BrightView Holdings Poised to Climb Higher on Positive Earnings Estimates Revisions

May 18, 2023

Trending News ☀️

BRIGHTVIEW ($NYSE:BV): BrightView Holdings, a leading landscaping services provider, has seen strong earnings estimate revisions that indicate the company’s share price could continue to climb in the near future. The company, which provides services to commercial, public sector and residential customers, has seen its share price increase over the past year due to its strong performance and outlook. In addition to its core landscaping services, BrightView also provides snow removal services, irrigation and water management, turf and tree health care, landscape design and construction, and grounds management services. The company’s diverse range of services has enabled it to expand its customer base while continuing to grow its revenue and profits. This has resulted in an overall improvement in its financial performance and outlook.

The strong earnings estimates revisions for BrightView suggest the company is well-positioned for continued growth in the near future. Analysts have revised their estimates upwards over the course of the past year, citing the company’s strong performance and outlook. As a result, many investors have taken a long-term position on BrightView’s stock, expecting it to continue to climb higher. With the company’s share price already trending upwards, BrightView Holdings appears to be poised for further gains in the near future.

Earnings

BRIGHTVIEW HOLDINGS has recently reported their second fiscal quarter ending March 31 2023, posting a total revenue of 650.4M USD but a net income loss of 22.0M USD. This is a noteworthy 8.6% decrease compared to the previous year, and total revenue has decreased from 651.9M USD to 650.4M USD in the last 3 years. Despite this overall decrease in total revenue, BRIGHTVIEW HOLDINGS has managed to stay afloat and continues to remain a leader in the industry. Analysts have taken note of BRIGHTVIEW HOLDINGS’ resilience in light of their recent earnings report, with many revising their positive predictions for the company’s future.

With the current market outlook, analysts are expecting BRIGHTVIEW HOLDINGS to climb higher in the coming months as they continue to build on their impressive performance. Investors are confident that BRIGHTVIEW HOLDINGS will continue to show strong growth and consistent profitability, making it an exciting stock to watch.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brightview Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.78k | -14.8 | -0.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brightview Holdings. More…

| Operations | Investing | Financing |

| 119.6 | -99.8 | -54.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brightview Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.28k | 2.09k | 12.68 |

Key Ratios Snapshot

Some of the financial key ratios for Brightview Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.8% | -7.4% | 2.4% |

| FCF Margin | ROE | ROA |

| 1.2% | 3.5% | 1.3% |

Market Price

BrightView Holdings has been performing well in the market lately, evident by its stock price increasing by 3.7% on Wednesday, closing at $6.5. This is up from its previous closing price of $6.3. This surge in stock price could be attributed to the positive earnings estimates revisions for the company.

Analysts have been revising their estimates and expectations of the company’s growth in the coming months, which could lead to the stock climbing higher. Investors will be watching closely to see if BrightView Holdings can meet the revised estimates. Live Quote…

Analysis

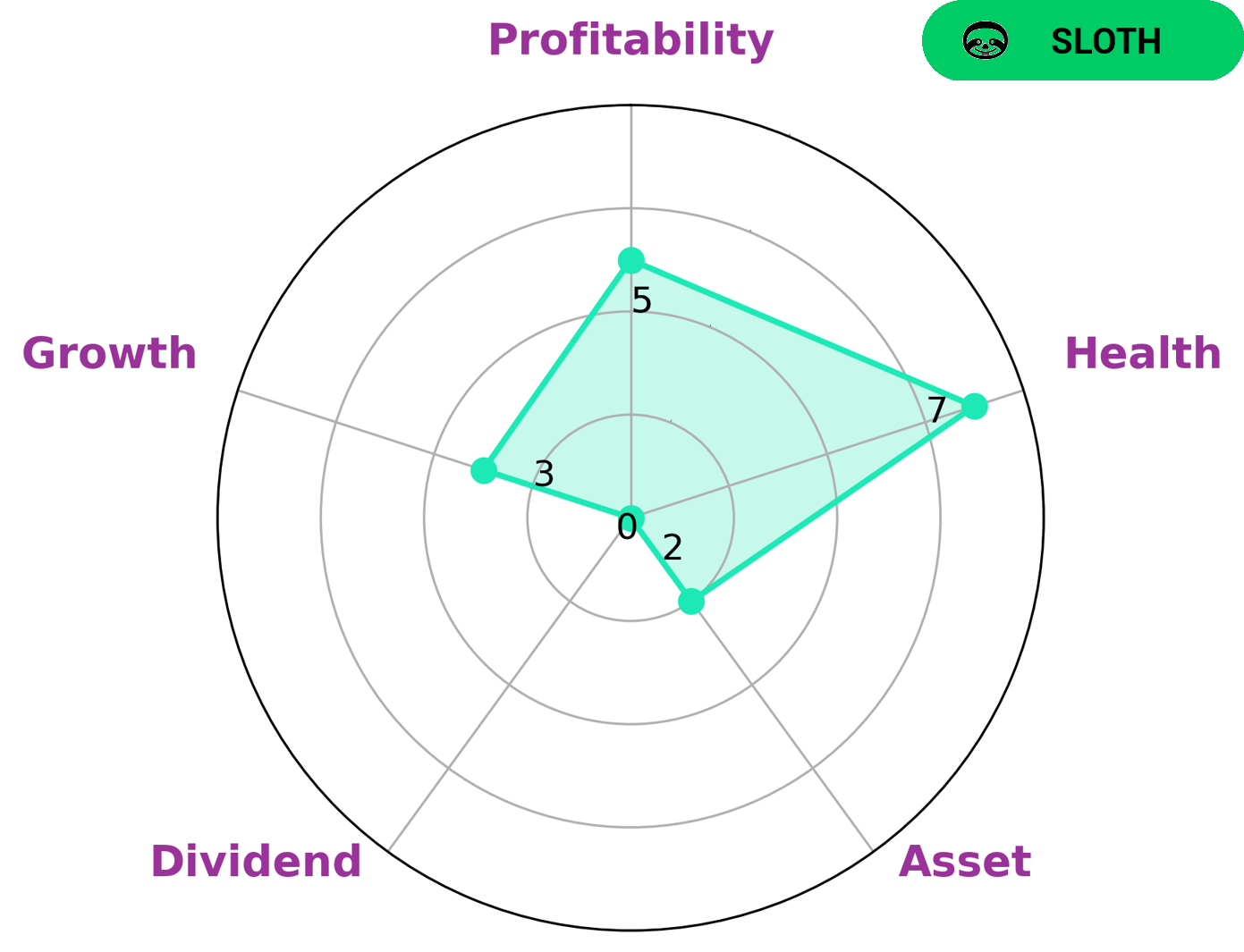

At GoodWhale, we analyzed BRIGHTVIEW HOLDINGS‘s financials and compiled a Star Chart to give an overview of the company’s financial performance. According to the chart, BRIGHTVIEW HOLDINGS is strong in profitability, medium in asset, dividend, and growth, and weak in all other categories. Additionally, it has a high health score of 7/10 with regard to its cashflows and debt, meaning it is capable to safely ride out any crisis without the risk of bankruptcy. Given this information, we have classified BRIGHTVIEW HOLDINGS as a ‘sloth’, a type of company that has achieved revenue or earnings growth slower than the overall economy. Investors who are looking for a long-term, lower risk investment with some potential for growth may be interested in BRIGHTVIEW HOLDINGS. The company’s low risk profile and its ability to ride out any crisis make it an appealing option for those looking for a steady and reliable investment. More…

Peers

The competition between BrightView Holdings Inc and its competitors is fierce, with Mader Group Ltd, Japan Elevator Service Holdings Co Ltd, and Simplex Holdings Inc all vying for a share of the market. With each company offering unique products and services, the competition is sure to be fierce in the coming years.

– Mader Group Ltd ($ASX:MAD)

Mader Group Ltd is a global engineering services provider based in Australia. The company provides turnkey engineering, project management and maintenance services to clients in the resources, energy, infrastructure and industrial sectors across the globe. As of 2022, the company has a market cap of 704M and a Return on Equity (ROE) of 33.68%. The market cap reflects the market value of the company and its shareholders’ equity, while the ROE is an indicator of how well the company is utilizing its shareholders’ investments. Mader Group’s high ROE suggests that it has been able to produce high returns for its shareholders.

– Japan Elevator Service Holdings Co Ltd ($TSE:6544)

Elevator Service Holdings Co Ltd is a Japanese company that specializes in the manufacturing and installation of elevators, escalators, and moving walkways. With a market cap of 141.94B as of 2022, the company is well-positioned to remain a leader in the industry. The company has also shown strong financial performance, with a Return on Equity of 24.68%. This indicates that the company is effective in utilizing its assets to generate profits. The company’s strong market position and financial performance make it well-positioned to remain a leader in the industry.

– Simplex Holdings Inc ($TSE:4373)

Simplex Holdings Inc is a leading technology company that designs and manufactures products for the consumer electronics and automotive industries. It is listed on the NYSE and has a market cap of 118.08B as of 2022. The company’s Return on Equity (ROE) stands at 10.23%, indicating that its shareholders earned 10.23 cents for each dollar of shareholders’ equity invested in the company. This is a sign of strong performance and a well-managed business. Simplex Holdings Inc has been able to successfully capitalize on the growing demand for consumer electronics and automotive products, allowing it to become one of the largest players in the sector.

Summary

BrightView Holdings is a leading landscape services provider in the United States, offering a wide range of services such as design, installation, and maintenance of landscaping projects. Recently, BrightView announced strong earnings that beat expectations and the stock price moved up as a result. Analysts have been revising their estimates upwards in light of the strong performance.

This bodes well for investors looking to capitalize on the stock’s potential growth. With a strong balance sheet and a diverse range of services, it is likely that BrightView will continue to remain an attractive investment for those looking for long-term growth.

Recent Posts