CANACOL ENERGY Reports First Quarter Earnings Results for FY2023

May 26, 2023

Earnings Overview

On May 11, 2023, CANACOL ENERGY ($TSX:CNE) reported its earnings results for the first quarter of FY2023. Total revenues for the quarter that ended on March 31, 2023 totaled USD 76.2 million, which was a 7.8% decrease from the same period in the previous year. Net income for the quarter was USD 16.9 million, a 30.9% drop from the same quarter in the prior year.

Share Price

The company’s stock opened the day at CA$10.3 and closed at the same price, up by 0.2% from the prior closing price. The company reported overall positive financial results for the quarter, indicating a strong start to the year. The company attributed the increase in revenue and net income to strong performance from its oil and gas projects, as well as from its exploration activities.

Additionally, increased activity in the company’s Colombian and Ecuadorian operations helped to contribute to the positive results for the quarter. Investors were pleased with the news and sent the company’s stock price up by 0.2% by the end of the day. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Canacol Energy. More…

| Total Revenues | Net Income | Net Margin |

| 329.24 | 139.73 | 48.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Canacol Energy. More…

| Operations | Investing | Financing |

| 178.34 | -193.46 | -34.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Canacol Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.1k | 794.15 | 8.86 |

Key Ratios Snapshot

Some of the financial key ratios for Canacol Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.4% | 7.1% | 30.8% |

| FCF Margin | ROE | ROA |

| 20.2% | 21.3% | 5.8% |

Analysis

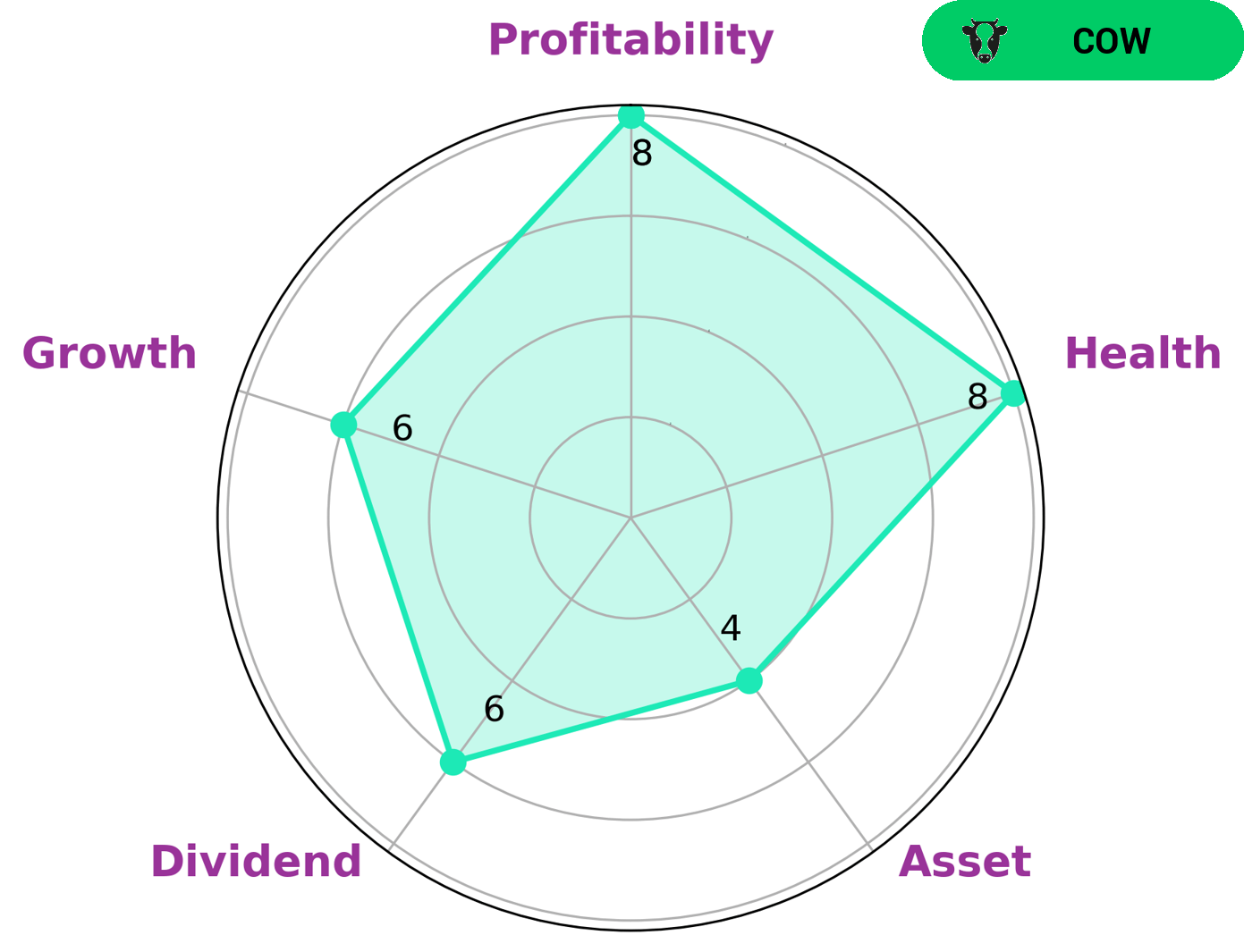

GoodWhale recently conducted an analysis of CANACOL ENERGY‘s wellbeing. The Star Chart analysis shows that CANACOL ENERGY is strong in profitability and medium in asset, dividend and growth. Our health score of 8/10 indicates that CANACOL ENERGY is capable to safely ride out any crisis without the risk of bankruptcy. After analyzing the data, we have classified CANACOL ENERGY as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. Due to its impressive financials, CANACOL ENERGY is likely to attract investors who are looking for long-term stability and steady returns. Those with a conservative approach to investing, who may be more risk-averse than most, are likely to invest in CANACOL ENERGY due to its strong profit margins and low volatility. Investors who prefer to play it safe and are looking for a consistent income over time should consider CANACOL ENERGY as an option. More…

Peers

The company was founded in 2002 and is headquartered in Calgary, Alberta, Canada. Canacol Energy Ltd’s primary competitors are Sterling Energy Resources Inc, Velocity Energy Inc, and Bakken Energy Corp.

– Sterling Energy Resources Inc ($OTCPK:SGER)

Velocity Energy Inc. is a Canadian oil and gas company with a market capitalization of $2.29M as of 2022. The company is engaged in the exploration, development and production of oil and natural gas properties in Canada. Velocity Energy’s primary focus is on the development of its Montney natural gas assets in British Columbia. The company’s Montney assets are located in the Peace River Arch region, where it holds approximately 100,000 net acres of land. Velocity Energy is headquartered in Calgary, Alberta.

– Velocity Energy Inc ($OTCPK:VCYE)

Bakken Energy Corp is a publicly traded company with a market capitalization of 383.21k as of 2022. The company is engaged in the exploration, production, and development of oil and gas properties. Bakken Energy Corp has a return on equity of 1.81%.

Summary

CANACOL ENERGY released their first quarter earnings results for FY2023 on May 11 2023. Total revenues for the quarter ending March 31 2023 were down 7.8% from last year, amounting to USD 76.2 million. Net income for the quarter was USD 16.9 million, representing a 30.9% decrease from the same period last year. For investors, this may be cause for concern, as decreased profits and revenues indicate a company’s performance is not meeting expectations.

However, further analysis is required to determine if the results are an anomaly or a sign of the company’s long-term prospects. Investors should review current and past financial statements, market trends, and management strategies to help decide whether or not to invest in CANACOL ENERGY.

Recent Posts