EXPEDIA GROUP Reports FY2022 Q4 Earnings Results on February 9 2023.

March 10, 2023

Earnings Overview

EXPEDIA GROUP ($NASDAQ:EXPE) reported their Q4 earnings results for the fiscal year ending December 31 2022 on February 9 2023. Total revenue for the quarter was USD 177.0 million, a decrease of 54.1% year-over-year. Net income was reported to be USD 2618.0 million, an increase of 14.9% from the same period in the prior year.

Transcripts Simplified

Expedia Group reported strong fourth quarter results, with total gross bookings down 12% on a reported basis and down 2% on a like-for-like basis versus the fourth quarter of 2019. Growth was driven by total lodging gross bookings, which were the highest Q4 on record at plus 4% on a reported basis and plus 6% on a like-for-like basis versus Q4 2019. Excluding the weather-related events, growth versus 2019 for each month in Q4 reached high-single digits that accelerated through the quarter.

In January, we saw a step change where our lodging gross bookings accelerated even further, growing over 20% versus 2019. We are pleased to see strong lodging demand continue, including total lodging bookings for stays expected to occur in the first half of 2023, continuing to meaningfully outpace 2019 and 2022 levels.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Expedia Group. More…

| Total Revenues | Net Income | Net Margin |

| 11.67k | 352 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Expedia Group. More…

| Operations | Investing | Financing |

| 3.44k | -580 | -2.62k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Expedia Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 21.56k | 17.83k | 14.89 |

Key Ratios Snapshot

Some of the financial key ratios for Expedia Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.1% | 7.4% | 7.0% |

| FCF Margin | ROE | ROA |

| 23.8% | 22.4% | 2.4% |

Stock Price

On Thursday, February 9th, 2023, the EXPEDIA GROUP reported their fourth quarter earnings results for the fiscal year 2022. The company’s stock opened at $120.8 and closed at $117.7, a decrease of 1.2% from the last closing price of 119.2. In addition to the financial results for the fourth quarter, EXPEDIA GROUP also announced their overall results for the entire fiscal year of 2022. Overall, EXPEDIA GROUP reported mixed results for the fourth quarter and fiscal year 2022.

The company was able to increase total revenue for the year, but net income and EPS dropped when compared to the previous year. Despite this, EXPEDIA GROUP remains optimistic about their future prospects. Live Quote…

Analysis

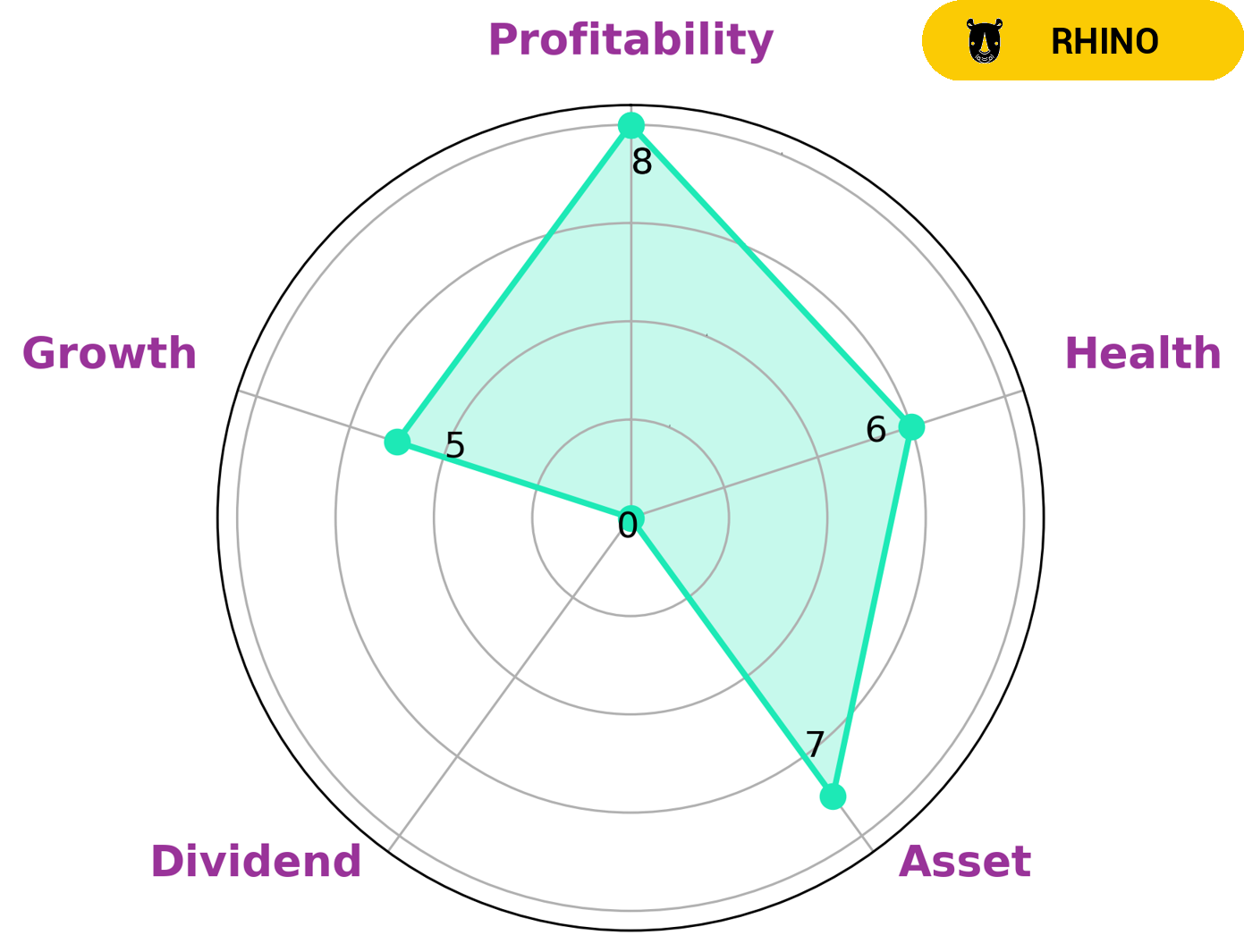

GoodWhale has conducted an analysis of EXPEDIA GROUP‘s wellbeing and have classified them as ‘rhino’ according to the Star Chart. This means that this company has achieved moderate revenue or earnings growth. The intermediate health score of 6/10 with regard to cashflows and debt is promising, and shows that the company is likely to pay off debt and fund future operations. EXPEDIA GROUP is strong in asset, profitability and medium in growth, while being weak in dividend. This kind of company is likely to interest investors that are looking for long-term, stable returns rather than short-term gains. More…

Peers

Expedia Group Inc is one of the world’s largest online travel companies, with a portfolio that includes some of the best-known brands in the industry. Its main competitors are Booking Holdings Inc, Adventure Inc, and Despegar.com Corp. All three companies are leaders in the online travel space, and each has a different focus.

– Booking Holdings Inc ($NASDAQ:BKNG)

Booking Holdings Inc is a online travel company that owns and operates a portfolio of travel brands. The company’s mission is to make it easy for everyone to experience the world. The company’s brands include Booking.com, Priceline.com, Agoda.com, Kayak.com, Rentalcars.com, and OpenTable. The company operates in over 200 countries and employs over 17,000 people.

– Adventure Inc ($TSE:6030)

Adventure Inc is a publicly traded company that operates in the adventure travel industry. The company is headquartered in Vancouver, Canada and was founded in 1971. The company offers a variety of adventure travel products and services including adventure tours, adventure travel packages, and adventure travel insurance. The company has a market cap of 80.18B as of 2022 and a Return on Equity of 13.93%.

– Despegar.com Corp ($NYSE:DESP)

Despegar.com Corp is an online travel company that offers a range of travel products and services, including air tickets, hotel rooms, vacation packages, and car rentals. The company operates in Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru, and Uruguay. As of 2022, Despegar.com had a market cap of 407.36M and a ROE of 95.41%.

Summary

Investors are generally satisfied with the results of Expedia Group‘s fourth quarter of FY2022. Total revenue was down significantly year-over-year, yet net income saw a notable increase. This is likely due to cost-reduction measures and changes in business structures that the company has implemented in recent quarters. Going forward, investors should continue to monitor Expedia Group’s overall performance and its ability to sustain profitability amidst a volatile economic environment.

Recent Posts