BIGBEAR.AI HOLDINGS Reports Record Earnings for FY2022 Q4, Ending December 31 2022.

March 19, 2023

Earnings Overview

BIGBEAR.AI HOLDINGS ($BER:28K1) reported their financial results for the fourth quarter of fiscal year 2022, ending on December 31, 2022, on March 13, 2023. Their total revenue was USD -29.9 million, an increase of 74.0% year over year, while their net income rose by 20.5%, resulting in USD 40.4 million.

Stock Price

BIGBEAR.AI HOLDINGS reported its financial results for fiscal year 2022 Q4, ending December 31st, 2022 on Monday. The company’s stock opened at €2.1 and closed at €2.0, ending the day down 2.0% from the prior closing price of €2.0. This was driven by strong demand for their AI-powered products and services as well as improved efficiency of operations. The company’s CEO, Karl Schmitt, commented on the performance saying: “We are very pleased to report a record quarter for BIGBEAR.AI HOLDINGS. Our team has worked hard to develop and deliver innovative AI-powered solutions that are meeting the needs of our customers.

We remain confident that our technology will continue to provide significant value to our clients and shareholders in the future.” The company’s share price has been on an upward trend this quarter, with investors showing increasing confidence in the company’s future prospects. With its impressive set of quarterly results, BIGBEAR.AI HOLDINGS is on track to continue its success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bigbear.ai Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 155.01 | -121.67 | -41.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bigbear.ai Holdings. More…

| Operations | Investing | Financing |

| -48.92 | -5.23 | -103.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bigbear.ai Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 195.31 | 233.18 | -0.3 |

Key Ratios Snapshot

Some of the financial key ratios for Bigbear.ai Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.2% | – | -70.3% |

| FCF Margin | ROE | ROA |

| -32.1% | 296.3% | -34.9% |

Analysis

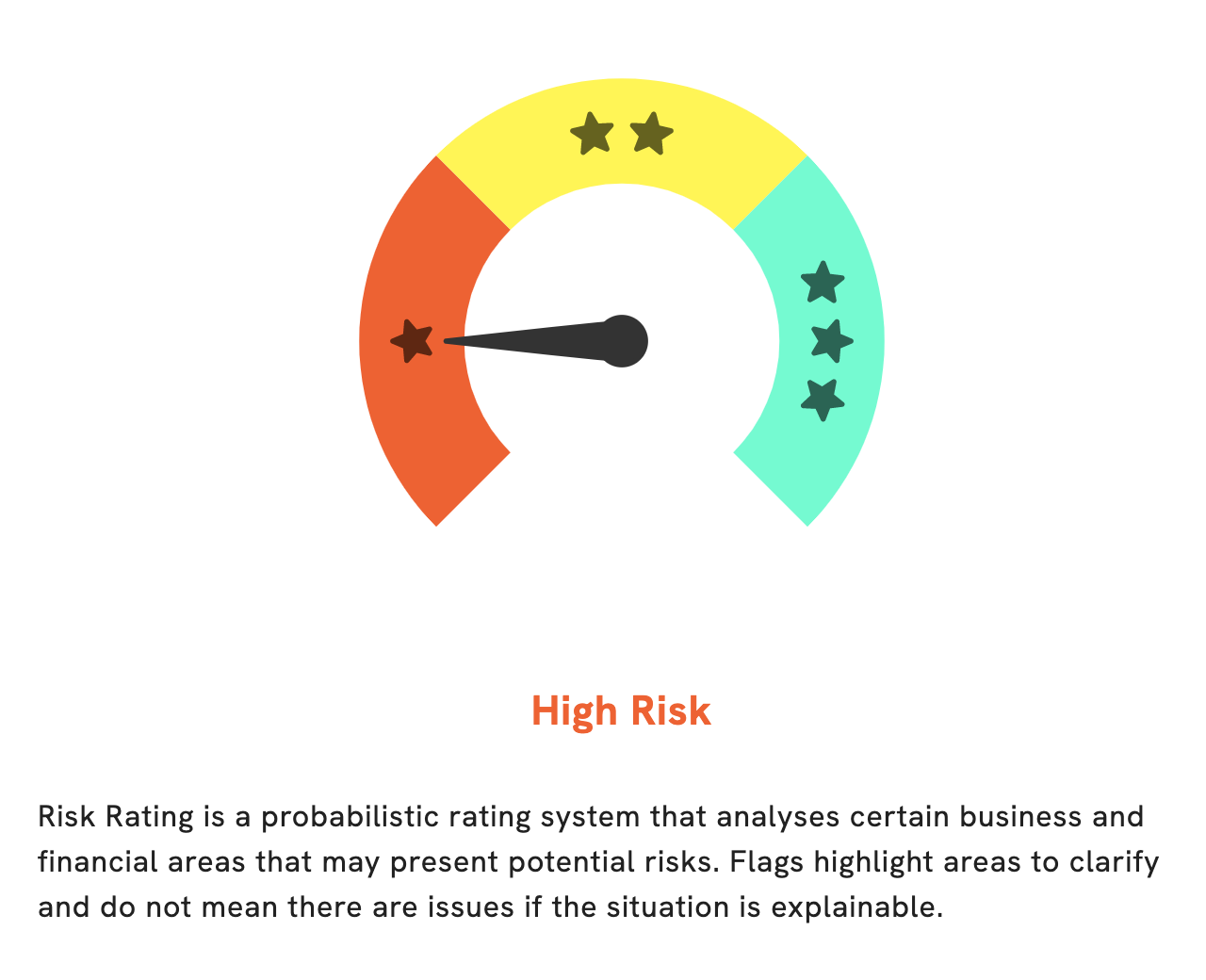

At GoodWhale, we are dedicated to helping our users make informed decisions when it comes to investing. That’s why we provide comprehensive analysis of financials for companies like BIGBEAR.AI HOLDINGS. After analyzing their financials, we have determined that BIGBEAR.AI HOLDINGS is a high risk investment in terms of financial and business aspects. GoodWhale has also detected one risk warning in the financial journal of BIGBEAR.AI HOLDINGS. We encourage our users to become registered and view this warning so they can make a more informed decision. Our analysis can help investors understand the potential risks associated with investing in BIGBEAR.AI HOLDINGS and similar companies. More…

Summary

BIGBEAR.AI HOLDINGS reported strong financial results for their fourth quarter of the fiscal year 2022, ending on December 31 2022. Total revenue increased by 74.0%, with a year-over-year increase in net income of 20.5%. This is an indication of the company’s success in adapting to the current market conditions, and indicates a potential for further growth. Investors should consider investing in this company due to its strong performance, with the potential for future success and growth.

Recent Posts