E N C O M P A S S H E A L T H R e p o r t s F o u r t h Q u a r t e r F Y 2 0 2 2 E a r n i n g s w i t h 2 . 4 % R e v e n u e D e c l i n e a n d 1 3

March 1, 2023

Earnings report

ENCOMPASS HEALTH ($NYSE:EHC) recently reported their fourth quarter FY2022 earnings results covering the period between October 1, 2022 and December 31, 2022. The results, which were made public on February 7, 2023, show that total revenue for the quarter came in at USD 89.4 million, representing a decline of 2.4% compared to the same quarter the previous year. Net income was equally negative, coming in at USD 1137.3 million, a decrease of 13.8% compared to the same quarter in the prior year. This performance is slightly below expectations, demonstrating the current financial pressure felt by many health providers due to the ongoing pandemic and other external factors.

However, ENCOMPASS HEALTH remains optimistic, as seen in their fourth quarter results which have shown some improvements compared to the previous year. As such, they have provided a strong outlook for the upcoming financial year, expecting a rebound in both top and bottom lines.

Market Price

On Tuesday, ENCOMPASS HEALTH reported its fourth quarter earnings for FY 2022, which showed a revenue decline of 2.4%. The company’s stock opened at $59.2 and closed at $58.9, down by 1.0% from prior closing price of 59.5. Despite this, ENCOMPASS HEALTH reaffirmed its guidance for the coming year and stated that it remains positive about its long-term growth prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Encompass Health. More…

| Total Revenues | Net Income | Net Margin |

| 4.35k | 271 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Encompass Health. More…

| Operations | Investing | Financing |

| 705.8 | -627 | -145.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Encompass Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.64k | 3.77k | 13.13 |

Key Ratios Snapshot

Some of the financial key ratios for Encompass Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.9% | -3.1% | 14.4% |

| FCF Margin | ROE | ROA |

| 2.8% | 31.0% | 6.9% |

Analysis

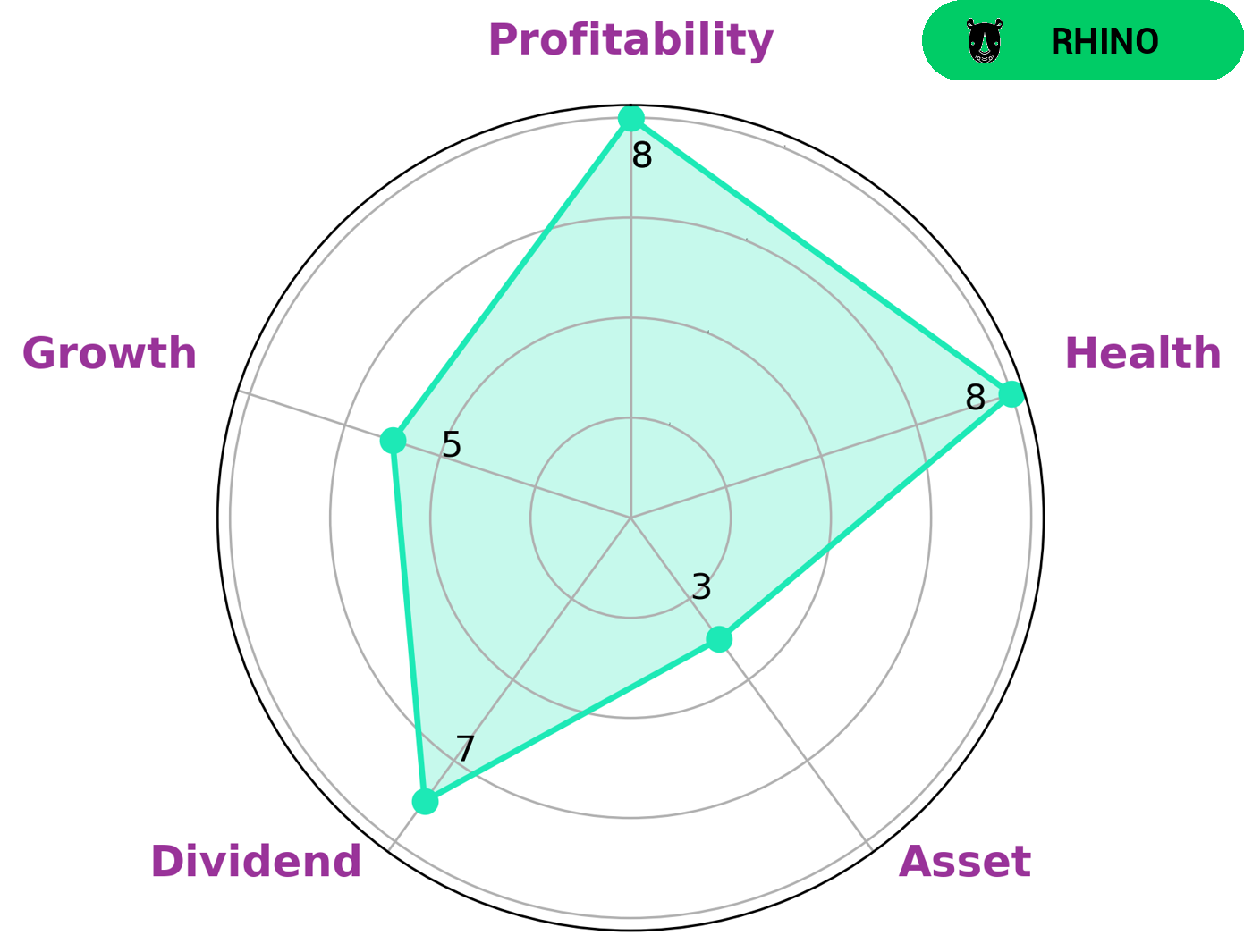

At GoodWhale, we conducted an in-depth analysis of ENCOMPASS HEALTH‘s wellbeing. Our analysis revealed that ENCOMPASS HEALTH has a high health score of 8/10 in regards to its cashflows and debt, indicating the company is capable of paying off all its debt obligations and funding future operations. Additionally, ENCOMPASS HEALTH is strong in dividend payments, profitability and is moderately growing, albeit with a slightly weaker asset base. As a result, we classified ENCOMPASS HEALTH as an ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Such companies may be of particular interest to those looking for steady dividend payments and are comfortable with the level of growth in this sector. Investors with a long-term strategy and those focused on bottom line profitability are likely to be interested parties for investing in ENCOMPASS HEALTH. More…

Peers

There is fierce competition between Encompass Health Corp and its competitors: Community Health Systems Inc, Pennant Group Inc, Greenbrook TMS Inc. All four companies are leaders in the healthcare industry and are constantly striving to be the best.

– Community Health Systems Inc ($NYSE:CYH)

The company’s market capitalization is 311.19 million as of 2022. The company’s return on equity is -48.01%. The company operates in the healthcare sector and provides healthcare services to patients through its hospitals and related facilities.

– Pennant Group Inc ($NASDAQ:PNTG)

Pennant Group, Inc. provides healthcare services in the United States. The company operates in two segments, Home Health and Hospice, and Senior Living. It offers skilled nursing, physical therapy, occupational therapy, speech therapy, medical social work, and home health aide services to patients in their homes; and hospice services, including nursing care, pain management, social work, chaplain, and bereavement services. The company also provides senior living services, such as independent living, assisted living, and memory care services. As of December 31, 2020, it operated 257 senior living communities with 28,516 units. The company was formerly known as Curo Health Services, Inc. and changed its name to Pennant Group, Inc. in July 2018. Pennant Group, Inc. was founded in 2006 and is headquartered in Carrollton, Texas.

– Greenbrook TMS Inc ($TSX:GTMS)

Greenbrook TMS Inc is a healthcare company that provides treatment for depression and other mental disorders. The company has a market capitalization of 123.09M and a return on equity of -213.16%. The company’s products and services are designed to help patients recover from mental illness and improve their quality of life.

Summary

N e t i n c o m e f o r t h e p e r i o d d e c r e a s e d 1 3 . 8 % t o U S D 1 1 3 7 .

Recent Posts