Caterpillar Inc Stock Intrinsic Value – CATERPILLAR INC Reports Fourth Quarter Fiscal Year 2022 Earnings Results

February 14, 2023

Earnings report

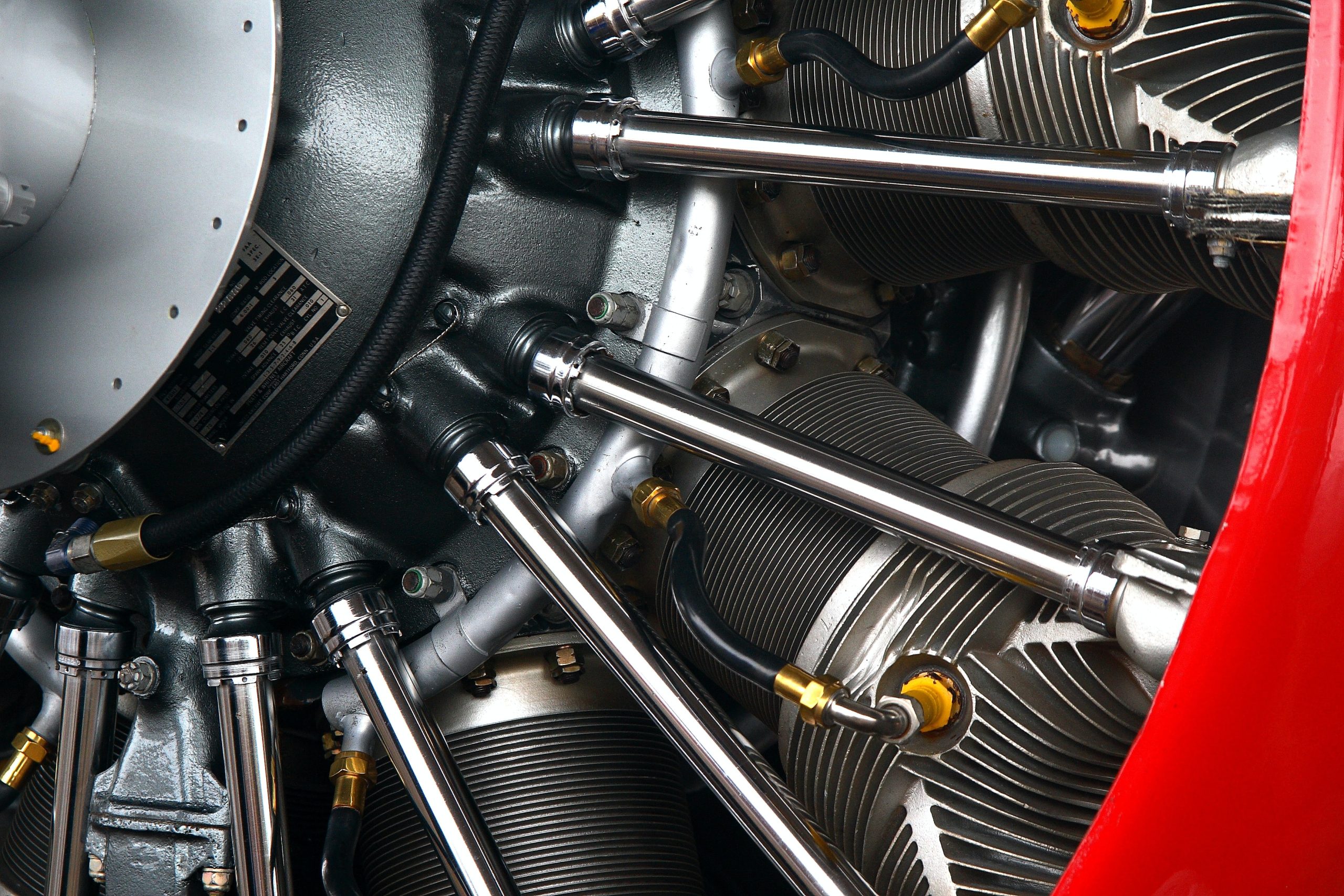

Caterpillar Inc Stock Intrinsic Value – CATERPILLAR INC ($NYSE:CAT), a publicly traded company listed on the New York Stock Exchange, is a leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. On January 31, 2023, CATERPILLAR INC reported its earnings results for the fourth quarter of fiscal year 2022, which ended on December 31, 2022. Total revenue for the period was USD 1.4 billion, a decrease of 31.6% from the same quarter the previous year. Despite this decrease, net income was USD 16.6 billion, representing an increase of 20.3% compared to the same period the previous year.

Despite this, the company plans to continue focusing on its long-term strategy by investing in R&D and capital expenditure and leveraging its strong balance sheet to drive growth in both its existing businesses as well as any new products and services that it may launch in the future. CATERPILLAR INC is an iconic name in the industrial sector and its strong financial results are a testament to its successful approach to business operations. The company is well-positioned to continue providing its customers with quality products and services and to support their operations in the long term.

Market Price

The company’s stock opened at $257.0 and closed at a lower price of $252.3, a 3.5% decrease from its previous closing price of $261.5. Caterpillar Inc CEO Jim Umpleby said in a statement “While the pandemic has created significant uncertainty and disruption, our team responded with determination and creativity to deliver outstanding results. Caterpillar Inc also announced that it is looking to expand its operations into new markets and technologies, such as robotics and automation, as well as strengthening its sustainability efforts. The company is aiming for long-term growth and increased profitability in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Caterpillar Inc. More…

| Total Revenues | Net Income | Net Margin |

| 59.43k | 6.71k | 12.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Caterpillar Inc. More…

| Operations | Investing | Financing |

| 7.77k | -2.54k | -7.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Caterpillar Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 81.94k | 66.05k | 29.96 |

Key Ratios Snapshot

Some of the financial key ratios for Caterpillar Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.4% | 2.1% | 15.5% |

| FCF Margin | ROE | ROA |

| 8.7% | 36.5% | 7.0% |

Analysis – Caterpillar Inc Stock Intrinsic Value

GoodWhale has conducted a thorough analysis of CATERPILLAR INC‘s fundamentals and found that the intrinsic value of a one share of CATERPILLAR INC stock is around $224.9. This figure has been drawn from GoodWhale’s proprietary Valuation Line, which takes into account a range of factors including asset value and projected earnings. Currently, CATERPILLAR INC shares are being traded for $252.3, meaning that the stock is currently overvalued by 12.2% when compared to its true intrinsic value. This may be the result of positive news or market trends that indicate investors believe CATERPILLAR INC is undervalued or has potential for growth in the near future. It is important to note that fair value should not be seen as a definitive guide to how much an investor should pay for a share of CATERPILLAR INC. Individual investors should always exercise their own judgement when considering buying, selling or holding shares of CATERPILLAR INC to ensure they make an informed investment decision. More…

Peers

Caterpillar Inc. is one of the world’s largest manufacturers of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. The company operates in more than 500 locations across six continents. Caterpillar’s products are used in a variety of industries, including construction, mining, forestry, and energy. The company competes with a number of other manufacturers, including CNH Industrial NV, Deere & Co, AGCO Corp, and others.

– CNH Industrial NV ($NYSE:CNHI)

CNH Industrial N.V. is a holding company, which engages in the manufacture of agricultural and construction equipment, trucks, commercial vehicles, buses, and specialty vehicles. It operates through the following segments: Agricultural Equipment, Construction Equipment, Commercial Vehicles, Powertrain, and Financial Services. The Agricultural Equipment segment produces and sells agricultural tractors, combines, haytools, sprayers, forage harvesters, implements and related replacement parts. The Construction Equipment segment manufactures and sells backhoe loaders, small and medium tracked excavators, wheeled excavators, skid steer loaders, compact track loaders, wheel loaders, telehandlers, dumpers, motor graders, soil and asphalt compactors, and other equipment. The Commercial Vehicles segment produces and sells light, medium, and heavy-duty trucks under the Iveco brand. The Powertrain segment manufactures and sells engines, transmissions, axles, and components. The Financial Services segment offers wholesale and retail financing products to customers and dealers to purchase equipment. The company was founded on November 12, 2012 and is headquartered in London, the United Kingdom.

– Deere & Co ($NYSE:DE)

As of 2022, Deere & Co has a market cap of 112.07B and a Return on Equity of 25.53%. The company is engaged in the manufacturing and distribution of equipment used in agricultural, construction, forestry, and turf care.

– AGCO Corp ($NYSE:AGCO)

AGCO Corp is a publicly traded company that manufactures and sells agricultural equipment and related products. As of 2022, the company had a market capitalization of 8.31 billion dollars and a return on equity of 16.62%. The company’s products include tractors, combines, hay tools, sprayers, forage equipment, and more. AGCO Corp is headquartered in Duluth, Georgia, and has operations in North America, Europe, South America, and Asia.

Summary

Caterpillar Inc. reported strong fourth quarter earnings results for the fiscal year 2022, with total revenue declining 31.6% year over year to $1.4 billion and net income rising 20.3% to $16.6 billion. Despite this, the stock price moved down on the same day of the report’s release. This presents an interesting investment opportunity for those seeking value in the market. Caterpillar Inc.’s strong earnings results demonstrate its financial stability, as well as its ability to weather economic downturns. Its net income growth of 20.3% is a strong indication of the company’s resilience and ability to remain profitable despite the challenging economic climate. It is important to note that Caterpillar Inc.’s revenue declined by 31.6% compared to the previous year. While this could be a sign of an economic slowdown, investors can take comfort in the company’s ability to remain profitable despite the challenging environment.

Additionally, Caterpillar Inc.’s strong balance sheet and liquidity position means it can weather further economic headwinds in the near future, making it a strong long-term investment opportunity. In conclusion, Caterpillar Inc.’s strong financial performance and attractive dividend yield make it an interesting investment prospect for those seeking value in the market. Investors should also pay attention to economic developments as they could impact Caterpillar Inc.’s performance in the near future.

Recent Posts