CVS HEALTH Reports FY2022 Q4 Earnings Results for Year-End December 31 2022 on February 8 2023

March 22, 2023

Earnings Overview

On February 8, 2023, CVS HEALTH ($NYSE:CVS) reported its financial results for the fourth quarter of FY2022, which concluded on December 31, 2022. Total revenue for the quarter increased by 75.6% year-over-year to USD 2.3 billion, while net income rose 9.5% to USD 83.8 billion.

Transcripts Simplified

CVS Health delivered strong fourth quarter and full year results for 2022, with total revenues of $83.8 billion and $322.5 billion respectively. Adjusted operating income of $4 billion in the fourth quarter and $8.69 adjusted EPS for the full year were both up year-over-year. The Health Care Benefits segment reported 11.3% growth in revenue and 68.2% growth in adjusted operating income. The Pharmacy Services segment reported 11.2% growth in revenue and 9% growth in adjusted operating income, driven by improved purchasing economics and increased pharmacy claims volume. The Retail/Long-Term Care segment reported strong revenue growth despite mixed COVID-related trends and continued economic uncertainty.

Additionally, CVS Health generated $16.2 billion in cash flow from operations in full year 2022. This morning, the company also announced the Oak Street transaction, which is expected to close in the second quarter of 2023.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cvs Health. More…

| Total Revenues | Net Income | Net Margin |

| 322.47k | 4.15k | 3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cvs Health. More…

| Operations | Investing | Financing |

| 16.18k | -5.05k | -10.52k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cvs Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 228.28k | 156.96k | 54.63 |

Key Ratios Snapshot

Some of the financial key ratios for Cvs Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.9% | 10.3% | 2.5% |

| FCF Margin | ROE | ROA |

| 4.2% | 7.0% | 2.2% |

Share Price

On Wednesday, February 8th, 2023, CVS HEALTH reported its financial results for the fourth quarter and year-end December 31, 2022. The stock opened at $87.9 and closed at $89.0, up 3.5% from the previous closing price of $86.0. This marks a positive quarter for the company and signals a strong end to the year. During the quarter, CVS HEALTH highlighted a few notable accomplishments that drove its growth and success.

These include increased sales of pharmacy services and specialty pharmacy offerings, successful initiatives around digital health technology, and improved customer service offerings. Overall, the news of CVS HEALTH’s financial results for the fourth quarter and year-end December 31, 2022 is positive, indicating that the company will have a strong start to 2023. With its strategic initiatives and continued commitment to providing quality healthcare and products, CVS HEALTH is well-positioned for future growth and success. Live Quote…

Analysis

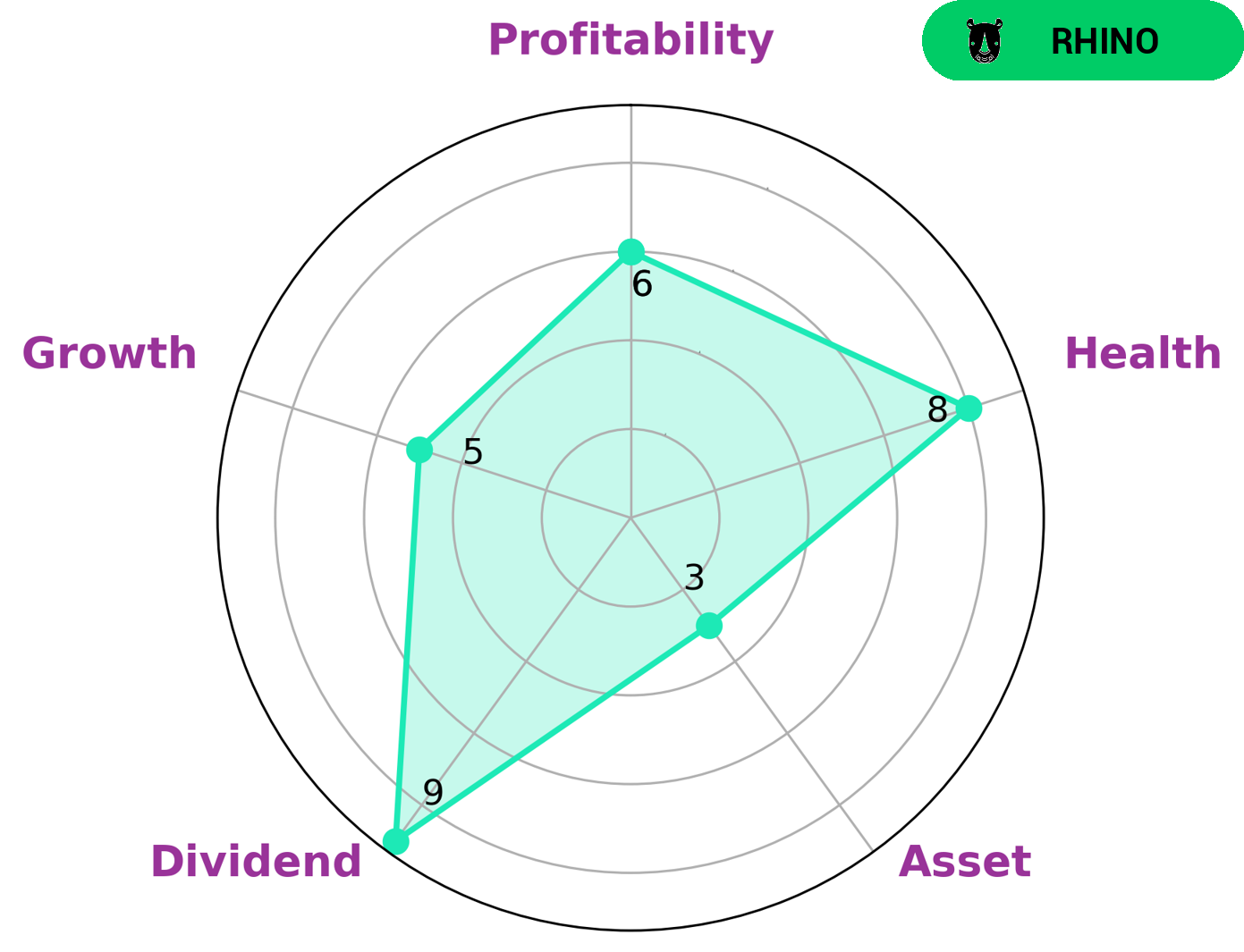

As GoodWhale, we have conducted an analysis of CVS HEALTH‘s wellbeing. According to our Star Chart, CVS HEALTH has been classified as a ‘rhino’, which is indicative of a company that has achieved moderate revenue or earnings growth. This means that the company may be of interest to a variety of different types of investors, from value investors seeking out dividend-paying companies to growth investors looking for opportunities that offer potential long-term gains. Moreover, CVS HEALTH has a high health score of 8/10 according to our metrics, which indicates it is capable of sustaining future operations in times of crisis, as it is strongly supported by its cashflows and debt structure. Furthermore, CVS HEALTH is strong in dividend and medium in growth, profitability and assets. These metrics show that the company is likely to remain a solid investment choice for the foreseeable future. More…

Peers

The competition between CVS Health Corp and its competitors is fierce. Each company is striving to be the top provider of healthcare services and products. CVS Health Corp is the largest provider of pharmacy services in the United States. Marpai Inc is a close second. Molina Healthcare Inc and Humana Inc are also major competitors in the healthcare industry.

– Marpai Inc ($NASDAQ:MRAI)

Marpai Inc is a publicly traded company with a market capitalization of 20.89 million as of 2022. The company has a return on equity of -64.66%. Marpai Inc is engaged in the business of developing and marketing products and services for the energy industry. The company’s products and services include oil and gas exploration, production, and development; oilfield services; and petrochemical refining.

– Molina Healthcare Inc ($NYSE:MOH)

Molina Healthcare Inc is a health care company that provides Medicaid-related solutions for low-income families and individuals. As of 2022, the company had a market capitalization of 20.52 billion dollars and a return on equity of 24.89%. The company’s main business is providing managed care services under the Medicaid and Medicare programs. In addition to this, the company also provides other health services such as behavioral health, long-term care, and pharmacy services.

– Humana Inc ($NYSE:HUM)

Humana Inc is a healthcare company that offers a wide range of health and wellness products and services. The company has a market cap of 63.3B as of 2022 and a return on equity of 17.4%. Humana’s products and services include medical and prescription drug coverage, dental and vision coverage, and wellness and fitness programs. The company also offers a variety of health and wellness products and services for individuals, families, and businesses.

Summary

Investors in CVS Health have been rewarded with strong performance in the fourth quarter of 2022. Revenue rose 75.6%, while net income increased 9.5%. The stock price reacted positively, suggesting investors are encouraged by the results. Looking ahead, analysts anticipate continued growth as CVS Health expands its offerings in the healthcare sector.

Going forward, investors should watch for key metrics such as earnings, revenue, and customer satisfaction. With a focus on innovation and commitment to providing quality services, CVS Health should remain an attractive option for long-term investors.

Recent Posts