BOWLERO CORP Releases FY2023 Q3 Earnings Results on May 17th

May 27, 2023

Earnings Overview

On May 17 2023, BOWLERO CORP ($NYSE:BOWL) released the earnings results for the third quarter of FY2023, which closed on March 31 2023. The company reported total revenue of USD 315.7 million, showing a 22.5% year-on-year increase. Net income for Q3 was -32.1 million, compared to -18.0 million in the same quarter of the prior year.

Stock Price

On Wednesday, May 17th, bowling alley and entertainment chain BOWLERO CORP released their fiscal year 2023 third quarter earnings results. The stock opened at $13.9 and closed at $14.1, an increase of 2.1% from its last closing price of $13.8. This marks a positive development for the company, which has seen its share price dip slightly in the week leading up to the announcement. The announcement included a detailed report on the company’s performance over the past quarter, including total revenue and operating profit.

Furthermore, the report highlighted key areas of development for BOWLERO CORP over the course of the quarter, such as new store openings, product launches, and marketing initiatives. Overall, the results were positive and suggest that BOWLERO CORP is continuing to remain a competitive force in the bowling alley and entertainment sector. As investors continue to watch the company’s performance over the coming quarters and years, it will be interesting to see how BOWLERO CORP continues to grow and develop. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bowlero Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.09k | -70.18 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bowlero Corp. More…

| Operations | Investing | Financing |

| 243.61 | -229.55 | -25.92 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bowlero Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.01k | 1.72k | 1.69 |

Key Ratios Snapshot

Some of the financial key ratios for Bowlero Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 5.0% |

| FCF Margin | ROE | ROA |

| 9.6% | 15.3% | 1.7% |

Analysis

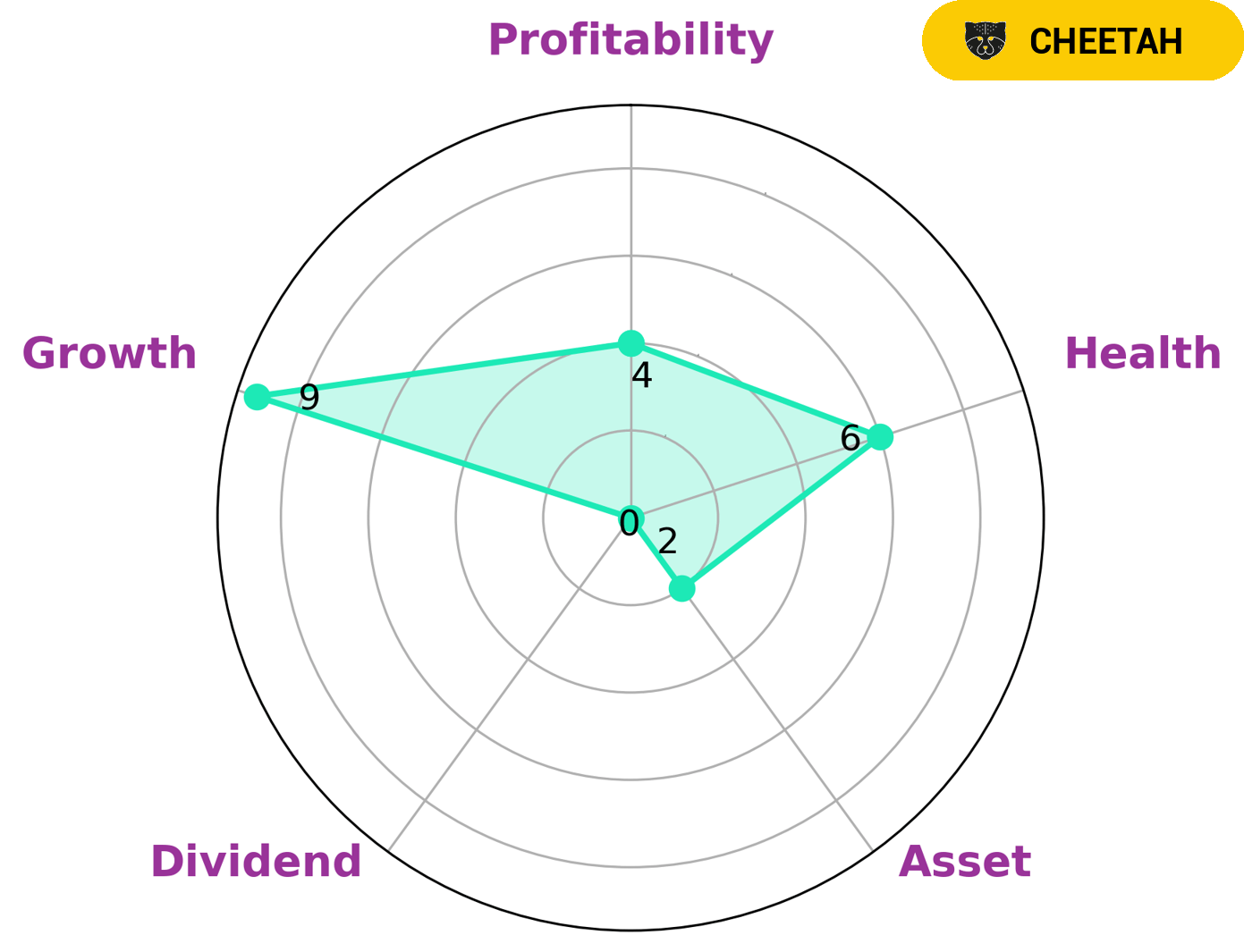

At GoodWhale, we have conducted an in-depth analysis of BOWLERO CORP‘s fundamentals. Our Star Chart has classified BOWLERO CORP as a ‘cheetah’ – a type of company which typically has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Given its strong growth and medium profitability, BOWLERO CORP may attract investors who are seeking a higher-risk investment opportunity with the potential for significant rewards. However, BOWLERO CORP is weak with regards to asset and dividend, indicating that those looking for more secure investments may look elsewhere. While there is some risk associated with investing in BOWLERO CORP, our analysis has determined that it has an intermediate health score of 6/10. This score takes into account BOWLERO CORP’s cashflows and debt, and suggests that the company is likely to safely ride out any crisis without the risk of bankruptcy. More…

Peers

In the world of professional bowling, there are few companies that can compete with Bowlero Corp. Founded in 2013, Bowlero has quickly become the largest operator of bowling centers in the United States. With over 300 locations across the country, Bowlero offers bowlers of all skill levels a place to enjoy their favorite pastime. While Bowlero is the clear leader in the industry, there are a few other companies that are worth mentioning. PSYC Corp, Huayi Brothers Media Corp, and Thumzup Media Corp are all major players in the world of professional bowling. Each of these companies has its own unique strengths and weaknesses, but all three are worth keeping an eye on in the years to come.

– PSYC Corp ($OTCPK:PSYC)

PSYC Corp is a provider of mental health services. The company has a market capitalization of $364,120,000 as of 2022 and a return on equity of -178.11%. PSYC Corp offers a variety of services including psychiatric evaluations, medication management, individual and group therapy, and case management. The company serves patients of all ages, from children to adults.

– Huayi Brothers Media Corp ($SZSE:300027)

Huayi Brothers Media Corp is a Chinese entertainment company with a market cap of 6.41B as of 2022. The company has a Return on Equity of -26.65%. The company produces and distributes films and television programs, and also operates theaters.

– Thumzup Media Corp ($OTCPK:TZUP)

Thumzup Media Corp is a media company that focuses on creating and distributing content across multiple platforms. The company has a market cap of 44.84M as of 2022 and a Return on Equity of -286.45%. The company’s primary operations are in the United States, Canada, and the United Kingdom.

Summary

Based on BOWLERO CORP‘s earnings results for FY2023 Q3, the company experienced a positive year-over-year growth of 22.5% in total revenue at USD 315.7 million. This was not enough to offset the net loss of USD -32.1 million however, which was an increase from the -18.0 million reported in the same period last year. Investors should carefully consider these results when assessing the company’s current performance and future prospects. It is noteworthy that despite the substantial growth in revenue, the net income suggests there may be underlying issues that need to be addressed in order for BOWLERO CORP to achieve long-term success and profitability.

Recent Posts