CNO FINANCIAL Reports 4th Quarter Earnings Results for Fiscal Year 2022 Ending February 7, 2023

February 10, 2023

Earnings report

CNO ($NYSE:CNO): The company remains committed to providing innovative financial solutions that meet the needs of their customers, even during difficult economic times.

Share Price

The company opened their stock at $24.9, up by 0.8% from their last closing price of 25.2 and closed at 25.4. This is a positive sign for investors as it shows the potential for growth in coming quarters. CNO FINANCIAL also reported that their total assets increased by 7% from the prior year, with cash and cash equivalents increasing by 10%. The company is showing strong financial performance with strong balance sheet and cash flow. This is a testament to their commitment to manage their financials responsibly during these uncertain times.

Overall, CNO FINANCIAL reported solid financials in their 4th quarter results, showing strong growth and financial stability. Investors should be encouraged by this news as it shows the company’s commitment to deliver positive financial results in the future. They should continue to monitor the company closely in order to make informed investment decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cno Financial. More…

| Total Revenues | Net Income | Net Margin |

| 3.58k | 396.8 | 11.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cno Financial. More…

| Operations | Investing | Financing |

| 453.8 | -1.53k | 667.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cno Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 33.34k | 31.94k | 12.25 |

Key Ratios Snapshot

Some of the financial key ratios for Cno Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.8% | – | 18.3% |

| FCF Margin | ROE | ROA |

| 12.7% | 30.3% | 1.2% |

Analysis

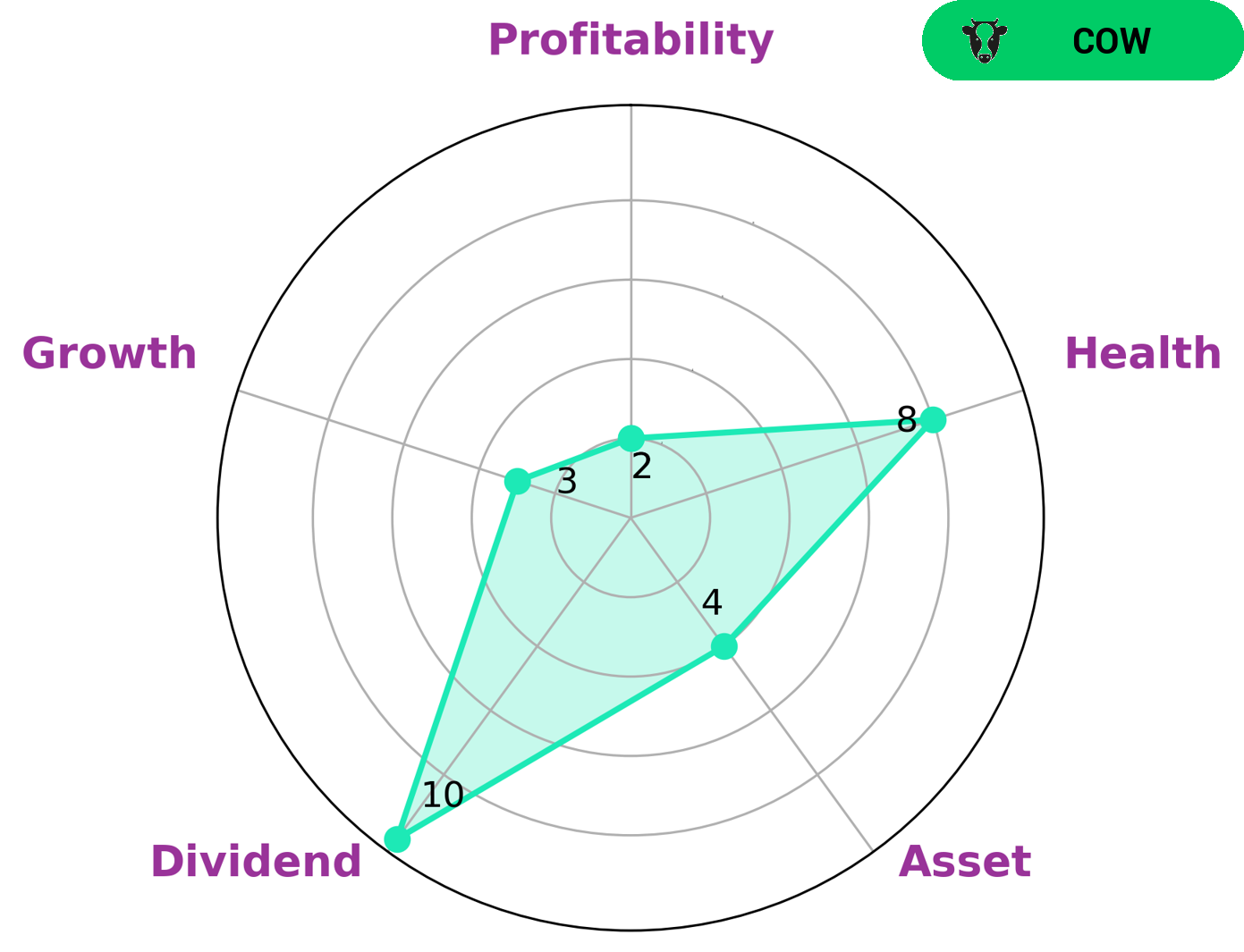

Investors looking for dividend income and low-risk investments may be interested in CNO FINANCIAL. Analysis conducted by GoodWhale shows that the company is strong in dividend, medium in asset, and weak in growth and profitability, according to its Star Chart rating. The company has a high health score of 8/10, indicating that it is capable of paying off debt and funding future operations. Additionally, CNO FINANCIAL is classified as a ‘cow’ company, a type of company that has the track record of paying out consistent and sustainable dividends. The company’s stock has been volatile recently due to market uncertainties, but its dividend yields remain high, making it an attractive choice for long-term investors. Investors looking to build a portfolio of dividend-paying stocks may benefit from including CNO FINANCIAL in their mix. The company’s financial statements are also strong, which gives investors confidence in its ability to sustain its dividend payouts. Furthermore, the company is well diversified, with exposure to multiple sectors, which helps reduce risk and add stability to the portfolio. Overall, CNO FINANCIAL is an attractive option for investors looking for a reliable source of dividend income and low-risk investments. The company’s strong fundamentals, high health score and consistent dividends make it an ideal choice for long-term investors. More…

Peers

Its competitors are National Western Life Group Inc, Wustenrot & Wurttembergische AG, and iA Financial Corp Inc.

– National Western Life Group Inc ($NASDAQ:NWLI)

National Western Life Group Inc is a holding company that operates through its subsidiaries engaged in the life insurance business. Its products include whole life, term life, universal life, and annuities. The company was founded in 1906 and is headquartered in Austin, Texas.

– Wustenrot & Wurttembergische AG ($LTS:0GJN)

Wustenrot & Wurttembergische AG is a German mutual insurance company headquartered in Stuttgart. As of 2022, it had a market capitalization of €1.44 billion and a return on equity of 14.21%. The company provides a range of insurance products, including life, health, property and casualty, and pension products, as well as banking and investment products.

– iA Financial Corp Inc ($TSX:IAG)

AmeriA Financial Corp Inc has a market cap of 7.68B as of 2022. The company has a Return on Equity of 9.41%. AmeriA Financial Corp Inc is a provider of insurance and financial services. The company offers a range of products and services, including life insurance, annuities, and investments.

Summary

CNO Financial has experienced a decline in net income and total revenue over the fourth quarter of fiscal year 2022, ending February 7, 2023. The total revenue decreased by 62.5% compared to the same period of the previous year, and net income decreased by 9.4%. For investors, this presents a cause for concern as it indicates a weakening overall performance. Investors should consider what CNO Financial is doing to improve its revenue and net income performance, such as reducing costs, increasing customer retention, and diversifying its sources of revenue. Investors should also consider the macroeconomic environment and industry competition that CNO Financial may be facing. Finally, investors should consider the company’s financial position and liquidity, as these can affect its ability to grow and generate profits. Overall, CNO Financial’s financial performance has declined over the fourth quarter of fiscal 2022, presenting a risk to investors.

However, a thorough analysis of the company’s operations, environment, financial position, and liquidity can help investors make an informed decision about whether to invest in the company.

Recent Posts