BLACK HILLS Reports Fourth Quarter FY2022 Earnings Results on February 7, 2023

February 26, 2023

Earnings Overview

On February 7 2023, BLACK HILLS ($NYSE:BKH) reported its financial results for the fourth quarter of FY2022, which ended on December 31 2022. The company’s total revenue for the quarter was USD 72.5 million, representing a 2.0% increase from the same period in FY2021. Moreover, net income amounted to USD 130.6 million, a 13.8% increase year over year.

Transcripts Simplified

Black Hills reported earnings per share for the full year of $3.97 compared to $3.74 last year, a 6% increase. This was driven by $32 million from new rates and investment riders, $3.8 million of increased margin from customer growth and higher usage per customer, especially at their electric utilities, and $5.9 million of wholesale energy sales.

Additionally, the results for the year benefited from warm summer weather and higher than normal heating degree days in early Q1 and late Q4. O&M expenses increased 9% year-over-year, due to higher fuel and materials costs, and higher expenses for outside services, bad debt, labor, cloud computing and property taxes. DD&A increased due to their capital investment program, while interest expense increased due to higher short-term debt balances driven by volatile natural gas prices and increased short-term rates.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Black Hills. More…

| Total Revenues | Net Income | Net Margin |

| 458.5 | 258.4 | 56.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Black Hills. More…

| Operations | Investing | Financing |

| 574.48 | -664.23 | 731.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Black Hills. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.32k | 6.34k | 44.36 |

Key Ratios Snapshot

Some of the financial key ratios for Black Hills are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -35.8% | 3.9% | 99.7% |

| FCF Margin | ROE | ROA |

| -15.6% | 9.9% | 3.1% |

Share Price

On Tuesday, February 7, 2023, BLACK HILLS Inc. reported its fourth quarter financials for the fiscal year 2022. The first day of trading following the earnings report saw minimal movement in the stock price as BLACK HILLS stock opened at $70.9 and closed at $71.0, a 0.6% dip from the previous closing price of $71.4. The report detailed a variety of topics including revenue, net income and other financial indicators. BLACK HILLS also provided guidance on its outlook for the upcoming fiscal year of 2023 which was welcomed positively by investors.

All in all, it appears that BLACK HILLS has experienced a successful fourth quarter despite the turbulent market conditions. Investors have responded positively to the reports and are likely to continue to monitor the company’s progress throughout the next fiscal year to see if their optimism is warranted. Live Quote…

Analysis

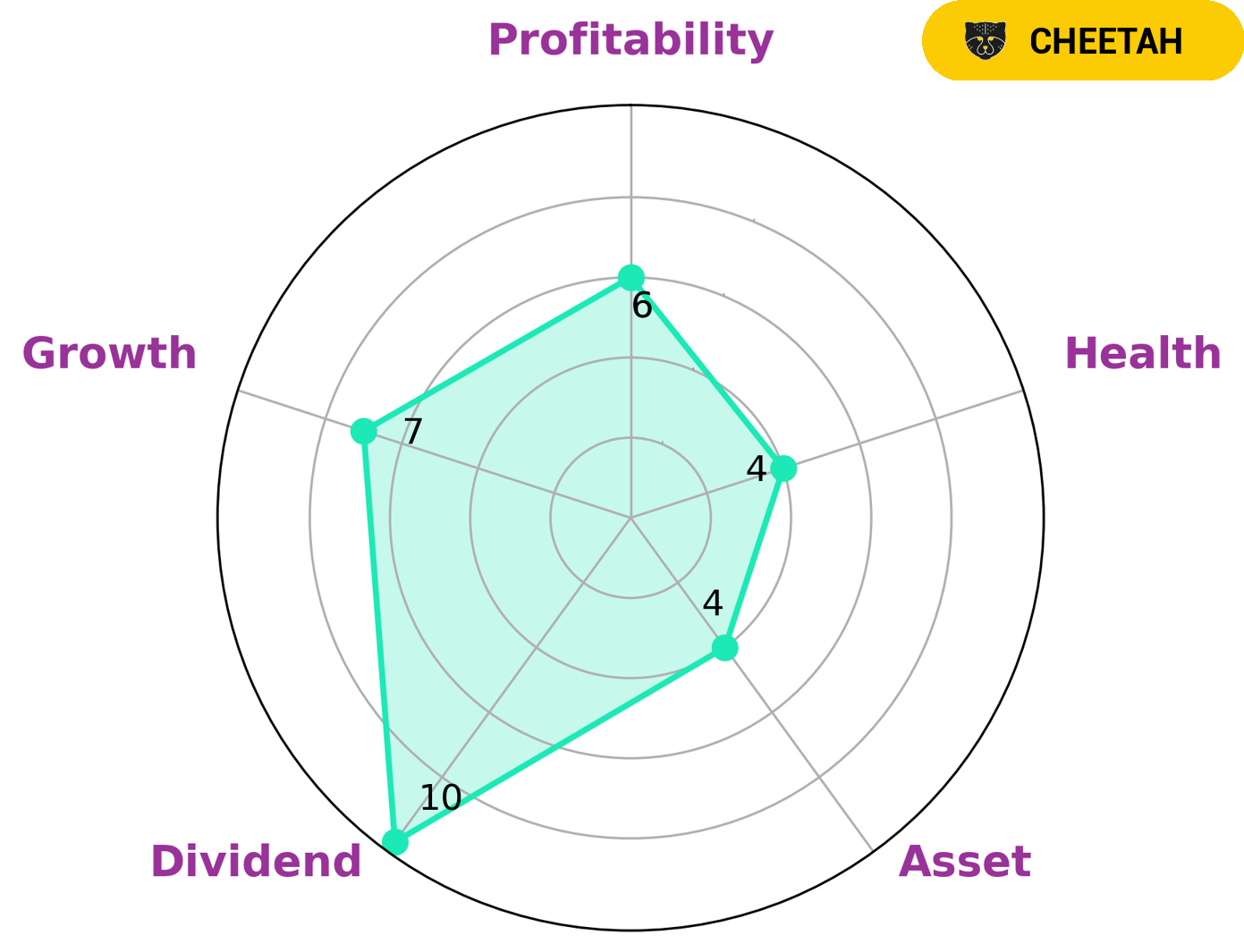

At GoodWhale, we analyze BLACK HILLS‘s financials and see that, according to our Star Chart, BLACK HILLS is strong in dividend, growth and medium in asset, profitability. Our health score of 4/10 for the company’s cashflows and debt tells us that BLACK HILLS is likely to safely ride out any crisis without the risk of bankruptcy. BLACK HILLS is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. As such, this type of company may be particularly interesting for investors looking for higher returns in exchange for taking on more risk. Investors who are willing to accept higher risk in their portfolio and embrace the potential of BLACK HILLS’s growth should consider investing in this type of company. More…

Peers

The company operates through four segments: Electric Utilities, Gas Utilities, Coal Mining, and Power Generation. Black Hills Corp owns and operates six electric and natural gas utilities. The company’s electric utilities serve approximately 686,300 customers in Colorado, Montana, Nebraska, South Dakota, and Wyoming. Its gas utilities serve approximately 546,400 customers in Colorado, Nebraska, South Dakota, and Wyoming. Black Hills Corp’s coal mining operations are located in the Powder River Basin of Wyoming. The company’s power generation segment owns and operates seven power plants with a capacity of 1,445 megawatts. Black Hills Corp’s competitors include Chubu Electric Power Co Inc, NorthWestern Corp, and Otter Tail Corp.

– Chubu Electric Power Co Inc ($TSE:9502)

Chubu Electric Power Co Inc is a Japanese electric utility company that services the Chubu region on the island of Honshu. It has a market cap of 928.54B as of 2022 and a Return on Equity of -1.25%. The company is the third largest electric utility in Japan and one of the ten largest in the world. It serves over 19 million people and has over 46,000 employees.

– NorthWestern Corp ($NASDAQ:NWE)

Northwestern Corp is a holding company that, through its subsidiaries, engages in the generation, transmission, and distribution of electricity in the United States. The company has a market cap of 3.01B as of 2022 and a Return on Equity of 11.07%. The company’s subsidiaries include Northwestern Public Service Company, which provides electric utility service in South Dakota; Montana-Dakota Utilities Co, which provides electric and natural gas utility service in North Dakota, South Dakota, and Montana; and Nipsco Industries, Inc, which provides electric utility service in Indiana and Illinois.

– Otter Tail Corp ($NASDAQ:OTTR)

Otter Tail Corporation is a holding company that engages in the electric, manufacturing, and plastics businesses in the United States. It operates through the following segments: Electric, Manufacturing, and Plastics. The Electric segment generates, transmits, and distributes electricity in Minnesota, North Dakota, and South Dakota. The Manufacturing segment designs and manufactures metal fabricated products and components primarily for the medical device and other industries. The Plastics segment manufactures and sells plastic products. The company was founded by John N. Teigen in 1907 and is headquartered in Fergus Falls, MN.

Summary

Investors may want to consider BLACK HILLS as a potential investment opportunity, given the company’s continued growth and strong financial performance in the fourth quarter of FY2022. Revenue increased 2.0%, and net income grew 13.8%, indicating a strong overall performance. Furthermore, the company has a strong balance sheet with sufficient liquidity, which suggests that the company is well-positioned to weather any potential economic downturns. As such, investors should carefully evaluate BLACK HILLS to potentially take advantage of potential growth opportunities.

Recent Posts