DELEK US Reports Q4 FY2022 Earnings with Total Revenue of -$118.7M and Net Income of $4.5B, up 44.1% Year-over-Year

March 7, 2023

Earnings report

DELEK US ($NYSE:DK) reported their earnings results for the fourth quarter of FY2022 on February 28 2023, as of December 31 2022. The company saw a significant decrease in total revenue as total revenue was USD -118.7 million, a decrease of 183.3% from the same period the previous year. Despite this, net income was USD 4479.2 million, an increase of 44.1% year over year. This increase was largely attributed to the company’s cost-cutting measures and strategic investments in the quarter.

In addition, DELEK US also saw significant gains in their oil and gas and retail sectors compared to last year. Going forward, DELEK US is looking to continue to drive revenue growth and increase profitability by further implementing cost saving initiatives, optimizing operations, and focusing on their core business areas. With these measures in place, DELEK US is optimistic they will continue to experience strong financial performance in the coming years.

Stock Price

In response to the news, the company’s stock opened at $27.2, but saw a 7.5% decrease from the prior closing price and ended the day at $25.2. Despite the decrease in stock price, analysts are still bullish on DELEK US and its long-term prospects due to its strong fundamentals and its position within the energy industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Delek Us. More…

| Total Revenues | Net Income | Net Margin |

| 20.25k | 257.1 | 1.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Delek Us. More…

| Operations | Investing | Financing |

| 425.3 | -931.6 | 491.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Delek Us. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.19k | 7.12k | 16.66 |

Key Ratios Snapshot

Some of the financial key ratios for Delek Us are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.6% | -2.4% | 2.7% |

| FCF Margin | ROE | ROA |

| 2.1% | 32.7% | 4.2% |

Analysis

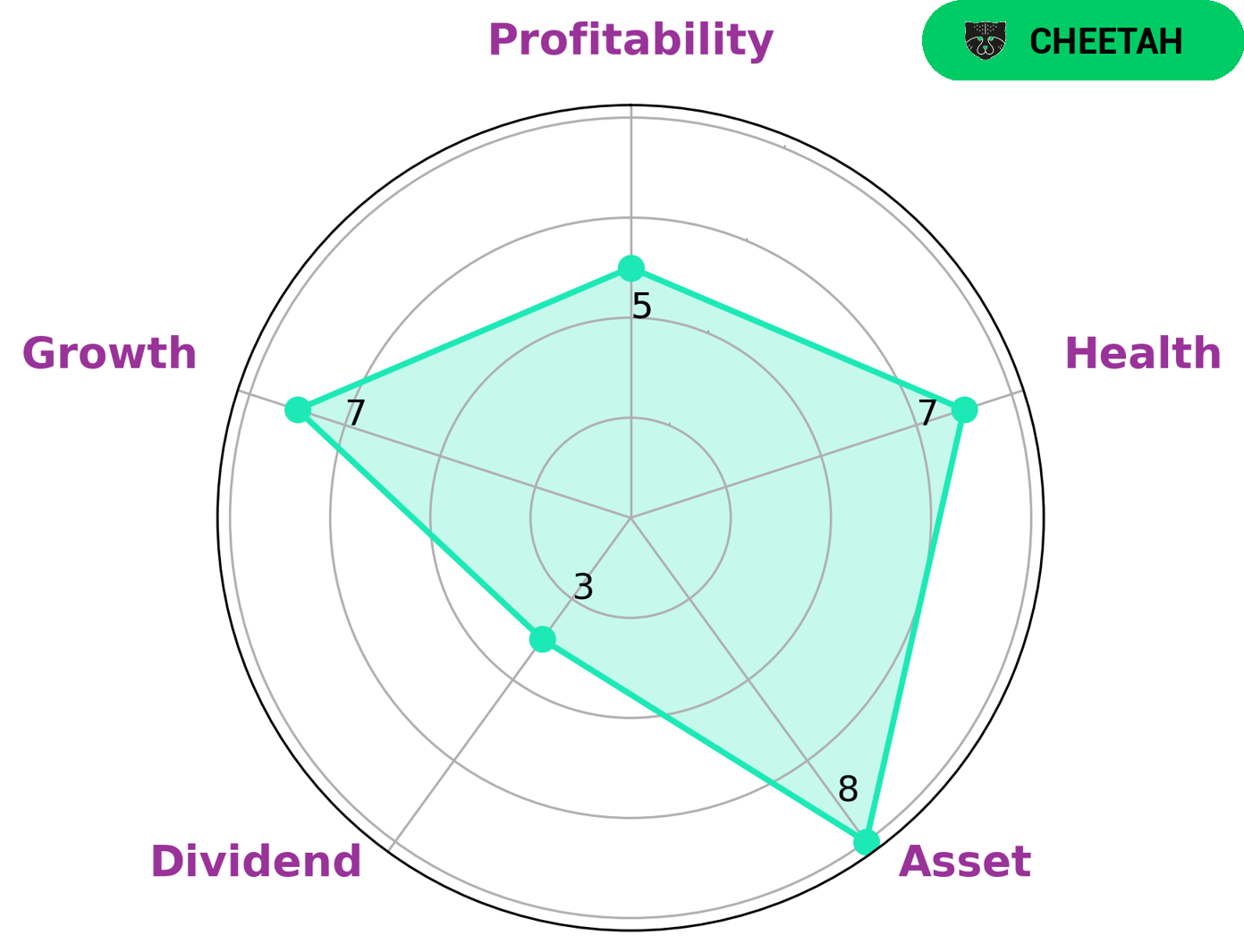

GoodWhale has examined the financials of DELEK US and evaluated the stock on the basis of its cashflows, debt, profitability, asset, growth and dividend. According to our Star Chart, DELEK US has a health score of 7/10, which implies that the company is capable of sustaining future operations in times of crisis. Furthermore, our analysis reveals that DELEK US has strong asset and growth but is only medium in profitability and weak in dividend. Based on these findings, DELEK US is classified as a ‘cheetah’ or ‘growth stock’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of stock may be interesting to investors looking for long-term growth – such as venture capitalists and entrepreneurs. These investors are likely to buy stocks in the early stages of growth and hold them until they become profitable and established. Other investors may also be attracted to DELEK US due to its potential for capital appreciation. More…

Peers

The company’s competitors are PBF Energy Inc, HF Sinclair Corp, and PBF Logistics LP. Delek US Holdings Inc. has a market share of 9.4%.

– PBF Energy Inc ($NYSE:PBF)

PBF Energy is a leading independent petroleum refiner and supplier of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other industrial products in the United States. The company’s market cap is $5.8 billion and its ROE is 52.76%. PBF Energy operates refining facilities in Ohio, New Jersey and Louisiana with a combined capacity of approximately 1.9 million barrels per day. The company also owns and operates two logistics businesses, PBF Logistics LP and PBF Holding Company LLC, which provide crude oil and refined product transportation and storage services.

– HF Sinclair Corp ($NYSE:DINO)

Sinclair Broadcasting Group, Inc. is an American telecommunications company that is owned by the family of company founder Julian Sinclair Smith. The company is the largest television station operator in the United States by number of stations, and largest by total coverage; owning or operating a total of 193 stations across the country. Many of the group’s stations are in the top markets, including Seattle, Pittsburgh, St. Louis and Las Vegas.

– PBF Logistics LP ($NYSE:PBFX)

PBF Logistics LP is a publicly traded master limited partnership that owns, operates, develops, and acquires crude oil, refined petroleum products, and natural gas liquids (NGL) logistics assets. The company has a market cap of 1.38B as of 2022 and a Return on Equity of 40.3%. PBF Logistics is headquartered in Parsippany, New Jersey.

Summary

Net income for the quarter increased by 44.1% to USD 4479.2 million. Despite this positive news, the stock price has dropped after the announcement. This could be attributed to shareholders’ apprehension regarding the effects of the pandemic on the company’s outlook, or it may be that investors feel that the company’s strategy is misguided. Ultimately, investors should perform their own analysis before investing in DELEK US, taking into account current market conditions and the company’s long-term prospects.

Recent Posts