EVERI HOLDINGS Announces Q2 FY2023 Earnings Results for June 30 2023

August 19, 2023

🌥️Earnings Overview

On August 9 2023, EVERI HOLDINGS ($NYSE:EVRI) unveiled their earnings results for the second quarter of FY2023, which concluded on June 30 2023. The company reported a total revenue of USD 208.7 million for the period, representing a 5.8% increase in comparison to the corresponding quarter of FY2022. Net income decreased by 15.7%, to USD 27.4 million, from the same quarter in the previous fiscal year.

Price History

The stock opened at $14.9 and closed at $13.0, a decrease of 11.4% from its previous closing price of 14.6. This marked a significant decline in the stock, which had previously been steadily climbing in recent weeks. The company also reported a decrease in revenue compared to the same period last year. The report also showed that the company had made progress in reducing its expenses, resulting in an increase in profit margins compared to the first quarter.

However, this was not enough to offset the decrease in revenue and net income. Overall, the news was not particularly well-received by investors, who had been expecting better results given the recent gains in the stock price. Going forward, it is likely that investors will be closely monitoring the company’s performance in order to gauge its prospects for future growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Everi Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 818.87 | 111.91 | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Everi Holdings. More…

| Operations | Investing | Financing |

| 294.61 | -204.65 | -113.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Everi Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.71k | 1.47k | 2.76 |

Key Ratios Snapshot

Some of the financial key ratios for Everi Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.8% | 503.2% | 25.8% |

| FCF Margin | ROE | ROA |

| 20.4% | 53.2% | 7.7% |

Analysis

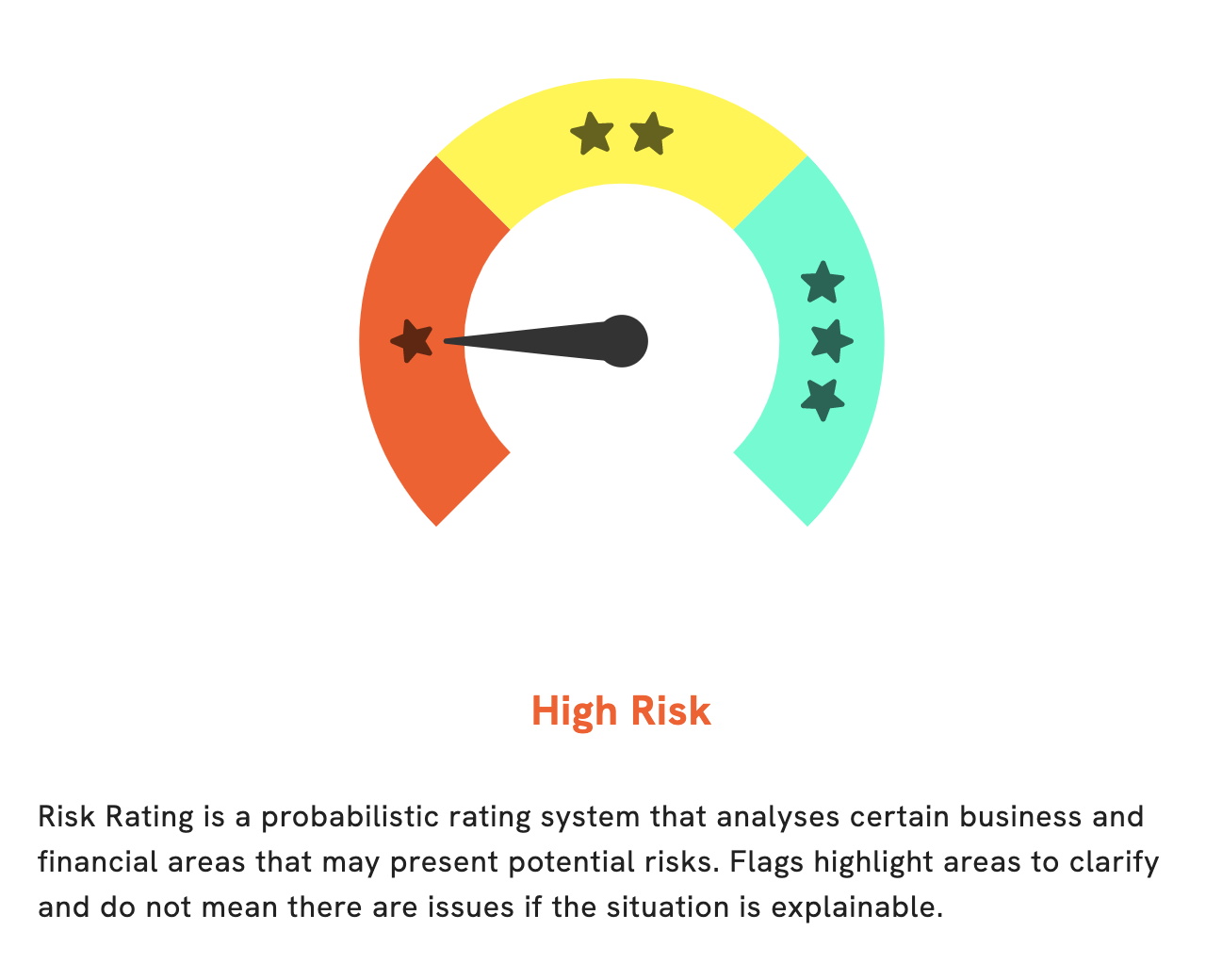

At GoodWhale, we have conducted a detailed financial analysis of EVERI HOLDINGS. Our analysis shows that EVERI HOLDINGS is a high risk investment with respect to financial and business aspects. Specifically, we have detected two risk warnings in the income statement and balance sheet. To find out more information about these warnings, become a registered user of GoodWhale and gain access to our in-depth analysis of EVERI HOLDINGS. With GoodWhale, you can make informed decisions regarding your investments. More…

Peers

Its competitors include Galaxy Gaming Inc, Inspired Entertainment Inc, Four Corners Inc. Everi Holdings Inc operates in the US, Europe, and Asia Pacific.

– Galaxy Gaming Inc ($OTCPK:GLXZ)

Galaxy Gaming Inc is a gaming company that operates in the casino industry. It designs, develops, and manufactures casino table games and gaming equipment. The company has a market cap of 61.85M as of 2022 and a Return on Equity of -17.14%. Galaxy Gaming is headquartered in Las Vegas, Nevada.

– Inspired Entertainment Inc ($NASDAQ:INSE)

Inspired Entertainment is a global games technology company that provides virtual sports, mobile gaming and server-based gaming systems for regulated markets. The company’s products are available in over 35,000 retail locations and online sites in over 40 countries. The company has a market cap of 308.85M as of 2022 and a Return on Equity of -51.07%.

– Four Corners Inc ($OTCPK:FCNE)

Four Corners Inc is a publicly traded company that owns and operates a chain of casual dining restaurants. The company was founded in 1988 and is headquartered in Houston, Texas. As of 2022, Four Corners Inc had a market capitalization of 10.79 million and a return on equity of -21.68%. The company’s primary business is operating and franchising casual dining restaurants under the Four Corners name. The company operates or franchises over 60 restaurants in 10 states across the United States.

Summary

EVERI HOLDINGS recently announced their earnings for the second quarter of FY2023, with total revenue of USD 208.7 million and net income of USD 27.4 million. This is a 5.8% increase in revenue compared to the same quarter of the previous year, but net income was 15.7% lower than the same quarter in FY2022. The stock price reacted negatively to the results, suggesting that investors may be concerned about the company’s profitability. While the revenue increase is a positive sign, further analysis will need to be done to determine whether EVERI HOLDINGS can continue to grow and generate higher profits in the future.

Recent Posts