CHEVRON CORPORATION Reports Second Quarter FY2023 Earnings Results for June 30 2023

July 30, 2023

🌥️Earnings Overview

On July 28 2023, CHEVRON CORPORATION ($NYSE:CVX) reported its earnings results for the second quarter of FY2023, as of June 30 2023. Compared to the same period last year, total revenue decreased by 27.8%, amounting to USD 47.2 billion, while net income dropped by 48.3% to USD 6.0 billion.

Price History

The company’s stock opened the day at $158.4 and closed at $158.9, a decrease of 0.5% from the prior closing price of $159.7. Looking ahead, CHEVRON CORPORATION is confident in their ability to deliver long-term value to shareholders with their ambitious and innovative strategies for growth. The company’s focus on operational excellence, cost savings and capital discipline will ensure their continued success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chevron Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 214.09k | 30.17k | 14.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chevron Corporation. More…

| Operations | Investing | Financing |

| 27.78k | -6.49k | -15.49k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chevron Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 251.78k | 251.78k | 84.69 |

Key Ratios Snapshot

Some of the financial key ratios for Chevron Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.0% | 636.5% | 19.8% |

| FCF Margin | ROE | ROA |

| 9.8% | 16.7% | 10.5% |

Analysis

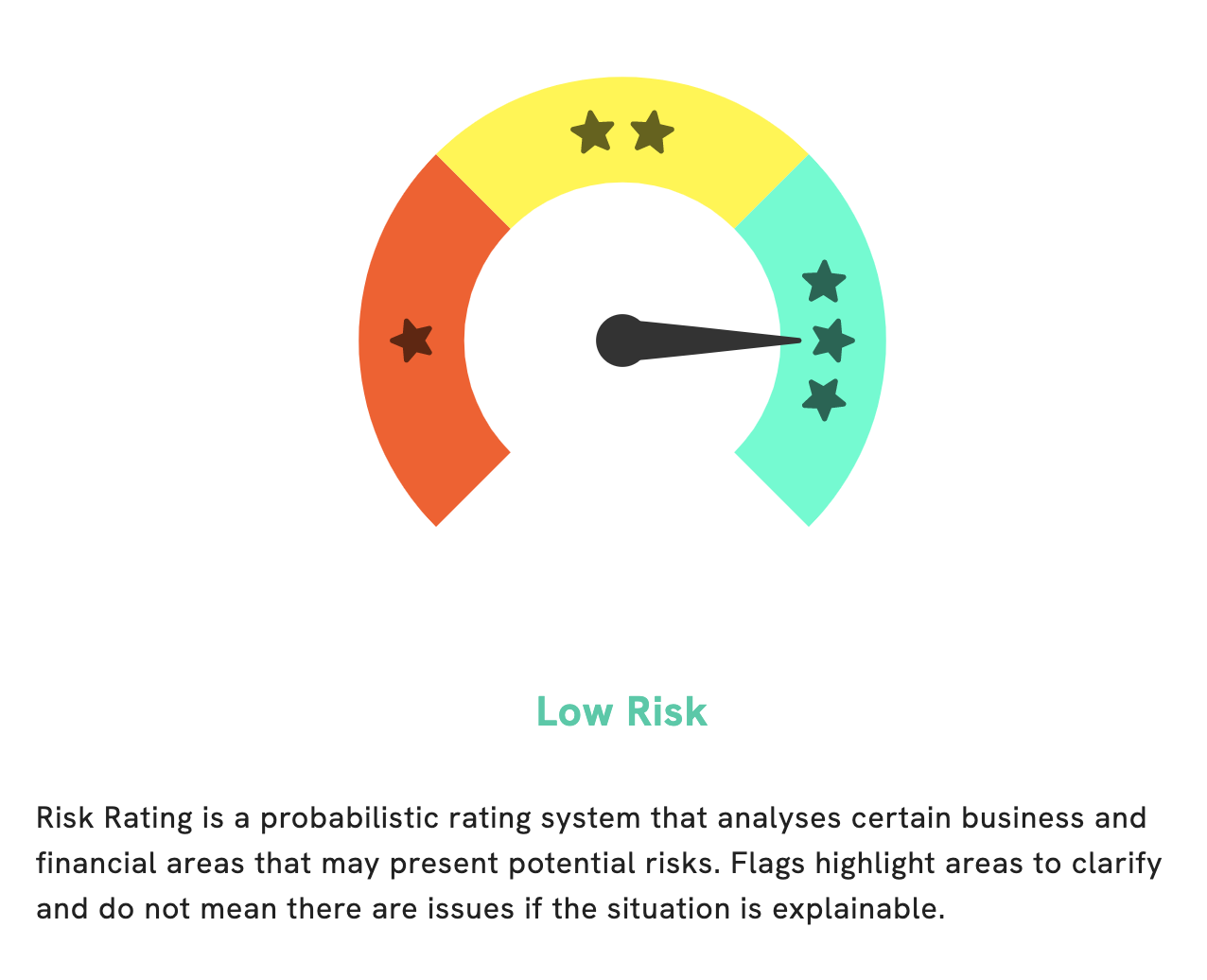

At GoodWhale, we recently conducted an analysis of CHEVRON CORPORATION‘s wellbeing. After a thorough review of the company’s financials, our Risk Rating showed that CHEVRON CORPORATION is a low risk investment in terms of financial and business aspects. However, goodwhale.com detected one risk warning in CHEVRON CORPORATION’s balance sheet which should be considered before investing. If you’re interested in learning more about this, you can register on goodwhale.com and take a look at our comprehensive report. More…

Peers

The Chevron Corp competes with Exxon Mobil Corp, Occidental Petroleum Corp, and ConocoPhillips. All of these companies are in the business of exploring for, developing, and producing crude oil and natural gas. Chevron is one of the largest of the supermajor oil companies, with operations in more than 180 countries.

– Exxon Mobil Corp ($NYSE:XOM)

Exxon Mobil Corporation is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller’s Standard Oil Company, and was formed on November 30, 1999 by the merger of Exxon (formerly the Standard Oil Company of New Jersey) and Mobil (formerly the Standard Oil Company of New York). The world’s seventh largest company by revenue, ExxonMobil is also the seventh largest publicly traded company by market capitalization. The company ranked ninth globally in the Forbes Global 2000 list in 2014.

– Occidental Petroleum Corp ($NYSE:OXY)

Occidental Petroleum Corp is a large American oil and gas company with operations in the United States, the Middle East, and Latin America. The company has a market cap of 63.77B as of 2022 and a return on equity of 29.73%. Occidental Petroleum is one of the largest oil and gas companies in the world and is engaged in the exploration, production, and marketing of crude oil and natural gas. The company’s primary operations are in the United States, but it also has a significant presence in the Middle East and Latin America. Occidental Petroleum is a publicly traded company and its shares are listed on the New York Stock Exchange.

– ConocoPhillips ($NYSE:COP)

ConocoPhillips is an American multinational energy corporation with its headquarters in Houston, Texas. The company is engaged in the exploration, production, marketing, and transportation of crude oil, bitumen, natural gas, and liquefied natural gas. As of December 31, 2019, the company had estimated proved reserves of 8.4 billion barrels of oil equivalent.

ConocoPhillips has a market capitalization of $150.08 billion as of January 2021. The company’s return on equity was 30.9% for the year ended December 31, 2020.

ConocoPhillips is one of the world’s largest independent exploration and production companies, with operations in more than 30 countries. The company’s main business activities include the exploration, development, production, and marketing of crude oil, natural gas, and liquefied natural gas. ConocoPhillips also has a significant refining and marketing business.

Summary

Investors should take note of Chevron Corporation‘s second quarter FY2023 earnings results, which showed that total revenue decreased 27.8% year-over-year to USD 47.2 billion, while net income fell 48.3% to USD 6.0 billion. These results reflect a challenging business environment, and investors will want to watch for signs of improvement in future quarters. Short-term investors may want to wait for a more favorable outlook before making any decisions, while long-term investors might focus on the company’s growth potential and potential value appreciation over time.

Recent Posts