CUSTOM TRUCK ONE SOURCE Reports Fourth Quarter Earnings for FY2022.

March 26, 2023

Earnings Overview

CUSTOM TRUCK ONE SOURCE ($NYSE:CTOS) reported its financial results for the fourth quarter of FY2022, ending on December 31, 2022. The company achieved total revenue of USD 30.9 million, representing a 934.0% increase year-on-year, and net income of USD 486.7 million, a 36.6% increase compared to the same quarter in the previous year.

Transcripts Simplified

All participants will be in a listen only mode. Operator Instructions. Please note this event is being recorded. I would now like to turn the conference over to Chris Catto, Chief Financial Officer. Please go ahead. Chris Catto: Thank you and good morning everyone. With me today on the call are Bill Ruh, President and CEO; and Craig Moore, Executive Vice President and COO. During this call management will make forward-looking statements regarding our outlook for the future performance of the business that involve risks and uncertainties. These forward-looking statements include comments about revenue, gross margin, expenses, earnings, liquidity and capital resources. Actual results may differ materially from those contained in our forward-looking statements as a result of various factors including those discussed in the Risk Factors section of our Annual Report on Form 10-K.

We assume no obligation to update any forward-looking statements made during the call. This conference call also includes certain non-GAAP financial measures as defined by SEC Regulation G and reconciliations of those measures can be found in our press release which can be found on our website at http://www.customtruckonesource.com under the investor relations section. We experienced a decrease in both new and used equipment sales due to the global pandemic and associated economic downturn, partially offset by increased rental equipment revenues. We remain focused on managing liquidity and continue to be well-positioned with sufficient liquidity to execute on our strategic initiatives and navigate through this uncertain operating environment. I hope this provides you with a good overview of our first quarter performance and financial position. Our team remains focused on providing excellent service and product solutions to our customers while actively managing costs throughout the organization in order to remain agile in this dynamic environment. We thank you for your participation today and look forward to updating you on our progress throughout the year. With that, I will turn it back over to the operator for questions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CTOS. More…

| Total Revenues | Net Income | Net Margin |

| 1.57k | 38.91 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CTOS. More…

| Operations | Investing | Financing |

| 45.97 | -218.94 | 153.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CTOS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.94k | 2.05k | 3.61 |

Key Ratios Snapshot

Some of the financial key ratios for CTOS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 81.3% | 43.0% | 8.6% |

| FCF Margin | ROE | ROA |

| -18.7% | 9.7% | 2.9% |

Share Price

The company’s stock opened the day at $6.4 but closed at $6.3, up marginally by 1.6% from its previous closing price of 6.2. The earnings report highlights several positive developments in CUSTOM TRUCK ONE SOURCE’s financial performance. Further, the company has continued to maintain its cost-effectiveness, with their operating expenses remaining below their last year’s levels. The report also showed that CUSTOM TRUCK ONE SOURCE is continuing to invest in its core business, with capital investments of $4 million for the quarter. This investment has helped the company expand into new markets and develop new products, which have resulted in increased sales and profitability.

In addition, the company has also focused on improving its customer service, with a new online ordering platform launched in July of this year. Overall, CUSTOM TRUCK ONE SOURCE’s fourth quarter earnings report demonstrates the company’s ability to maintain a healthy financial performance and growth trajectory. With continued investment in its core products, improved customer service, and the introduction of new products, CUSTOM TRUCK ONE SOURCE is well-positioned to continue delivering value to stakeholders in the years to come. Live Quote…

Analysis

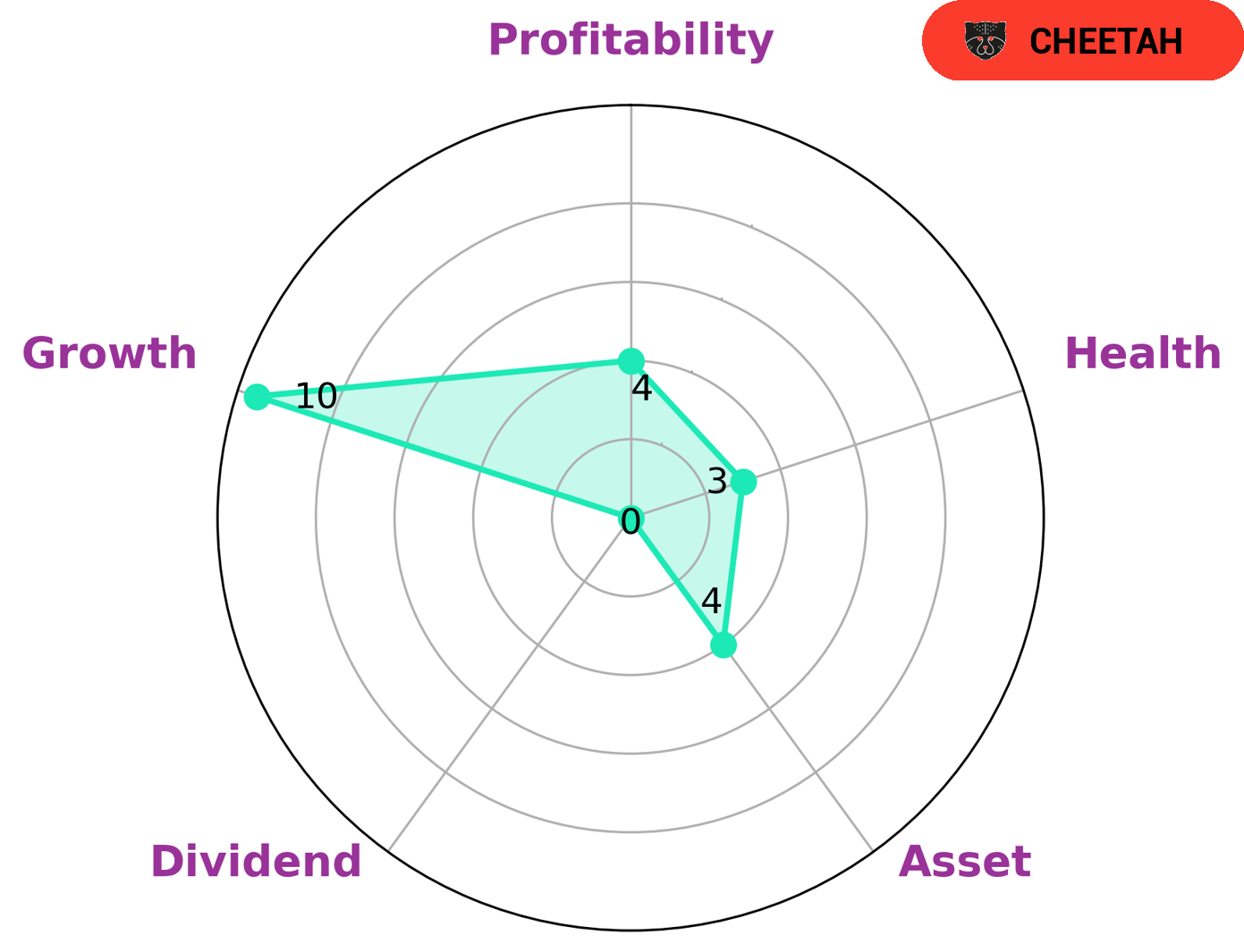

At GoodWhale, we conducted an analysis of CUSTOM TRUCK ONE SOURCE’s fundamentals. Our Star Chart categorizes CUSTOM TRUCK ONE SOURCE as ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This suggests that investors interested in this company should be aware of the risks involved due to its instability. CUSTOM TRUCK ONE SOURCE has a low health score of 3/10, indicating that it is less likely to pay off debt and fund future operations. Furthermore, it is strong in growth, medium in asset, profitability and weak in dividend. Therefore investors need to keep this in mind and assess the risks involved when determining whether to invest in this company. More…

Peers

The company has a strong competitive position in the market, with a wide range of products and services. Custom Truck One Source Inc is a publicly traded company on the New York Stock Exchange under the ticker symbol CUST.

– H&E Equipment Services Inc ($NASDAQ:HEES)

H&E Equipment Services is a leading provider of equipment services and solutions for a wide range of industries, including construction, mining, oil and gas, government, and power generation. The company has a market cap of 1.49B as of 2022 and a return on equity of 35.46%. H&E Equipment Services provides a wide range of services, including equipment rental, sales, and maintenance, to its customers. The company has a strong focus on customer service and provides a wide range of support services to its customers.

– Babylon Pump & Power Ltd ($ASX:BPP)

Babylon Pump & Power Ltd is a market leader in providing pump and power solutions. The company has a strong focus on customer service and providing high quality products. The company has a market capitalization of 12.29M as of 2022 and a return on equity of -43.24%. The company’s products are used in a wide range of industries, including mining, construction, agriculture, and manufacturing.

– Triton International Ltd ($NYSE:TRTN)

Triton International Ltd is a leading provider of containers and related services. The company has a market cap of 3.83B as of 2022 and a return on equity of 15.89%. Triton International Ltd is a publicly traded company listed on the New York Stock Exchange. The company was founded in 2006 and is headquartered in Hamilton, Bermuda. Triton International Ltd is a leading provider of intermodal transportation equipment and services with a focus on container leasing and sales, depot services, container trucking, and related logistics services.

Summary

CUSTOM TRUCK ONE SOURCE saw a significant surge in its fourth quarter earnings for FY2022, with total revenue reaching USD 30.9 million and net income of USD 486.7 million. This marks a 934.0% and 36.6% increase from the same period one year prior, respectively. This strong performance makes CUSTOM TRUCK ONE SOURCE an attractive investment option for those looking to capitalize on the company’s heightened success. However, investors should keep an eye on future developments as the company looks to maintain its positive momentum going forward.

Recent Posts