BRUKER CORPORATION Reports FY2022 Q4 Earnings Results for December 31 2022 on February 9 2023

February 26, 2023

Earnings Overview

BRUKER CORPORATION ($NASDAQ:BRKR) released their fourth quarter FY2022 earnings results as of December 31 2022 on February 9 2023, revealing total revenue of USD 97.4 million, an increase of 28.7% from the previous year. Net income for the quarter was USD 708.4 million, a 3.6% rise from the prior year.

Transcripts Simplified

Bruker reported $708 million in revenue for the fourth quarter of 2022, a 3.6% increase. GAAP EPS was $0.66 per share, compared to $0.50 for the same time period in 2021. Non-GAAP EPS was $0.74 per share, a 25% increase from the fourth quarter of 2021. Organic revenue grew 8.9%, with acquisitions contributing 1.7% and foreign currency headwinds being 7%. BioSpin fourth quarter revenue increased in the high single digit percentage, with notable strength in PCI and BioSpin software businesses. Nano organic revenue grew in the low 20%.

CALID Group performance was constrained by supply chain delays, but bookings were robust. BSI systems revenue was up high single digit percentages organically and aftermarket was also up high single digit percentage organically. Europe was down mid-single digit percentage, Americas increased in the high single digit percentage, and APAC grew in the 20% range year-over-year. Bruker purchased 435,000 shares of stock for total consideration of $26 million and 4.2 million shares for a total consideration of $265 million in the fourth quarter. Operating cash flow was $159 million and free cash flow was $135 million resulting from higher net income in the fourth quarter.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bruker Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.53k | 296.6 | 11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bruker Corporation. More…

| Operations | Investing | Financing |

| 262 | -239.3 | -415.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bruker Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.62k | 2.49k | 6.36 |

Key Ratios Snapshot

Some of the financial key ratios for Bruker Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 15.6% | 18.3% |

| FCF Margin | ROE | ROA |

| 5.7% | 28.0% | 8.0% |

Price History

At the opening of trading, BRUKER CORPORATION stock began at $72.4 and when markets closed for the day, the stock was valued at $72.3, representing an increase of 1.3% from its previous closing price of $71.4. In terms of guidance, the company reported that it expects to have a double-digit revenue growth over the next two years with a slight improvement in gross margins and net income.

In addition, BRUKER CORPORATION also announced that they are looking to increase investments in research and development and capital expenditures to support their long-term growth strategy. Overall, the earnings report reflects both the strong performance of BRUKER CORPORATION in Q4 and the bright future that lies ahead for the company. As the company eyes growth for the coming years and continues to invest in research and development, investors have plenty of reasons to be optimistic about the future of BRUKER CORPORATION’s stock. Live Quote…

Analysis

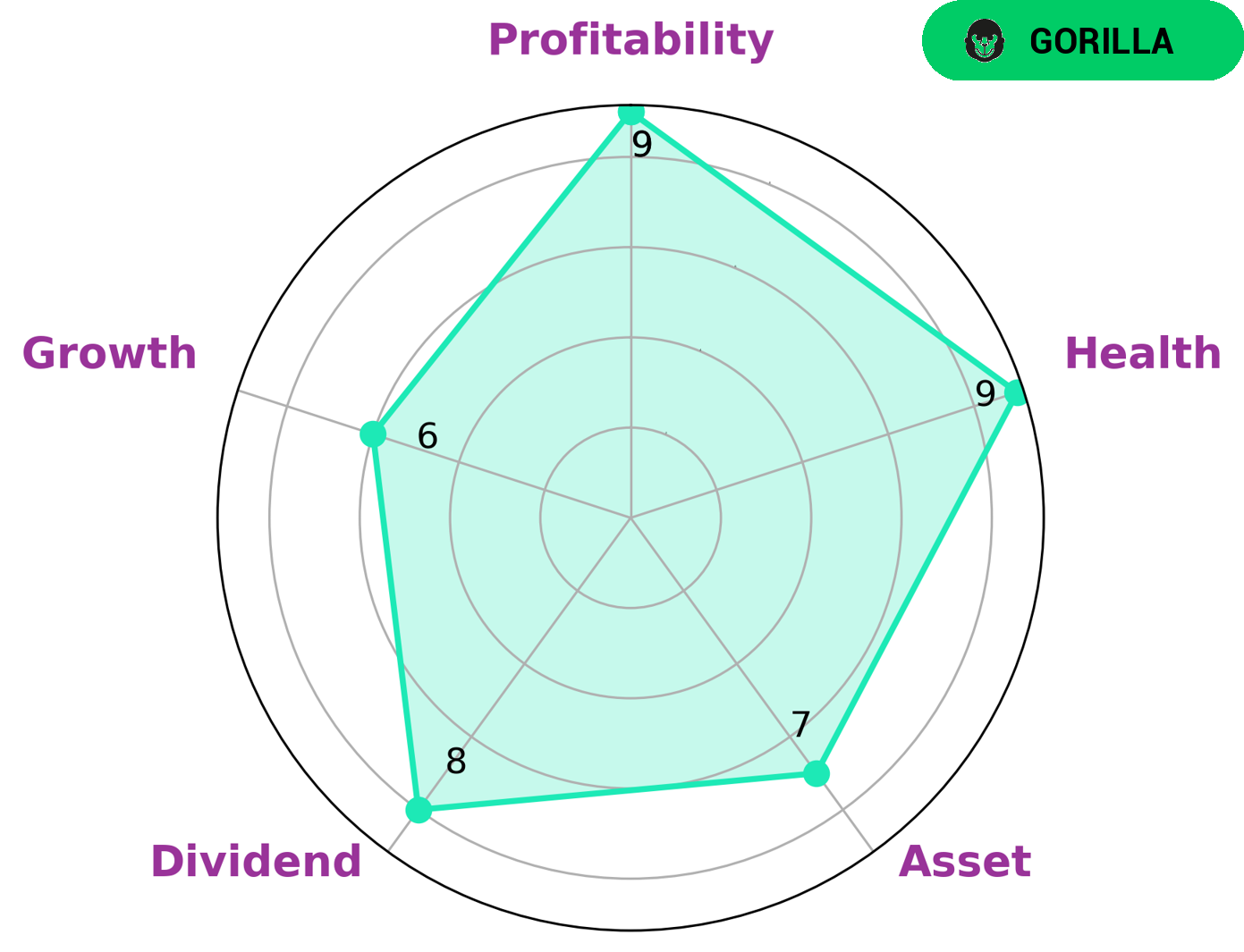

As a financial analyst, I recently studied BRUKER CORPORATION and am impressed with what I found. The company has a high health score of 9/10 according to GoodWhale’s Star Chart, which evaluates cashflow and debt. This suggests that BRUKER CORPORATION is well-positioned to survive any financial turbulence and sustain operations during times of crisis. Furthermore, BRUKER CORPORATION scores highly on criteria such as asset strength, dividend yield, and profitability, and moderately in terms of growth. This places them in the ‘gorilla’ category, which indicates that their competitive advantage has allowed them to achieve stable and high revenue and earning growth. Given its impressive performance in all areas, BRUKER CORPORATION could appeal to many types of investors. Those who have a long-term view may appreciate the stability of the company’s financials, along with its dividend yield and profitability. Growth investors may also be enticed by the higher-than-average growth prospects that the company has displayed, while those looking for strong asset performance will likely find BRUKER CORPORATION appealing. In conclusion, BRUKER CORPORATION is a great option for any type of investor looking for a solid performer in their portfolio. More…

Peers

Its products are used in a variety of applications, including drug discovery, food and environmental testing, and materials science research. The company’s main competitors are Tecan Group AG, Stevanato Group SPA, and Cerus Corporation.

– Tecan Group AG ($LTS:0QLN)

Tecan Group AG is a leading provider of laboratory instruments and solutions. The company has a market cap of 4.56B as of 2022 and a Return on Equity of 6.13%. Tecan provides a wide range of products and services for the life science research, diagnostics and pharmaceutical sectors. The company offers a broad range of solutions for drug discovery, genomics, diagnostics and forensics. Tecan also provides contract research services to the pharmaceutical industry.

– Stevanato Group SPA ($NYSE:STVN)

Stevanato Group SPA is a company that manufactures and sells pharmaceuticals and medical devices. The company has a market cap of 4.89B as of 2022 and a return on equity of 11.0%. The company’s products are sold in over 100 countries and it has a presence in Europe, North America, and Asia.

– Cerus Corp ($NASDAQ:CERS)

Cerus Corp is a medical technology company that specializes in blood safety. The company’s primary product is the Intercept Blood System, which is designed to inactivate viruses, bacteria, parasites, and other potentially harmful agents in donated blood. Cerus Corp’s market cap as of 2022 is 625.13M, and its ROE is -28.3%. The company has been facing some financial difficulties in recent years, but continues to invest in research and development in order to bring new products to market.

Summary

T o t a l r e v e n u e w a s U S D 9 7 . 4 m i l l i o n , s h o w i n g 3 . T h i s i n d i c a t e s a p o s i t i v e o v e r a l l t r e n d f o r t h e c o m p a n y , a n d w i t h i t s f i n a n c i a l s a l r e a d y a t a h i g h l e v e l , i n v e s t o r s m a y f i n d a t t r a c t i v e r e t u r n s w i t h B R U K E R C O R P O R A T I O N.

Recent Posts