DOMINION ENERGY Reports FY2022 Q4 Earnings Results for Period Ending December 31, 2022 on February 8, 2023

April 1, 2023

Earnings Overview

DOMINION ENERGY ($NYSE:D) reported its FY2022 Q4 earnings results on February 8 2023, with total revenue at USD -0.0 billion, a decrease of 103.0% year over year, and net income increasing by 26.5% to USD 4.9 billion for the period ending December 31 2022.

Transcripts Simplified

Dominion Energy reported fourth quarter and full year 2022 operating earnings at the midpoint of its guidance range. A noncash charge of $1.5 billion due to the company no longer investing in unregulated solar projects was recorded as a result of a business review. For the first quarter 2023, Dominion Energy expects operating earnings to be between $0.97 and $1.12 per share. Weather-normalized sales increased 3.4% in 2022 as compared to 2021 and are expected to remain above the long-term demand growth assumption of 1% to 1.5%.

The company bolstered its liquidity with an opportunistic long-term debt issuance and a 364-day term loan facility. Interest rates have increased, which is expected to lead to higher interest expense, while pension and OPEB may decrease earnings due to asset performance.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dominion Energy. More…

| Total Revenues | Net Income | Net Margin |

| 17.17k | 901 | 19.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dominion Energy. More…

| Operations | Investing | Financing |

| 3.7k | -6.75k | 2.98k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dominion Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 104.24k | 76.36k | 33.39 |

Key Ratios Snapshot

Some of the financial key ratios for Dominion Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.2% | 1.7% | 23.8% |

| FCF Margin | ROE | ROA |

| -22.7% | 9.0% | 2.4% |

Market Price

The stock opened at $59.8 and closed at $59.6, representing a 3.3% decrease from the prior closing price of 61.6. Despite the decreased stock price, DOMINION ENERGY reported positive earnings in this quarter, signaling potential for future growth in the upcoming year. The reported earnings come as a surprise to many investors, as the company had previously experienced an extended period of relative stagnation in the stock price.

However, with the release of these fourth-quarter earnings results, it appears that DOMINION ENERGY is on the track to recovery. The company has worked hard to maintain a positive outlook for the future, and these earnings results are a strong indicator of their success in doing so. Overall, the release of these fourth-quarter earnings results show that DOMINION ENERGY is on the right track towards recovering from the past financial struggles and heading towards a brighter future. Investors should continue to monitor the company closely as they progress in their efforts to remain successful business in the coming years. Live Quote…

Analysis

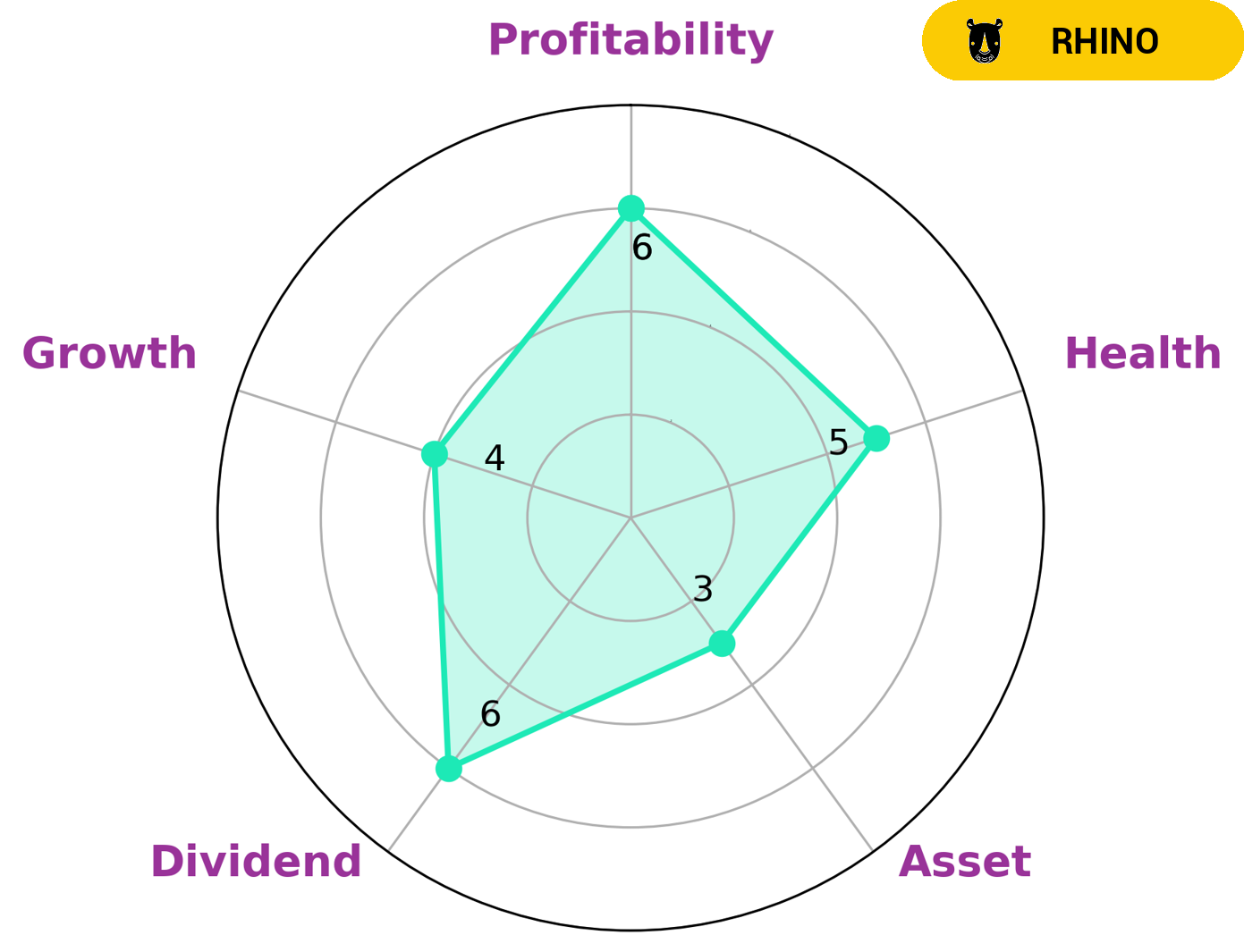

GoodWhale has conducted an analysis of DOMINION ENERGY‘s well-being and the results are displayed in our Star Chart. Our assessment shows that DOMINION ENERGY has an intermediate health score of 5/10, indicating that it might be able to sustain future operations in times of crisis. When looking at the individual components of our analysis, DOMINION ENERGY is strong in cashflows and debt, medium in dividend, growth, profitability and weak in asset. Based on these results, DOMINION ENERGY is classified as a ‘rhino’, a type of company we conclude that has achieved moderate revenue or earnings growth. Investors interested in such companies may include those looking for more conservative investments with more stability and less risk. More…

Peers

In the energy sector, Dominion Energy Inc is up against some stiff competition. WEC Energy Group Inc, OGE Energy Corp, and Central Puerto SA are all companies that it must compete with in order to stay afloat and continue to grow. Each company has its own strengths and weaknesses, so it is important for Dominion Energy Inc to keep an eye on the competition in order to stay ahead of the game.

– WEC Energy Group Inc ($NYSE:WEC)

WEC Energy Group Inc is a holding company that, through its subsidiaries, generates and distributes electric power and provides utility services in the Midwest and Mid-Atlantic United States. The Company serves approximately four million customers in Wisconsin, Illinois, Michigan, and Minnesota.

WEC Energy Group Inc has a market cap of 27.02B as of 2022. It has a ROE of 11.61%. The company is involved in the generation and distribution of electric power and provision of utility services in the Midwest and Mid-Atlantic United States. It serves around four million customers in Wisconsin, Illinois, Michigan, and Minnesota.

– OGE Energy Corp ($NYSE:OGE)

Duke Energy Corporation is an American electric power holding company headquartered in Charlotte, North Carolina. The company is the largest utility in the United States with 7.3 million customers in six states. Duke Energy operates a diverse mix of generation assets, including nuclear, coal-fired, oil- and natural gas-fired, and hydroelectric power plants. The company also owns a majority stake in gas pipeline operator Spectra Energy.

– Central Puerto SA ($NYSE:CEPU)

Central Puerto SA is an Argentinean electricity generation company. The company has a market cap of 1.34 billion as of 2022 and a return on equity of 7.42%. Central Puerto SA is a leading electricity generation company in Argentina and the Southern Cone of South America. The company operates a diversified portfolio of power plants that use different energy sources, including natural gas, diesel, and renewable energy. Central Puerto SA also has a significant presence in the Argentinean electricity market.

Summary

Investors reacted negatively to Dominion Energy‘s fourth quarter FY2022 earnings report, released on February 8, 2023. Total revenue for the quarter fell by 103.0% compared to the same period last year. Despite an increase of 26.5% in net income to USD 4.9 billion, the stock price decreased that day.

Investors should consider the long-term potential of Dominion Energy in light of its declining revenue. With its strong financial performance and commitment to sustainability, the company has a good chance of regaining investor confidence over time.

Recent Posts