Cytek Biosciences Stock Intrinsic Value – CYTEK BIOSCIENCES Reports Earnings Results for FY2023 Q3

December 17, 2023

🌥️Earnings Overview

On November 7 2023, CYTEK BIOSCIENCES ($NASDAQ:CTKB) announced their earnings results for the third quarter of FY2023, which concluded on September 30 2023. Revenue for the quarter amounted to USD 48.0 million, representing an 18.6% increase from the same period in the previous year. Net income was USD -6.5 million, compared to 1.7 million from Q3 of FY2022.

Share Price

The company’s stock opened at $4.4 and closed at $4.4, giving it a 2.1% increase in share value from the previous day’s closing price. This rise was largely attributed to the strong quarterly performance the company had in terms of revenue and profits. Overall, CYTEK BIOSCIENCES‘ earnings report was a positive one, indicating that the company is continuing to make strong progress in its financial performance. This should provide investors with further confidence in the future of the company and its ability to continue to deliver strong financial results over the next few quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cytek Biosciences. More…

| Total Revenues | Net Income | Net Margin |

| 183.12 | -14.12 | -7.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cytek Biosciences. More…

| Operations | Investing | Financing |

| 1.96 | -174.02 | -4.21 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cytek Biosciences. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 519.43 | 103.91 | 3.07 |

Key Ratios Snapshot

Some of the financial key ratios for Cytek Biosciences are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 41.5% | – | -7.3% |

| FCF Margin | ROE | ROA |

| -4.3% | -2.0% | -1.6% |

Analysis – Cytek Biosciences Stock Intrinsic Value

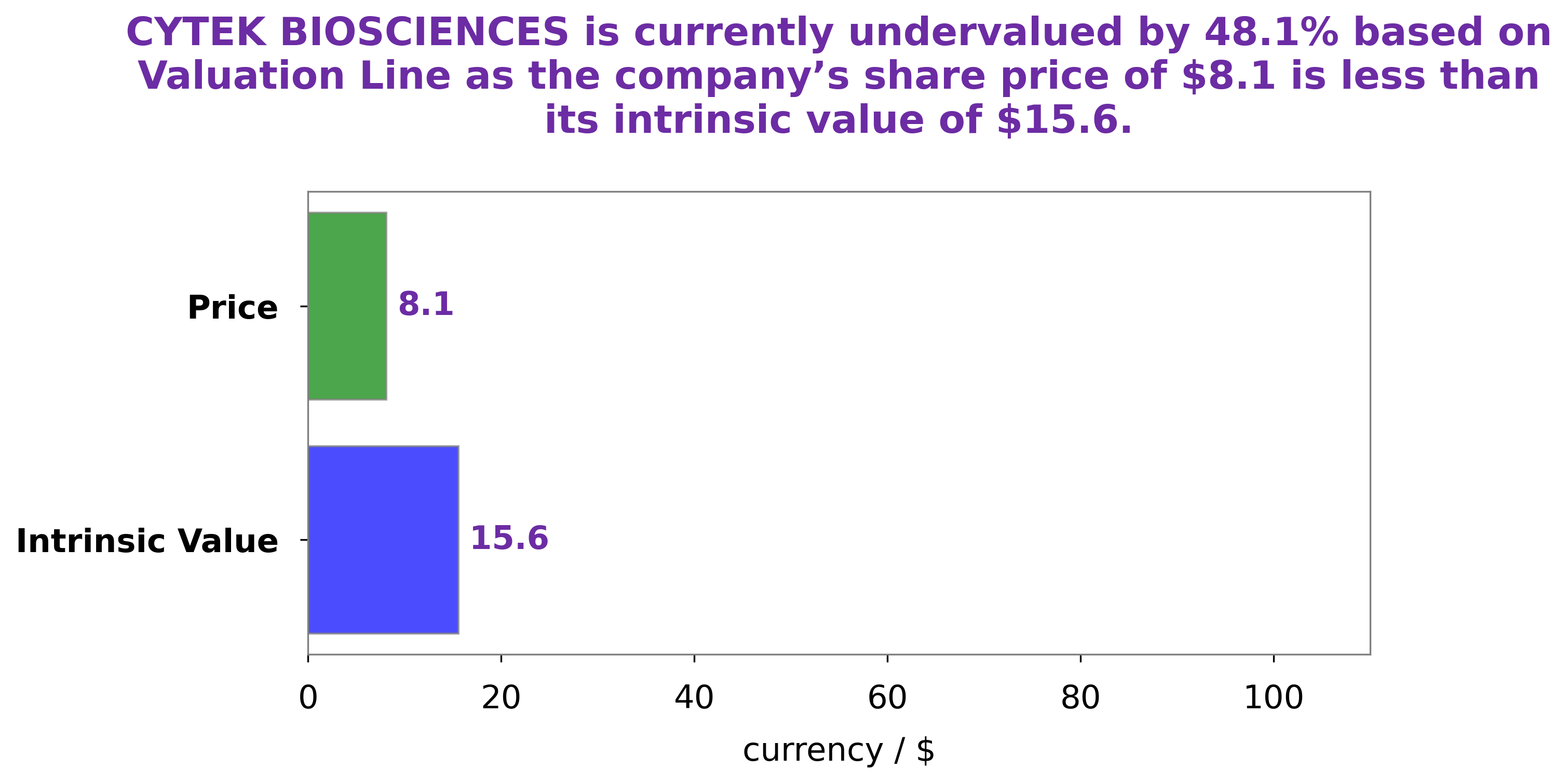

At GoodWhale, we believe in providing our users with the latest and greatest information on all the stocks they are interested in. That’s why we’ve taken a deep dive into CYTEK BIOSCIENCES‘s fundamentals in order to better understand the company and give investors an accurate valuation of its stock. After looking through the company’s financials, we’ve calculated that the fair value of CYTEK BIOSCIENCES share is around $15.9. That means that right now CYTEK BIOSCIENCES’s stock is being traded at $4.4, which is a massive discount – more than 72.3% lower than its true value. Therefore, we believe that now is the time to seriously consider investing in this company. More…

Peers

Its competitors are Pressure BioSciences Inc, Delcath Systems Inc, Longport Inc.

– Pressure BioSciences Inc ($OTCPK:PBIO)

Pressure BioSciences Inc is a biotechnology company that develops, manufactures, and markets systems and consumables for sample preparation and analytical techniques used in the life sciences industry. The company’s products are based on the pressure cycling technology, which is a method of applying alternating cycles of hydrostatic pressure between ambient and ultra-high levels to biological samples in order to open or lyse cells and archives, release their contents for further analysis.

– Delcath Systems Inc ($NASDAQ:DCTH)

Delcath Systems Inc. is a commercial-stage pharmaceutical company focused on the treatment of primary and metastatic liver cancers. The Company’s product, Melphalan Hydrochloride for Injection for use with the Delcath Hepatic Delivery System (Melphalan/HDS), is an investigational drug delivery system that is designed to administer very high-dose melphalan, a chemotherapeutic agent, to the liver while minimizing exposure of other normal tissues.

Summary

CYTEK BIOSCIENCES reported its third quarter financials for FY2023, with revenue of USD 48.0 million, a year-over-year increase of 18.6%. Net income was USD -6.5 million, compared to a profit of USD 1.7 million in the same period last year. Investors may be encouraged by the strong revenue growth and the fact that the company was able to remain profitable in such an adverse environment.

However, the negative net income suggests there may be further operational improvements to be made to boost the company’s profitability going forward. This should be kept in mind when assessing the investment opportunity presented by CYTEK BIOSCIENCES.

Recent Posts