DYNATRACE Reports Fourth Quarter Earnings Results for Fiscal Year Ending May 17, 2023

May 25, 2023

Earnings Overview

On March 31, 2023, DYNATRACE ($NYSE:DT) announced earnings results for the fourth quarter of their fiscal year ending May 17, 2023. Total revenue for the quarter was USD 314.5 million, a 24.5% rise year-on-year. The company also reported net income of USD 80.3 million, compared to a loss of 0.9 million in the same period in the prior year.

Share Price

DYNATRACE stock opened at $46.0 and closed at $47.1, indicating a 0.6% increase from its prior closing price of $46.8. This marks a successful quarter for the company, as it continues to remain competitive in the market and deliver positive results. These results demonstrate DYNATRACE’s commitment to delivering strong financial performance and returning value to its shareholders.

Going forward, the company aims to build on this momentum and continue its growth trajectory. Investors remain eager to learn more about the company’s plans and strategies, as it looks to capitalize on the opportunities ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dynatrace. More…

| Total Revenues | Net Income | Net Margin |

| 1.16k | 107.96 | 9.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dynatrace. More…

| Operations | Investing | Financing |

| 354.88 | -21.54 | -232.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dynatrace. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.77k | 1.16k | 5.53 |

Key Ratios Snapshot

Some of the financial key ratios for Dynatrace are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.5% | – | 8.1% |

| FCF Margin | ROE | ROA |

| 28.8% | 3.8% | 2.1% |

Analysis

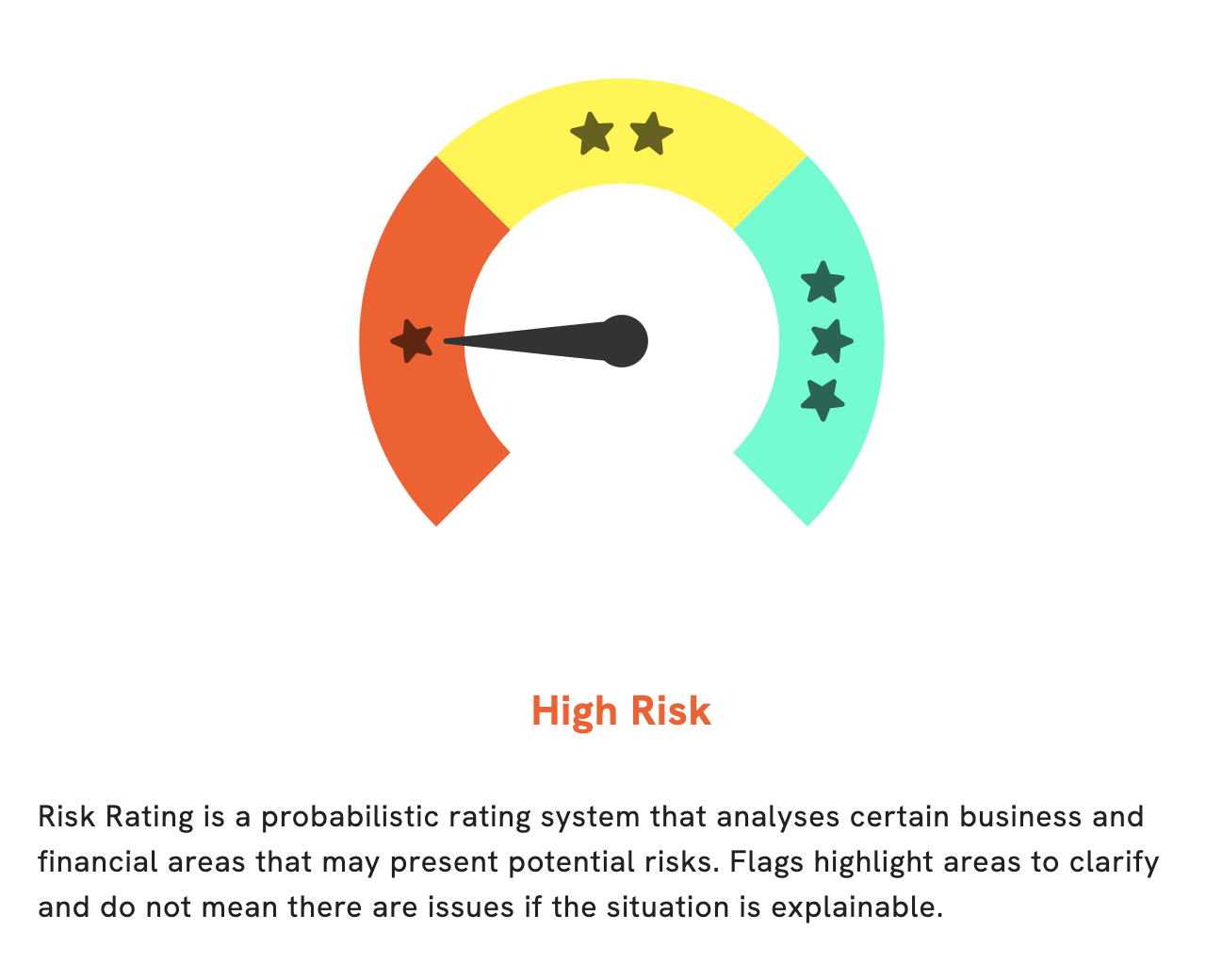

At GoodWhale, we recently performed an analysis of DYNATRACE‘s financial and business wellbeing. After thoroughly examining numerous factors, we have concluded that DYNATRACE is a high risk investment according to our Risk Rating. In our assessment, we have identified three inherent risk warnings in the income sheet, balance sheet, and cashflow statement. We strongly recommend that potential investors register with us in order to gain access to the full details of our analysis. By doing so, you will be able to make an informed decision prior to investing in DYNATRACE. More…

Peers

Its competitors are Datadog Inc, Insig AI PLC, and NICE Ltd.

– Datadog Inc ($NASDAQ:DDOG)

Datadog Inc is a cloud-based monitoring service provider. The company has a market cap of $25.57 billion and a return on equity of 1.87%. Datadog Inc provides monitoring and analytics tools for IT and DevOps teams. The company’s platform enables users to collect and analyze data from multiple data sources, including AWS, Azure, Google Cloud Platform, and on-premises systems.

– Insig AI PLC ($LSE:INSG)

Insignia AI PLC is a technology company that specializes in artificial intelligence and machine learning. The company has a market capitalization of 20.08 million as of 2022 and a return on equity of -5.9%. The company’s products and services are used by businesses and organizations in a variety of industries, including healthcare, retail, and manufacturing.

– NICE Ltd ($OTCPK:NCSYF)

NICE Ltd is a global technology company that provides software and services that enable organizations to improve customer experience and business results. The company has a market capitalization of $12.09 billion as of 2022 and a return on equity of 6.21%. NICE provides a suite of software and services that helps organizations to interact with customers and employees, and to manage and analyze customer data. The company’s products and services are used by organizations in a variety of industries, including banking, healthcare, insurance, retail, and telecommunications.

Summary

DYNATRACE is a company to consider for investing. The company reported strong financial results in the fourth quarter of their fiscal year ending May 17, 2023. Total revenue for the quarter came in at USD 314.5 million, which was an impressive 24.5% increase compared to the same period last year.

Net income was also significantly higher, coming in at USD 80.3 million compared to a loss of 0.9 million last year. Its stock is likely to perform well in the long-term.

Recent Posts