China Gold International Resources Reports Q1 Earnings for FY2023 on May 15

May 24, 2023

Earnings Overview

On May 15 2023, CHINA GOLD INTERNATIONAL RESOURCES ($TSX:CGG) reported their earnings results for the first quarter (Q1) of FY2023, which ended on March 31 2023. In comparison with Q1 of the previous fiscal year, total revenue decreased by 16.9% to USD 252.8 million, however, their net income increased by 9.2%, reaching USD 77.8 million.

Market Price

The stock opened at CA$6.1 and closed at CA$6.2 on Monday, an increase of 1.8% from their previous closing price of CA$6.1. This marks a positive sign for the company as they continue to grow and expand their operations in the coming year. The company’s first quarter earnings report showed a 4% increase in their revenue year over year and a 9% increase in their net income from the same period last year. This increase in revenue and profit was driven by continued growth in sales of their gold and copper mining operations and their investments in other mineral projects in China. CHINA GOLD INTERNATIONAL RESOURCES’ outlook for the upcoming year is positive, and they have plans to continue to expand into new markets and areas of exploration.

They are also looking to invest more in research and development to stay ahead of the curve when it comes to innovation and technology advancements in the industry. Overall, CHINA GOLD INTERNATIONAL RESOURCES’ first quarter earnings report for fiscal year 2023 has been relatively positive. Their increased revenue and profit, combined with their plans to expand their operations, create an optimistic outlook for the company’s future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CGG. More…

| Total Revenues | Net Income | Net Margin |

| 1.05k | 229.29 | 23.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CGG. More…

| Operations | Investing | Financing |

| 414.23 | -28.13 | -185.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CGG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.3k | 1.46k | 4.6 |

Key Ratios Snapshot

Some of the financial key ratios for CGG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.8% | 306.0% | 28.7% |

| FCF Margin | ROE | ROA |

| 35.5% | 10.2% | 5.7% |

Analysis

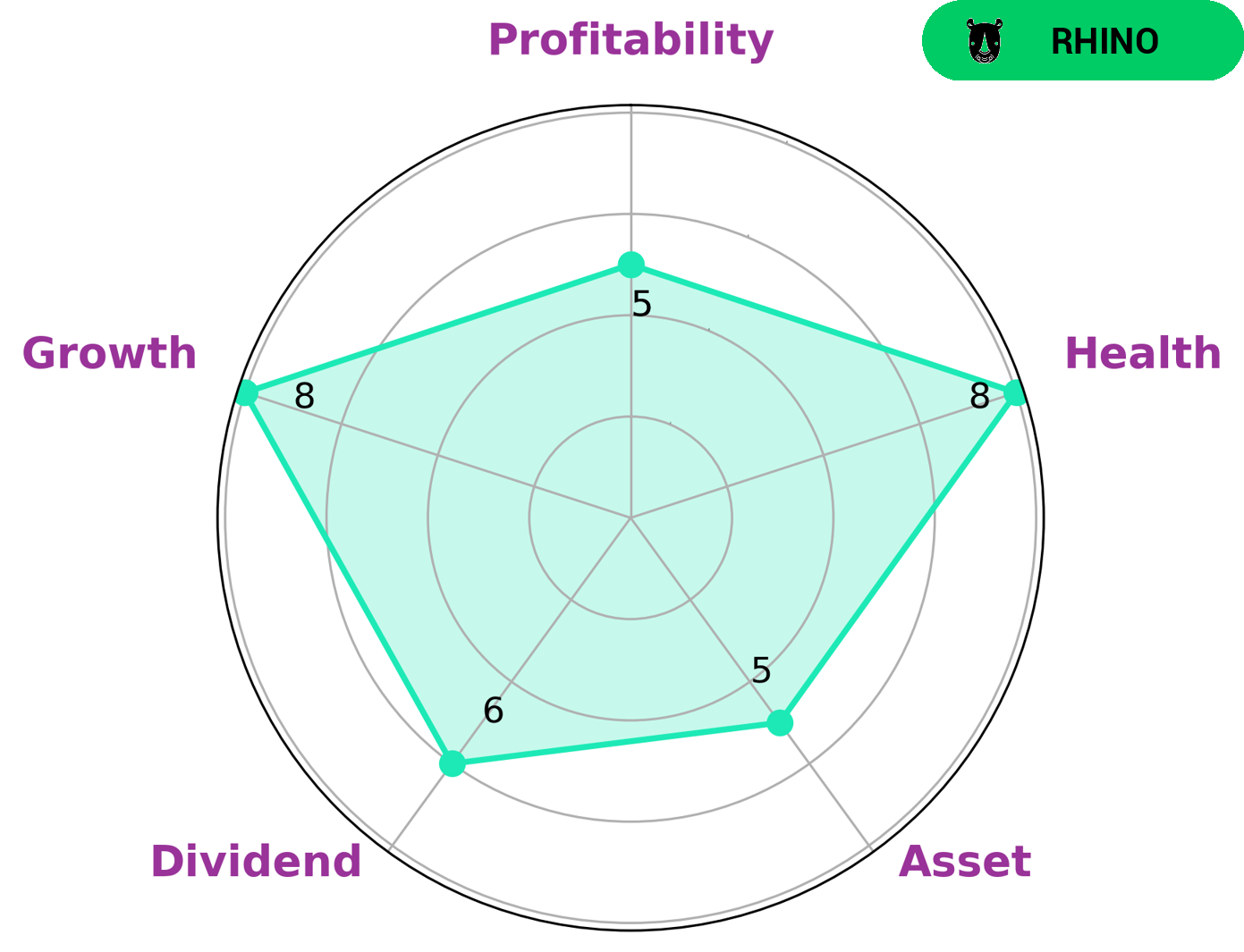

GoodWhale’s analysis of CHINA GOLD INTERNATIONAL RESOURCES’ wellbeing reveals that the company has achieved moderate revenue or earnings growth, as classified by our Star Chart as a ‘rhino’. GoodWhale believes that investors interested in such a company would be those looking for steady, moderate growth. CHINA GOLD INTERNATIONAL RESOURCES has a high health score of 8/10. Our metrics suggest that the company is well-positioned to ride out any crisis without the risk of bankruptcy, with healthy cashflows and manageable debt. Moreover, CHINA GOLD INTERNATIONAL RESOURCES is strong in growth, and medium in asset, dividend, and profitability. This indicates that the company is a safe investment and likely to deliver moderate returns over the long-term. More…

Peers

It operates mines in both China and Canada and is known for its high-quality operations and resources. Its competitors include Hunan Gold Corp Ltd, Sotkamo Silver AB, and Orvana Minerals Corp, all of which are engaged in gold and copper production.

– Hunan Gold Corp Ltd ($SZSE:002155)

Hunan Gold Corp Ltd is a large Chinese gold mining and exploration company. It has a market capitalization of 15.61 Billion USD, as of 2022, making it one of the largest listed gold miners in China. The company has an impressive Return on Equity (ROE) of 5.42%. This indicates that the company is able to generate decent returns on its equity and is a good sign for investors. Hunan Gold Corp Ltd has mines located in Hunan Province and has been in operation since 1999. It is engaged in the exploration, mining and processing of gold ore, and sales of gold products.

– Sotkamo Silver AB ($LTS:0N0X)

Sotkamo Silver AB is a mining and exploration company that specializes in the exploitation and development of silver deposits. The company’s primary focus is on the Silver Mine Project located in Sotkamo, Finland. As of 2022, the company has a market cap of 106.12M, indicating that the company is valued at over a hundred million dollars. Additionally, Sotkamo Silver AB has a Return on Equity (ROE) of 0.1%, which falls below the industry average. As such, investors should be aware of the potential risks associated with investing in the company.

– Orvana Minerals Corp ($TSX:ORV)

Orvana Minerals Corp is a mineral processing and copper producer with operations in Europe and the Americas. The company is focused on producing copper, gold and silver from its mines in Spain and Bolivia. As of 2022, the company had a market capitalization of 27.32M. Its return on equity (ROE) was -9.38%, indicating that the company has not been able to generate a positive return from its investments. Despite the negative return, the company has been able to remain profitable and continue its operations.

Summary

China Gold International Resources reported an overall decrease in total revenue of 16.9% year-over-year in the first quarter of FY2023, ending on March 31 2023. Net income, however, rose 9.2%, outperforming the decrease in revenue. Investors looking to invest in this company should consider this mixed performance when evaluating the stock, as the net income growth has not been enough to offset the decline in total revenue. Further analysis of the company’s financials is recommended to determine whether this stock is a sound investment.

Recent Posts