CONSOL ENERGY Reports Impressive Earnings Results for FY2022 Q4

February 9, 2023

Earnings report

CONSOL ENERGY ($NYSE:CEIX) is an American energy company that specializes in the production of coal, natural gas, and oil. The company is one of the largest publicly traded coal companies in the world and is a major producer of natural gas in the Appalachian region. On February 7 2023, CONSOL ENERGY reported their earnings results for FY2022 Q4, ending on December 31 2022. The revenue for the fourth quarter was USD 193.0 million, a 64.5% increase from the previous year. This was primarily driven by higher demand for natural gas and coal as well as higher prices. Net income achieved a 81.7% year-over-year growth, reaching USD 608.9 million.

This was mainly due to higher sales volumes, cost reduction measures, and increased efficiency. This was mainly due to higher sales volume and improved operating margins. The company also reported increased cash flow from operations and higher gross margin. This is great news for investors in CONSOL ENERGY and is expected to result in increased share prices for the company.

Market Price

The stock opened at $60.5 and closed at $62.4, representing a 7.1% increase from its previous closing price of 58.3. This demonstrates the strong performance of the company in the fourth quarter and its ability to exceed expectations. The impressive earnings results were fueled by higher sales, improved cost controls, and a strong balance sheet. The company’s success is also attributed to its strategic acquisitions and investments in its core businesses. In the fourth quarter, CONSOL ENERGY invested in new oil and gas plays in the Appalachian Basin, as well as in infrastructure projects that will help to improve transportation and reduce costs.

Additionally, the company was able to increase its production of natural gas liquids, which further improved its profitability. The company is well-positioned to capitalize on future opportunities and continue to deliver strong results for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Consol Energy. More…

| Total Revenues | Net Income | Net Margin |

| 2.28k | 466.98 | 29.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Consol Energy. More…

| Operations | Investing | Financing |

| 650.99 | -142.18 | -380.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Consol Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.7k | 1.54k | 26.28 |

Key Ratios Snapshot

Some of the financial key ratios for Consol Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.3% | 77.6% | 27.2% |

| FCF Margin | ROE | ROA |

| 21.0% | 42.4% | 14.4% |

Analysis

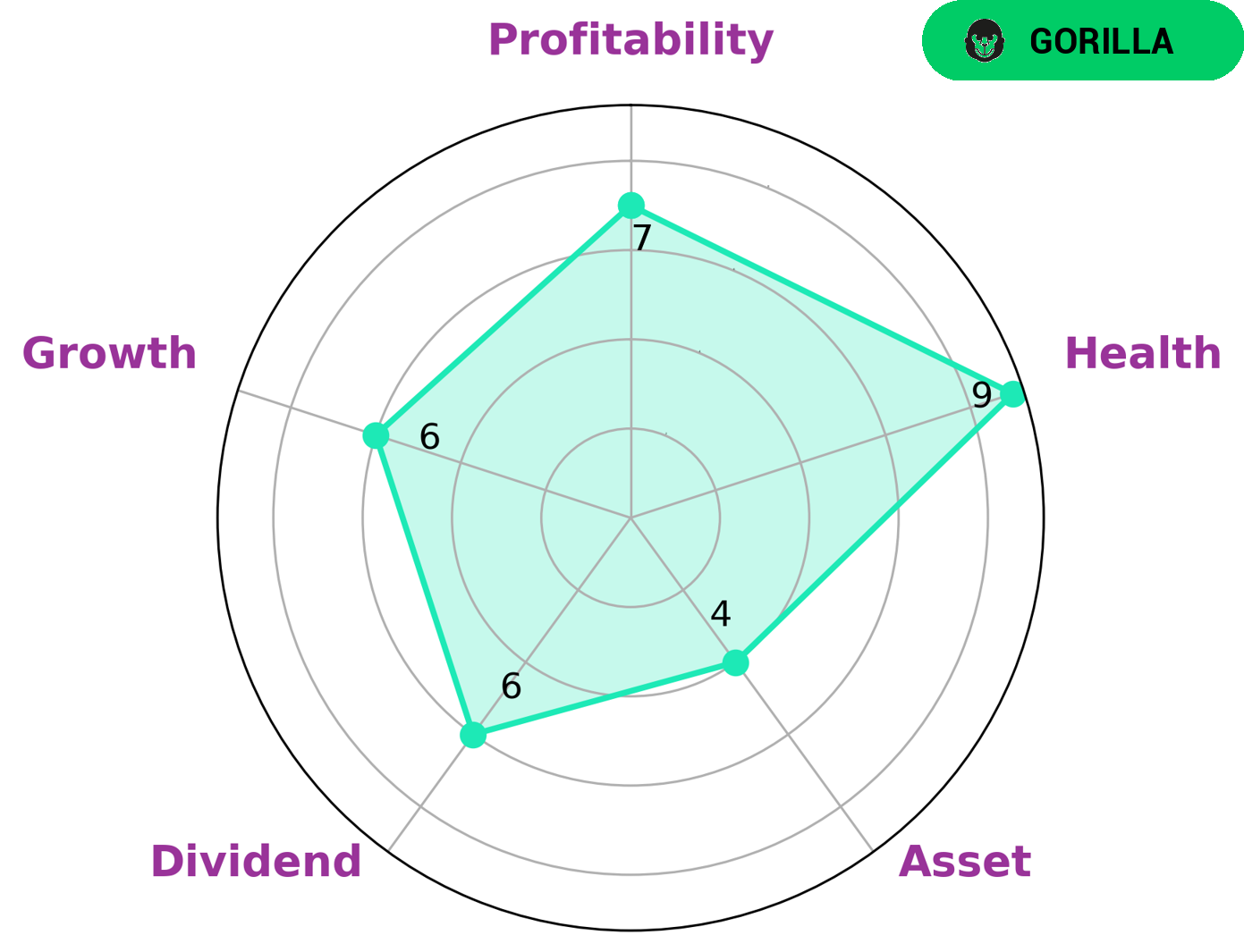

Analyzing CONSOL ENERGY‘s fundamentals, GoodWhale conducted research and classified the company as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes the company an attractive option for investors with an eye for growth. In terms of financial metrics, CONSOL ENERGY is strong in profitability, and medium in asset, dividend, and growth. Additionally, the company has a high health score of 9/10 with regard to its cashflows and debt. This shows that CONSOL ENERGY is capable of paying off debt and funding future operations. As such, investors that are looking for a stable and reliable company with a strong competitive advantage, yet still offering growth potential, should consider CONSOL ENERGY. The company’s solid financial metrics and good health score suggest that it is a good option for investors. Furthermore, the company’s strong competitive advantage would ensure that it remains attractive even in more turbulent times. More…

Peers

The company’s competitors include PT Prima Andalan Mandiri Tbk, NACCO Industries Inc, and PT Delta Dunia Makmur Tbk.

– PT Prima Andalan Mandiri Tbk ($IDX:MCOL)

In 2022, PT Prima Andalan Mandiri Tbk had a market capitalization of 25.6 trillion rupiah and a return on equity of 66.4%. The company is a leading Indonesian provider of integrated logistics solutions. It offers a wide range of services, including transportation, warehousing, and distribution. The company has a strong focus on customer service and has a reputation for reliability and efficiency.

– NACCO Industries Inc ($NYSE:NC)

NACCO Industries, Inc. is a holding company, which engages in the mining, and consumer and industrial products businesses. It operates through the following segments: Mining, Consumer Products, and Industrial Products. The Mining segment comprises of coal mining operations. The Consumer Products segment consists of small appliances, specialty housewares, and gourmet cookware. The Industrial Products segment covers material handling products and other industrial equipment. The company was founded by Sherman Conger in 1919 and is headquartered in Cleveland, OH.

– PT Delta Dunia Makmur Tbk ($IDX:DOID)

Delta Dunia Makmur Tbk has a market cap of 3.18T as of 2022, a Return on Equity of 26.49%. The company is a leading provider of coal mining services in Indonesia. It is the largest producer of thermal coal in Indonesia and supplies coal to power plants and industrial customers in Indonesia and abroad.

Summary

Investing in CONSOL Energy can be a lucrative opportunity for investors. The company has shown strong performance in its fourth quarter, reporting a 64.5% year-over-year increase in revenue and an 81.7% year-over-year growth in net income. This performance has been reflected in the stock price, which moved up the same day the earnings were released. Investors can look to the company’s recent success to assess the potential of investing in the stock. This includes analyzing the company’s financial performance, the strength of its management team, and the current industry trends. Investors should also take into consideration any potential risks associated with investing in CONSOL Energy, such as volatility and macroeconomic factors. Overall, CONSOL Energy has shown impressive performance and investors may find it to be a lucrative opportunity for long-term gains.

However, investors should conduct their own research and consider all possible risks involved before making any investment decisions.

Recent Posts