CAPRI HOLDINGS Reports Fourth Quarter Fiscal Year 2023 Earnings Results on March 31, 2023

June 11, 2023

🌥️Earnings Overview

On March 31, 2023, CAPRI HOLDINGS ($NYSE:CPRI) revealed their earnings results for the fourth quarter of fiscal year 2023, which concluded on that day. Revenue for the quarter totaled USD 1335.0 million, a 10.5% drop from the same period of the previous year. Net income also declined to USD -34.0 million, down from USD 81.0 million in the prior year.

Market Price

The stock opened at $38.6 and plummeted 11.3% to close at $35.1, down from its last closing price of $39.6. This resulted in a steep decline in the company’s market capitalization which has been on a steady rise since its inception. The company’s latest earnings report showed weaker-than-expected revenue, as well as growth in operating expenses. This, combined with a higher Tax rate, caused profits to come in much lower than expected.

Despite the negative earnings report, CAPRI HOLDINGS said that it is optimistic about the company’s future prospects, touting its strong balance sheet and strategic investments in technology-driven projects. The company is confident that its long-term strategies will help it achieve sustained future growth. CAPRI HOLDINGS’ management remains focused on driving shareholder value and is committed to creating a strong financial foundation that will be crucial to success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Capri Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 5.62k | 616 | 13.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Capri Holdings. More…

| Operations | Investing | Financing |

| 771 | 183 | -776 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Capri Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.29k | 5.45k | 15.75 |

Key Ratios Snapshot

Some of the financial key ratios for Capri Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.4% | 14.5% | 14.9% |

| FCF Margin | ROE | ROA |

| 9.7% | 25.7% | 7.2% |

Analysis

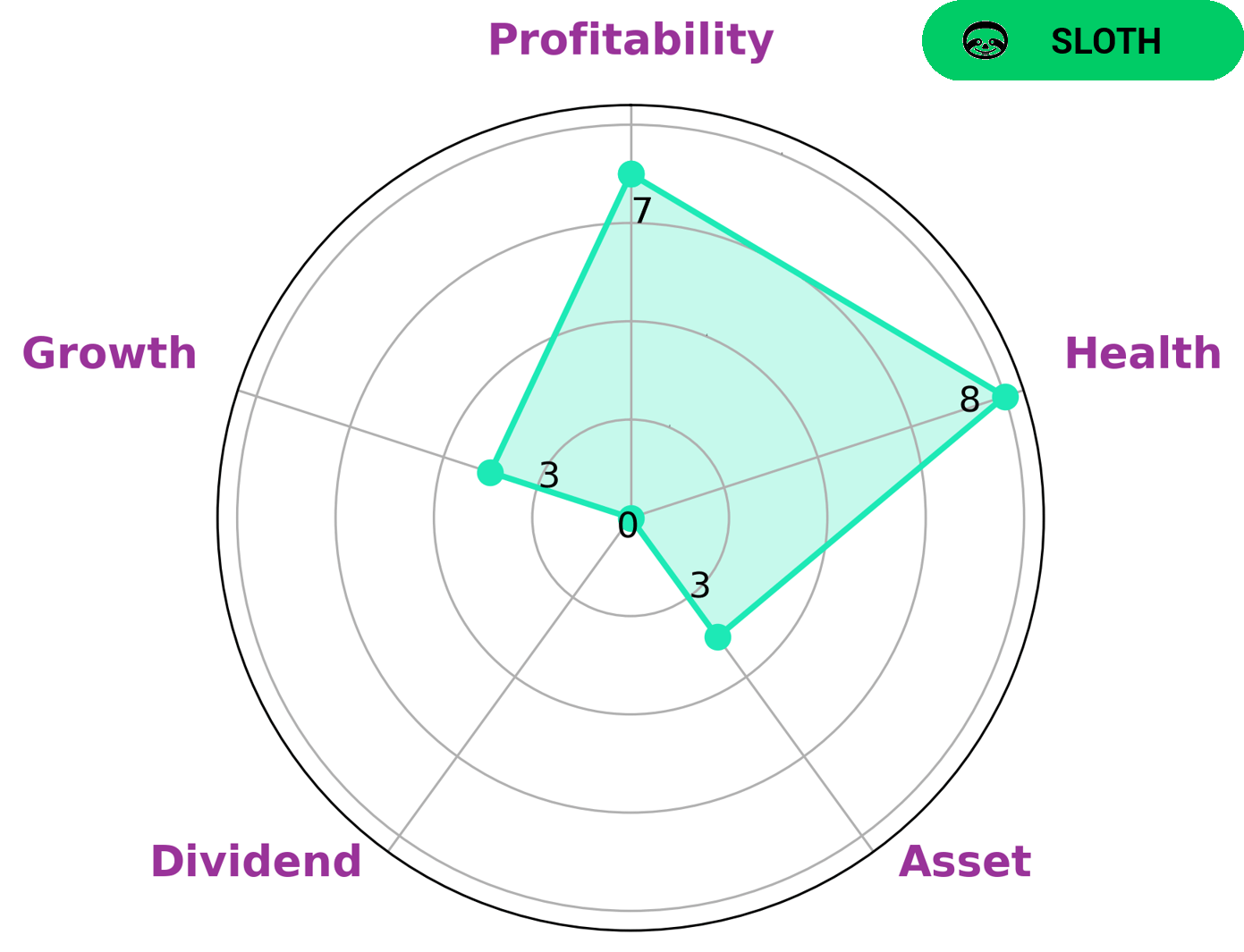

At GoodWhale, we have performed an analysis of CAPRI HOLDINGS‘ fundamentals. Our Star Chart assessment has given CAPRI HOLDINGS a high health score of 8/10, indicating that the company is capable of paying off its debt and funding future operations. We have classified CAPRI HOLDINGS as a ‘sloth’, a type of company which has achieved slower revenue or earnings growth than the overall economy. For investors interested in CAPRI HOLDINGS, the company is strong in profitability, yet weak in asset, dividend, and growth. Thus, investors who have a higher tolerance for risk may be interested in CAPRI HOLDINGS, since potential returns could be higher than other investments. Meanwhile, investors who prioritize asset preservation and dividend income should consider other investments before investing in CAPRI HOLDINGS. More…

Peers

The fashion industry is extremely competitive, with companies constantly vying for market share. Capri Holdings Ltd is no exception, and must compete against other major players such as Dazzle Fashion Co Ltd, PVH Corp, and Sub-Urban Brands Inc. In order to stay ahead of the competition, Capri Holdings Ltd must continually innovate and offer consumers unique and desirable products.

– Dazzle Fashion Co Ltd ($SHSE:603587)

Dazzle Fashion Co Ltd is a fashion company with a market cap of 6.76B as of 2022. The company has a Return on Equity of 11.66%. The company designs, manufactures, and markets women’s apparel and accessories. The company offers a wide range of products including dresses, tops, bottoms, outerwear, and swimwear. The company operates in two segments: wholesale and retail. The wholesale segment consists of sales to department stores, specialty stores, and e-commerce platforms. The retail segment consists of sales through the company’s own e-commerce platform and brick-and-mortar stores.

– PVH Corp ($NYSE:PVH)

PVH Corp is a publicly traded company with a market capitalization of 3.08 billion as of 2022. The company has a return on equity of 11.85%. PVH Corp is a holding company that operates through its subsidiaries. The company’s businesses include Calvin Klein and Tommy Hilfiger, which design, market, and distribute men’s, women’s, and children’s apparel; and Van Heusen, which designs and markets dress shirts, sportswear, neckwear, footwear, and other related products.

Summary

CAPRI HOLDINGS released its earnings results for the fourth quarter of 2023 and showed a 10.5% decrease in total revenue compared to the same quarter the previous year. Net income also fell to USD -34.0 million from USD 81.0 million the year before. This news caused the stock price to dip the same day.

For those interested in investing in CAPRI HOLDINGS, it may be wise to consider the company’s current financial state, as well as potential future risks, prior to making an investment decision. A thorough analysis of the company’s financial statements and recent trends may provide more insight into the current status of the company and how its stock may perform in the future.

Recent Posts