ENVISTA HOLDINGS Reports Fourth Quarter FY2022 Earnings Results on February 8 2023

March 13, 2023

Earnings Overview

On February 8 2023, ENVISTA HOLDINGS ($NYSE:NVST) reported its financial results for the fiscal quarter ending December 31 2022. Total revenue for the period was USD 73.5 million, a 14.3% decrease from the same quarter of the prior year. In spite of this, net income rose 1.4% to USD 660.8 million.

Transcripts Simplified

In the fourth quarter of 2022, Envista Holdings reported a 1.4% increase in sales to $660.8 million. This growth was negatively impacted by 4%, due to foreign currency exchange rates, while acquisitions contributed 3.1% of growth in the quarter. Core sales growth was 2.3%, compared to the fourth quarter of 2021. Geographically, developed markets grew 3.5%, while China and Russia declined significantly. Our fourth quarter adjusted gross margin from continuing operations was 56.2%, a decrease of 90 basis points, compared to the prior year. Our adjusted EBITDA margin for the quarter was 20.9%, which is 240 basis points higher than Q4 of 2021.

Our fourth quarter adjusted EPS was $0.52 from continuing operations, compared to $0.46 in the comparable period of the prior year. In our Specialty Products and Technology segment, core revenue increased 4.5%, compared to the fourth quarter of 2021. Our orthodontics business grew more than 15% year-over-year in the fourth quarter with Spark continuing to outperform. Our implant-based tooth replacement business declined modestly in Q4 of 2022 versus Q4 of the prior year. Our Equipment and Consumables segment core sales in Q4 decreased by 0.9%, compared to Q4 of 2021.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Envista Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.57k | 243.1 | 9.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Envista Holdings. More…

| Operations | Investing | Financing |

| 182.7 | -657.3 | 12.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Envista Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.59k | 2.38k | 25.78 |

Key Ratios Snapshot

Some of the financial key ratios for Envista Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.3% | 4.8% | 12.5% |

| FCF Margin | ROE | ROA |

| 4.2% | 4.9% | 3.1% |

Market Price

ENVISTA HOLDINGS recently reported their fourth quarter FY2022 earnings results on Wednesday, February 8th 2023. The stock opened at $41.0, but closed at $40.7, marking a 2.0% decline from its previous closing price of $41.5. The company’s strong performance was driven by strong growth in its core business segments.

In addition, the company has continued to execute on its strategic objectives, investing in new technology and expanding its product portfolios. This has enabled ENVISTA HOLDINGS to remain competitive in a rapidly changing business environment. Overall, the company has succeeded in delivering a solid financial performance for the fourth quarter of FY2022. As ENVISTA HOLDINGS continues to build on its strong performance, investors should continue to monitor the stock for further updates on the company’s financials and future prospects. Live Quote…

Analysis

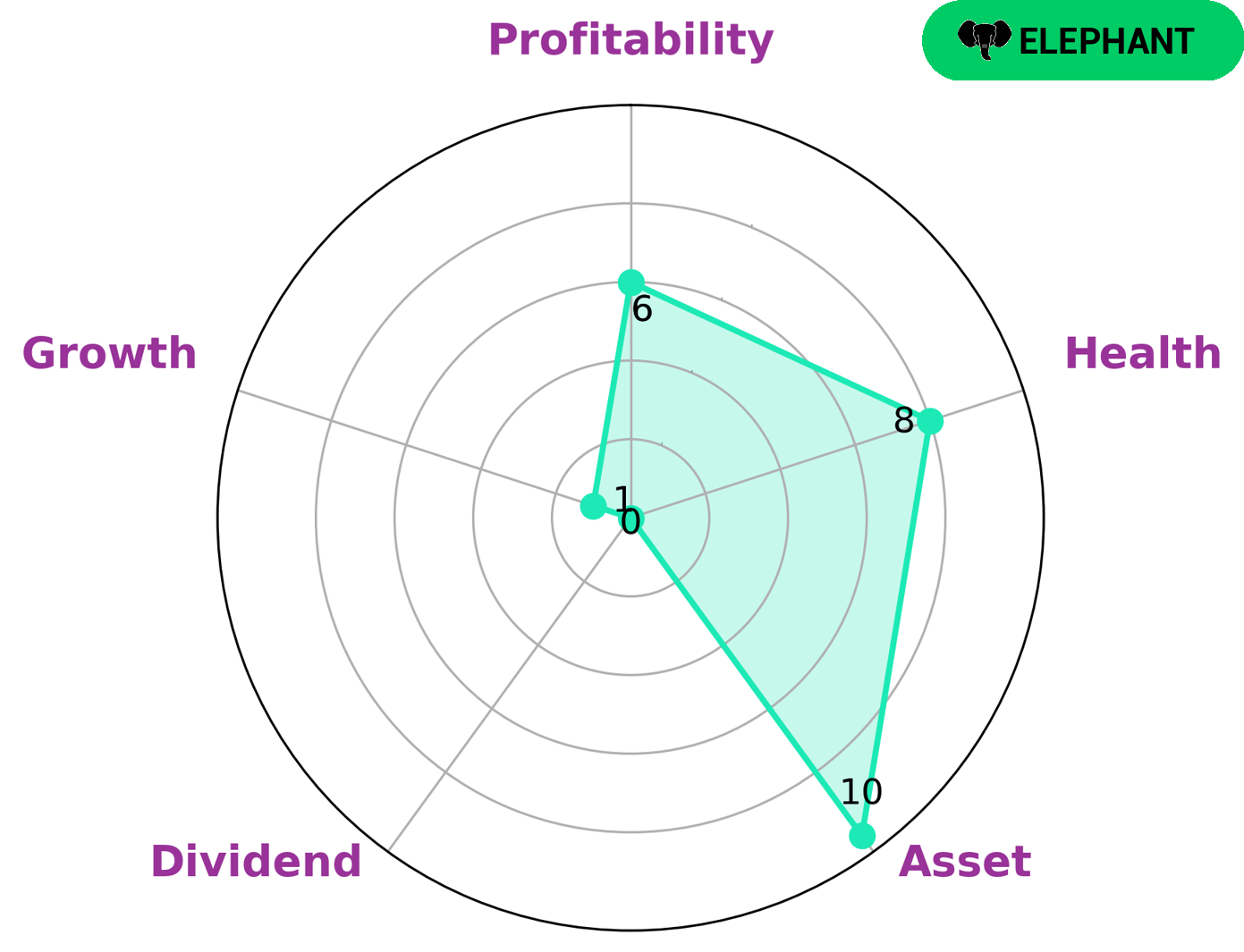

At GoodWhale, we analyze ENVISTA HOLDINGS‘s financials to get a better understanding of the company. According to our Star Chart analysis, ENVISTA HOLDINGS is strong in terms of assets, medium in profitability and weak in dividend and growth. Furthermore, ENVISTA HOLDINGS is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. This could be of interest to investors who are looking for a company that is capable of sustaining its operations in times of crisis or downturn. ENVISTA HOLDINGS has a high health score of 8/10 considering its cashflows and debt, making it an ideal investment option for long-term investors. Furthermore, with a strong asset base, ENVISTA HOLDINGS can also be a great option for investors who are looking to invest in a financially stable company. More…

Peers

Its main competitors are Medikit Co Ltd, Nihon Kohden Corp, and Fukuda Denshi Co Ltd. Envista has a strong market presence in the US, Europe, and Asia Pacific.

– Medikit Co Ltd ($TSE:7749)

As of 2022, Medikit Co Ltd has a market cap of 41.17B and a Return on Equity of 6.14%. The company produces and sells medical equipment and supplies. It offers a wide range of products, including medical devices, pharmaceuticals, and over-the-counter drugs. Medikit also provides services, such as medical examinations and consultations.

– Nihon Kohden Corp ($TSE:6849)

Nihon Kohden is a Japanese manufacturer of medical equipment, with a particular focus on patient monitoring systems. The company has a market cap of 278.79B as of 2022 and a return on equity of 13.19%. Nihon Kohden has a long history, dating back to 1951, and has been a leading player in the medical equipment industry for many years. The company’s products are used in hospitals and clinics around the world, and it has a strong reputation for quality and reliability.

– Fukuda Denshi Co Ltd ($TSE:6960)

Fukuda Denshi Co Ltd is a Japanese company that manufactures and sells medical equipment. The company has a market cap of 138.83B as of 2022 and a Return on Equity of 9.95%. Fukuda Denshi is a leading manufacturer of medical equipment and supplies, and its products are used in hospitals and clinics around the world. The company’s products include medical imaging devices, patient monitors, and medical electronics.

Summary

Investors in ENVISTA HOLDINGS should take note of the company’s fourth quarter of FY2022 earnings results. Total revenue for the quarter was USD 73.5 million, a 14.3% decrease from the same period the previous year.

However, net income increased 1.4%, to USD 660.8 million. This indicates that ENVISTA HOLDINGS remains a worthwhile investment despite the decreased revenue, with a strong balance sheet and a healthy bottom line. Investors should continue to monitor the company’s performance in the long term to determine the best entry and exit points.

Recent Posts