, together with its subsidiaries, designs, develops, manufactures, markets, and sells automatic identification and data collection products worldwide. The company has a market cap of $8.74 million and a return on equity of -2.36%. Intermec Technologies PLC was founded in 1966 and is based in London, United Kingdom.

Summary

This week, FD Technologies Plc (FD) saw a 12% dip in their shares despite losses in the last five years. The company’s earnings continue to decline in 2023, and the media coverage of the company has mostly been negative. The stock price showed a downward trend on the same day.

As a result, investors should be cautious with FD Technologies and conduct thorough research and analysis before deciding to invest. It is important to take into account current market conditions and the company’s financial health before investing in FD.

Recent Posts