Clearway Energy Stock Fair Value Calculation – CLEARWAY ENERGY Reports Financial Results for Q2 2023 Fiscal Year

August 25, 2023

☀️Earnings Overview

On August 8, 2023, CLEARWAY ENERGY ($NYSE:CWEN.A) reported its financial results for the second quarter of the 2023 fiscal year ending on June 30. The total revenue for the quarter was USD 406.0 million, which was an increase of 10.3% compared to the same period in the previous year. Unfortunately, net income was USD 38.0 million, a decrease of 93.3% compared to the previous year.

Price History

The company’s stock opened at $23.1 and closed at $22.9, a decrease of 2.3% from its prior closing price of $23.4. This was due mainly to higher sales, general, and administrative costs associated with the company’s growth initiatives. The company’s total revenue and net income increased from the prior quarter while it also declared a higher dividend for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Clearway Energy. More…

| Total Revenues | Net Income | Net Margin |

| 1.3k | 82 | 7.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Clearway Energy. More…

| Operations | Investing | Financing |

| 717 | -382 | -705 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Clearway Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.62k | 8.48k | 18.31 |

Key Ratios Snapshot

Some of the financial key ratios for Clearway Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | 3.6% | 27.0% |

| FCF Margin | ROE | ROA |

| 44.3% | 10.3% | 1.7% |

Analysis – Clearway Energy Stock Fair Value Calculation

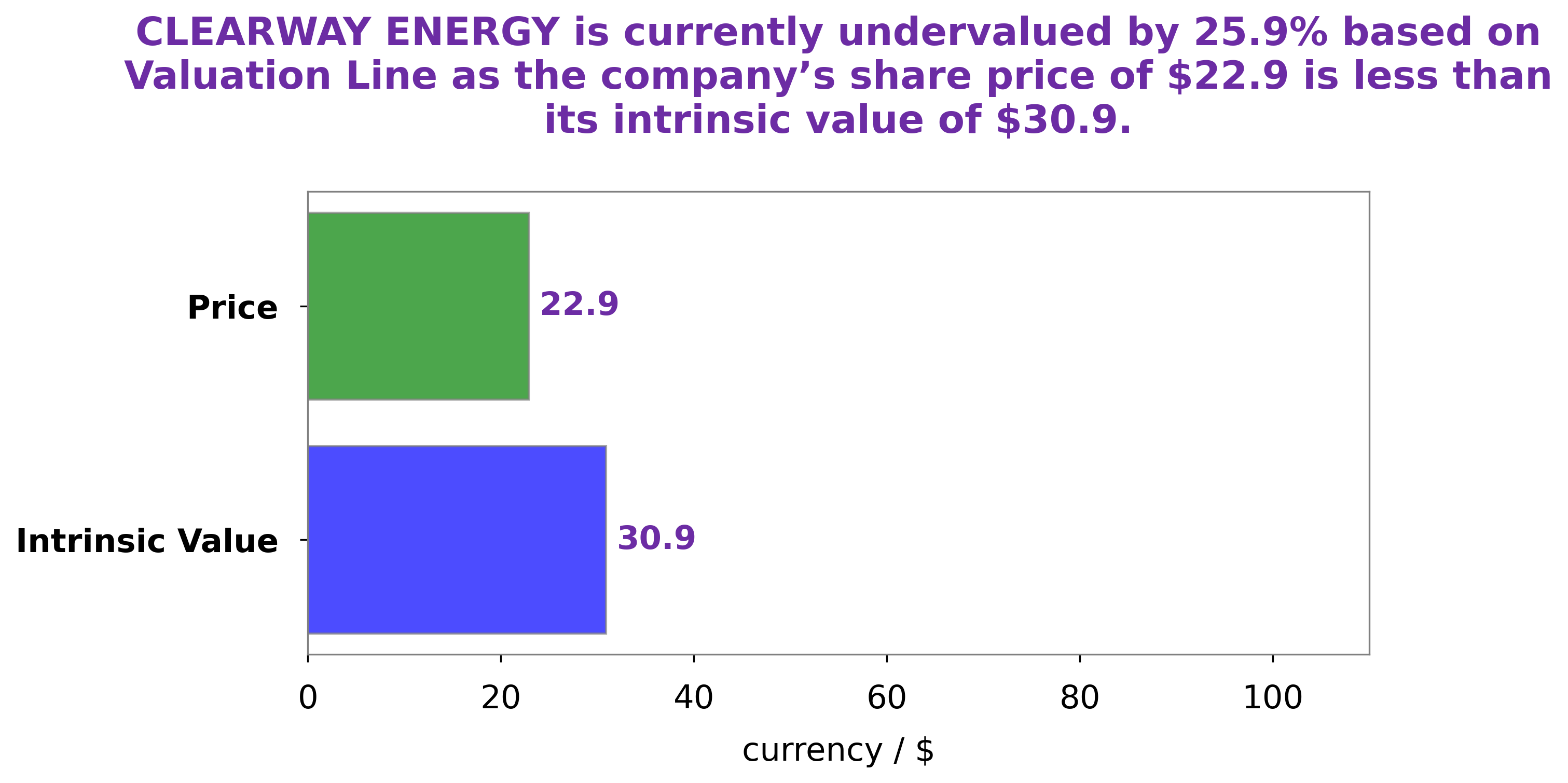

At GoodWhale, we recently conducted an analysis of CLEARWAY ENERGY‘s wellbeing. After careful consideration, we have determined that the intrinsic value of CLEARWAY ENERGY share is around $30.9, a figure we calculated using our proprietary Valuation Line. Currently, CLEARWAY ENERGY stock is being traded at $22.9, meaning it is currently undervalued by 25.8%. This presents an interesting opportunity for investors who may be looking to capitalize on the undervalued status of the share. More…

Peers

CEZ a.s., RENOVA Inc., and Beijing Jingneng Clean Energy Co Ltd are just some of the major competitors that Clearway Energy Inc has to contend with in order to stay at the top. The competition between these companies is fierce, as each strives to provide the best services and products at the most competitive prices.

– CEZ a.s ($LTS:0NZF)

CEZ a.s is a Czech energy company based in Prague. It is involved in the production, distribution and sale of electricity and related services to customers in the Czech Republic and abroad. The company has a market cap of 402.86 billion as of 2022, which makes it one of the largest energy companies in the Czech Republic. The company also has a strong Return on Equity (ROE) of 47.29% which is indicative of its strong financial performance. This is due to the company’s focus on efficient operations and cost-cutting strategies, which have allowed it to maximize profits and returns for its shareholders.

– RENOVA Inc ($TSE:9519)

RENOVA Inc is a leading energy and infrastructure company based in the United States. It develops and operates energy projects, large-scale infrastructure projects, and provides asset management services. The company has a market capitalization of 203.44 billion dollars as of 2022, making it one of the largest energy companies in the US. It also has a very healthy return on equity of 6.73%, indicating that it is managed efficiently and its investors are being rewarded for their investments. RENOVA Inc has proven to be a reliable and dependable company, dedicated to creating value for its stakeholders.

– Beijing Jingneng Clean Energy Co Ltd ($SEHK:00579)

Beijing Jingneng Clean Energy Co Ltd is a Chinese clean energy provider that produces energy from renewable sources such as solar and wind. As of 2022, the company has a market capitalization of 14.51 billion and a return on equity of 9.93%. Market capitalization is the total value of a company’s outstanding shares, and the return on equity is an indicator of how efficiently the company is utilizing its investments. The high market cap and ROE are indicative of the company’s strong financial health and operational performance.

Summary

Investors should take note of CLEARWAY ENERGY’s second quarter financial results for the fiscal year 2023. With total revenue increasing 10.3% compared to the year prior, the company has shown it is capable of growing its revenue despite the challenging economic landscape. However, net income decreased 93.3% year over year, casting doubt over whether the increase in revenue is sustainable long-term. Investors should research CLEARWAY ENERGY’s financials more deeply before making any investing decisions.

Recent Posts