EXPEDITORS INTERNATIONAL OF WASHINGTON Reports Third Quarter Results for FY2023 Ending September 30 2023

December 3, 2023

🌥️Earnings Overview

Expeditors ($NASDAQ:EXPD) International of Washington reported its results for the third quarter of FY2023, which ended on September 30, 2023, on November 7, 2023. Revenue totaled USD 2190.0 million, a decrease of 49.8% compared to the third quarter of FY2022. Net income was USD 171.4 million, representing a 58.6% year-over-year drop.

Stock Price

The stock opened at $110.9 and closed at $110.4, down 1.0% from the previous closing price of $111.5. This marks a decrease in share price from the start of the quarter. This positive report is reflective of the company’s investment in their technology infrastructure which allows them to better manage their operations and improve customer service. This commitment to improvement has made EXPEDITORS INTERNATIONAL OF WASHINGTON a leader in the logistics sector and has allowed them to continue to deliver strong financial results. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for EXPD. More…

| Total Revenues | Net Income | Net Margin |

| 10.46k | 813.44 | 7.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for EXPD. More…

| Operations | Investing | Financing |

| 1.38k | -47.38 | -1.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for EXPD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.58k | 2.09k | 17.13 |

Key Ratios Snapshot

Some of the financial key ratios for EXPD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | 8.5% | 11.0% |

| FCF Margin | ROE | ROA |

| 12.8% | 28.4% | 15.7% |

Analysis

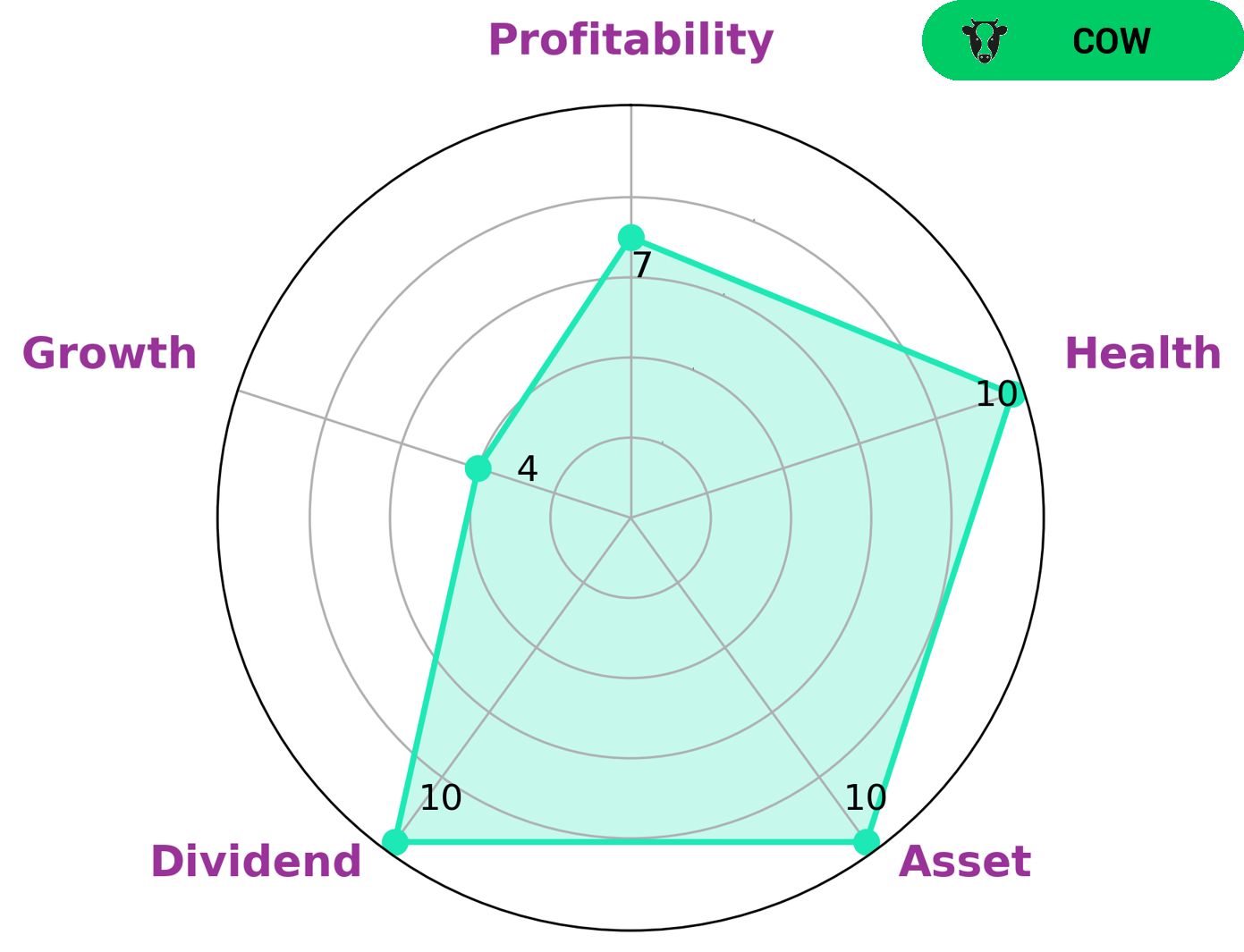

GoodWhale has conducted an analysis of EXPEDITORS INTERNATIONAL OF WASHINGTON’s wellbeing. Our Star Chart ranks the company at 10/10 for health, indicating that it is in good financial shape with plenty of cashflows and no major debt issues. With such a high score, we conclude that EXPEDITORS INTERNATIONAL OF WASHINGTON is a ‘cow’ – a type of company with a track record of paying out consistent and sustainable dividends. Given such a strong financial foundation, investors interested in a steady income stream may be attracted to EXPEDITORS INTERNATIONAL OF WASHINGTON. The company is strong in terms of asset, dividend, and profitability, and medium in terms of growth. On this basis, it provides an excellent opportunity for risk-averse investors who are looking to benefit from reliable returns. More…

Peers

Expeditors International of Washington Inc is a leading provider of global logistics services. The company has a strong competitive advantage over its competitors due to its vast experience in the industry, its global network of offices and warehouses, and its commitment to customer service.

– Jiangsu Feiliks International Logistics Inc ($SZSE:300240)

Jiangsu Feiliks International Logistics Inc is a leading provider of logistics services in China. The company has a market cap of 2.77B as of 2022 and a return on equity of 11.39%. The company provides a full range of logistics services, including transportation, warehousing, distribution, and supply chain management. The company has a strong network of logistics facilities and partners in China and around the world.

– 2Go Group Inc ($PSE:2GO)

As of 2022, Five Below Inc has a market cap of 15.76B and a Return on Equity of 1.07%. The company operates in the discount retail industry and offers products that are priced at $5 and below. Five Below targets teenagers and young adults with its trendy and affordable merchandise, which includes items such as clothes, accessories, beauty products, and home décor. The company has over 700 stores across the United States and plans to continue expanding its reach in the coming years.

– Unique Logistics International Inc ($OTCPK:UNQL)

As of 2022, Unique Logistics International Inc has a market cap of 8.39M and a ROE of 112.57%. The company is a provider of logistics and transportation services. It offers a range of services including airfreight, oceanfreight, warehousing, and trucking. The company has a strong focus on customer service and providing a high level of service.

Summary

Expeditors International of Washington reported its financial results for the third quarter of the fiscal year 2023, ending September 30 2023, on November 7 2023. Total revenue for the quarter was USD 2190.0 million, a decrease of 49.8% compared to the same period in the last year. Net income was USD 171.4 million, a decrease of 58.6% when compared to the same period in the previous year.

This reflects the company’s weakened financial performance over the last year due to the ongoing global pandemic. Investors should carefully analyze the company’s performance before making any decisions related to investing in Expeditors International of Washington.

Recent Posts