Delek Us Stock Fair Value Calculation – DELEK US Reports Third Quarter Earnings Results for Fiscal Year 2023

December 11, 2023

🌥️Earnings Overview

On November 7, 2023, DELEK US ($NYSE:DK) announced their earnings report for the fiscal year 2023 third quarter, ending September 30, 2023. Total revenue fell by 10.8% from the same period in the previous year, totaling to USD 4748.4 million. In contrast, net income rose dramatically from the year prior, amounting to USD 128.7 million compared to the 7.4 million reported in the previous year.

Stock Price

The stock opened at $25.3 and closed at $26.1, which represents a 1.3% increase from its closing price of $25.8 the day prior. The revenue and earnings gains were driven by the company’s strong position in the refining and marketing sector, with higher sales of diesel and gasoline across its chain of convenience stores. Overall, DELEK US reported solid results in the third quarter, indicating that the company is well-positioned to continue its financial success for the remainder of the fiscal year. Investors were pleased with the report, as evidenced by the 1.3% increase in the stock price on Tuesday. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Delek Us. More…

| Total Revenues | Net Income | Net Margin |

| 17.35k | 66 | 0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Delek Us. More…

| Operations | Investing | Financing |

| 632 | -450.3 | -433.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Delek Us. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.87k | 6.71k | 16.05 |

Key Ratios Snapshot

Some of the financial key ratios for Delek Us are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.1% | -2.4% | 2.3% |

| FCF Margin | ROE | ROA |

| 1.0% | 25.2% | 3.2% |

Analysis – Delek Us Stock Fair Value Calculation

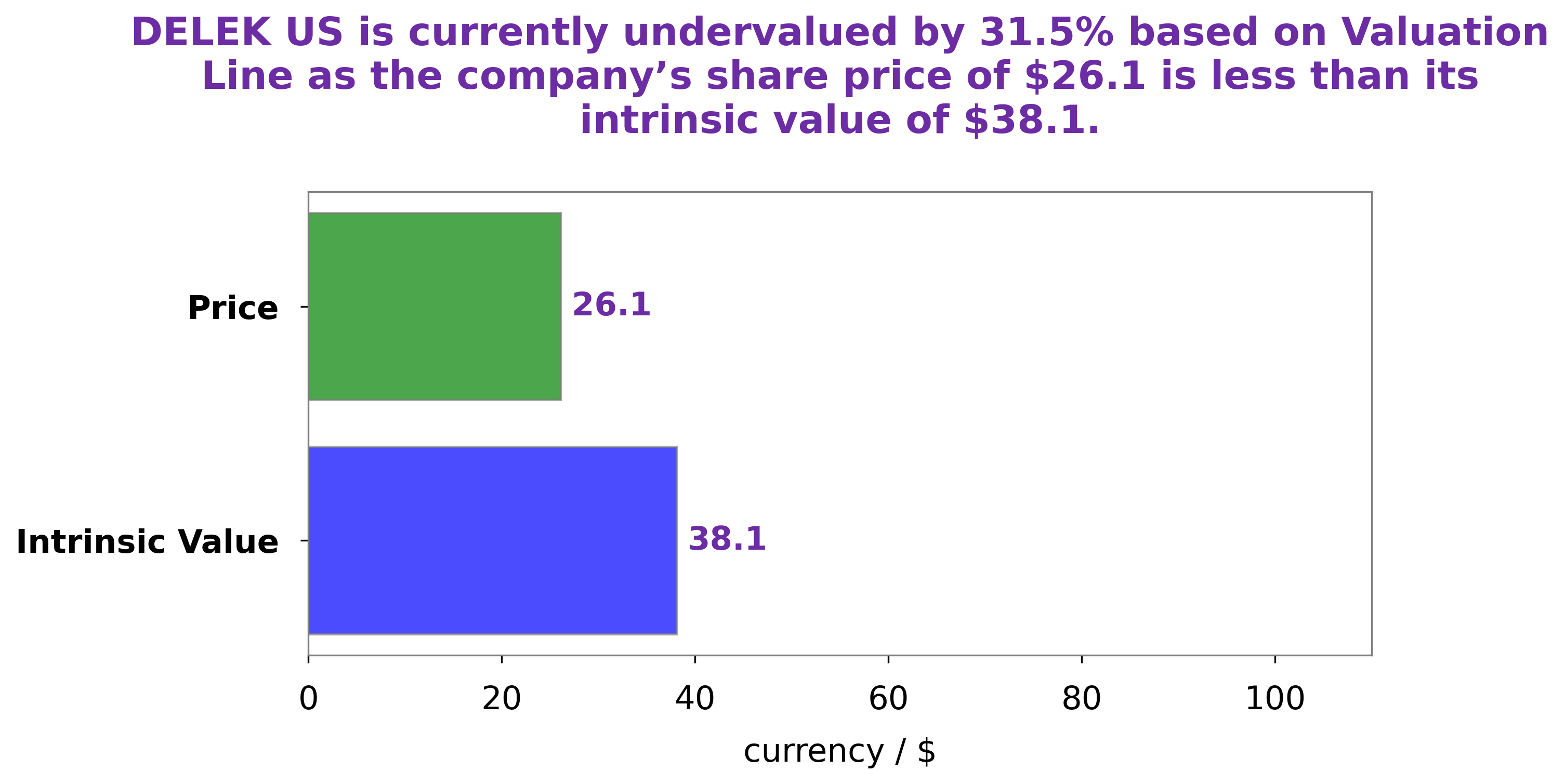

At GoodWhale, we have conducted a comprehensive analysis of DELEK US‘s wellbeing. After taking into account all relevant factors, we have calculated the intrinsic value of DELEK US shares to be around $38.1. We have done this using our proprietary Valuation Line. Currently, DELEK US stock is trading at $26.1, which represents a 31.4% undervaluation. This discrepancy between the market price and the intrinsic value provides an opportunity for investors who are looking for a potential upside. More…

Peers

The company’s competitors are PBF Energy Inc, HF Sinclair Corp, and PBF Logistics LP. Delek US Holdings Inc. has a market share of 9.4%.

– PBF Energy Inc ($NYSE:PBF)

PBF Energy is a leading independent petroleum refiner and supplier of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other industrial products in the United States. The company’s market cap is $5.8 billion and its ROE is 52.76%. PBF Energy operates refining facilities in Ohio, New Jersey and Louisiana with a combined capacity of approximately 1.9 million barrels per day. The company also owns and operates two logistics businesses, PBF Logistics LP and PBF Holding Company LLC, which provide crude oil and refined product transportation and storage services.

– HF Sinclair Corp ($NYSE:DINO)

Sinclair Broadcasting Group, Inc. is an American telecommunications company that is owned by the family of company founder Julian Sinclair Smith. The company is the largest television station operator in the United States by number of stations, and largest by total coverage; owning or operating a total of 193 stations across the country. Many of the group’s stations are in the top markets, including Seattle, Pittsburgh, St. Louis and Las Vegas.

– PBF Logistics LP ($NYSE:PBFX)

PBF Logistics LP is a publicly traded master limited partnership that owns, operates, develops, and acquires crude oil, refined petroleum products, and natural gas liquids (NGL) logistics assets. The company has a market cap of 1.38B as of 2022 and a Return on Equity of 40.3%. PBF Logistics is headquartered in Parsippany, New Jersey.

Summary

Investors may be encouraged by DELEK US‘s third quarter earnings results for fiscal year 2023, ending September 30 2023. The company reported total revenue of USD 4748.4 million, a decrease of 10.8% from the same period last year, yet net income was USD 128.7 million, a significant increase from the 7.4 million reported the previous year. This indicates to investors that the company has been able to manage its expenses and optimize its operations in order to improve its bottom line. In addition, given the potential for improvement in the economy, investors may see potential in DELEK US and its stock as a growth opportunity.

Recent Posts