CMS ENERGY Reports Fourth Quarter FY2022 Earnings Results for Period Ending February 2, 2023.

March 20, 2023

Earnings Overview

CMS ENERGY ($NYSE:CMS) announced its financial results for the fourth quarter of the fiscal year ending February 2, 2023 on December 31, 2022. The reported total revenue was USD 171.0 million, a decrease of 73.2% compared to the same quarter of the previous fiscal year. Conversely, net income showed an increase of 12.1%, amounting to USD 2278.0 million.

Transcripts Simplified

CMS Energy reported a consistently positive performance in 2022, allowing them to narrow and raise their adjusted EPS guidance on their third quarter call. They also settled $55 million in equity forward contracts as planned and priced an additional $440 million at a weighted-average price of over $68 per share to finance the pending acquisition of the Covert natural gas generation facility. For 2023, they are raising their adjusted earnings guidance to $3.06 to $3.12 per share from $3.05 to $3.11 per share.

The EPS growth will be driven primarily by the utility and will include modest growth from their non-utility business, NorthStar Clean Energy. The glide path to achieve this EPS guidance range will include normal weather, rate relief, productivity improvements, and conservative estimates around weather-normalized sales and non-utility performance.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cms Energy. More…

| Total Revenues | Net Income | Net Margin |

| 8.6k | 827 | 9.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cms Energy. More…

| Operations | Investing | Financing |

| 855 | -2.48k | 1.33k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cms Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 31.35k | 23.76k | 24.08 |

Key Ratios Snapshot

Some of the financial key ratios for Cms Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.9% | -0.4% | 16.5% |

| FCF Margin | ROE | ROA |

| -18.9% | 12.8% | 2.8% |

Stock Price

CMS ENERGY’s forward-looking statements for FY2023 remain optimistic as the company expects to continue to grow its revenue and earnings throughout the year. Additional projects are planned for the coming year, including expanding its renewable energy initiatives and modernizing its power grid infrastructure. Furthermore, the company plans to continue its cost containment efforts to help ensure long-term profitability and sustainability. Live Quote…

Analysis

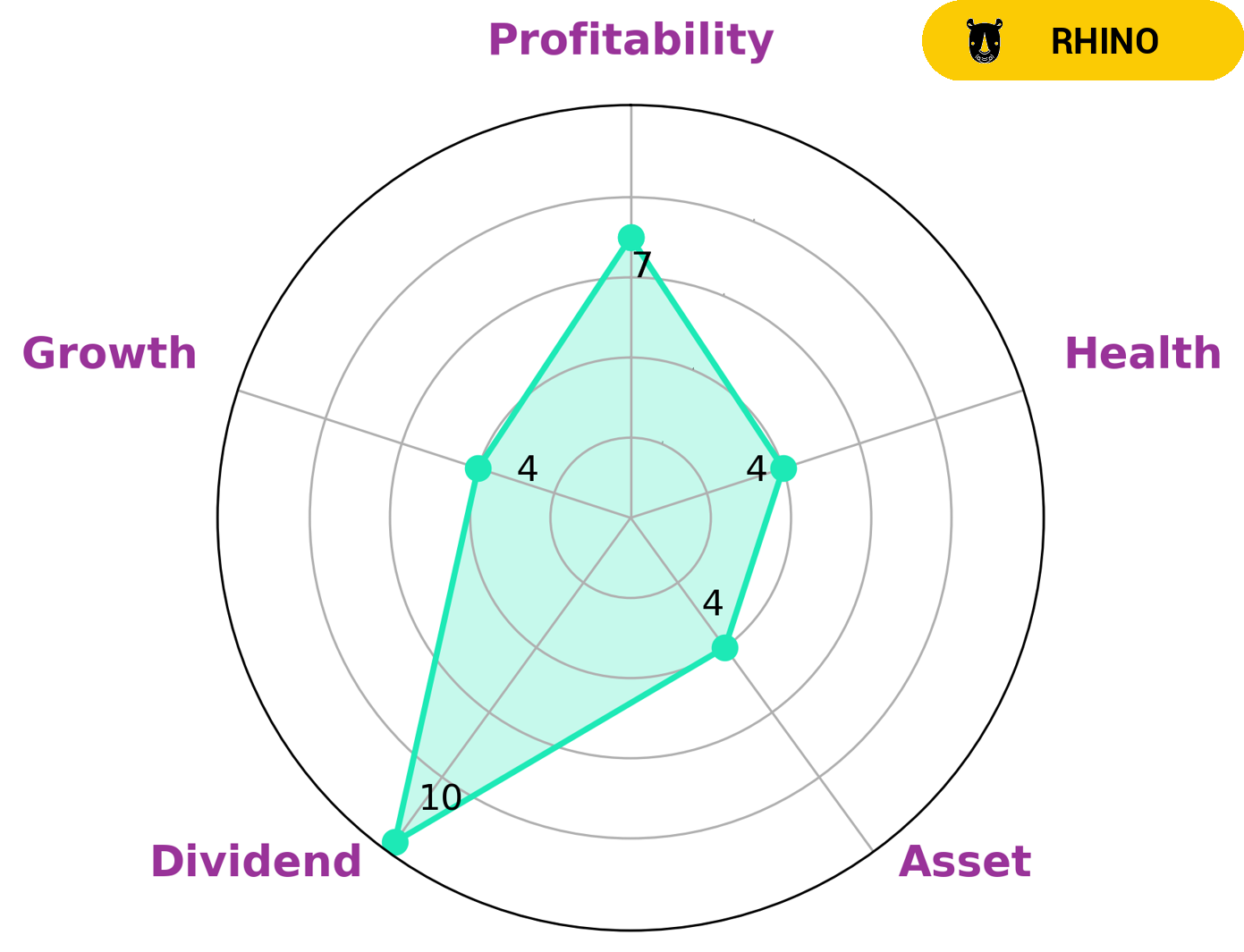

At GoodWhale, we are proud to analyze the financials of CMS ENERGY. Our analysis based on the Star Chart yields an intermediate health score of 4/10 for CMS ENERGY considering its cashflows and debt. This suggests that CMS ENERGY may be able to sustain future operations in times of crisis. Additionally, CMS ENERGY is strong in dividends and profitability, and medium in assets and growth. This leads us to classify CMS ENERGY as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given its financials, it is likely that investors who value stability and risk aversion would be interested in CMS ENERGY. Furthermore, those who are seeking a steady dividend yield may also find CMS ENERGY as a viable investment option. It is important to note, however, that while CMS ENERGY is a relatively safe investment, its low growth rate means that investors should not expect significant returns in the near future. More…

Peers

CMS Energy Corp and its competitors, OGE Energy Corp, Xcel Energy Inc, DTE Energy Co, are all fighting for a share of the energy market. All four companies are large, publicly-traded utilities with a history of providing reliable service to their customers.

However, CMS Energy Corp has a few key advantages that could help it to gain market share in the future. First, CMS Energy Corp is the only company of the four that is headquartered in Michigan. This gives CMS Energy Corp a better understanding of the needs of Michigan customers and allows the company to be more responsive to changes in the Michigan energy market. Additionally, CMS Energy Corp has a strong relationship with the state government, which can help the company to navigate the regulatory landscape and secure favorable treatment for its customers. Finally, CMS Energy Corp has a diversified portfolio of energy assets, including both traditional and renewable sources, which gives the company a hedge against fluctuations in the price of energy.

– OGE Energy Corp ($NYSE:OGE)

Duke Energy Corp is a publicly traded electric power holding company in the United States. Headquartered in Charlotte, North Carolina, Duke Energy has approximately 52,700 megawatts of electric generating capacity and 1,937 miles of transmission lines. The company serves approximately 7.6 million customers in six states. Duke Energy is the largest electric power holding company in the United States.

– Xcel Energy Inc ($NASDAQ:XEL)

Xcel Energy Inc is a public utility holding company based in Minneapolis, Minnesota. It is the largest provider of electricity and natural gas in the United States. The company serves 8 states: Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas, and Wisconsin. Xcel Energy Inc has a market cap of 33.31B as of 2022 and a Return on Equity of 8.81%. The company is a diversified energy company with operations in electricity generation, transmission and distribution, and natural gas storage and pipelines. Xcel Energy Inc’s primary business is the regulated utility business, which includes the generation, transmission and distribution of electricity and the storage and transportation of natural gas.

– DTE Energy Co ($NYSE:DTE)

DTE Energy Co is an energy company that operates in electric and natural gas utilities. It has a market cap of 20.82B as of 2022 and a Return on Equity of 9.17%. The company is headquartered in Detroit, Michigan, and employs around 10,000 people. DTE Energy Co is a diversified energy company that provides electricity and natural gas to customers in Michigan. The company also owns and operates several power plants, including coal-fired, nuclear, and renewable energy facilities.

Summary

Investors should take note of CMS Energy‘s performance in the fourth quarter of FY2022. Total revenue for the quarter was USD 171.0 million, a decrease of 73.2% year-over-year. Despite this, the company reported net income of USD 2278.0 million, an increase of 12.1% compared to the same period in the previous year.

This suggests a promising outlook for the company, as it was able to maintain profitability despite significant decreases in revenue. Going forward, investors should monitor CMS Energy’s performance and consider its strategy to ensure future success.

Recent Posts