BCE INC Reports Q4 FY2022 Earnings with CAD 572.0 Million in Revenue and CAD 6439.0 Million in Net Income.

February 13, 2023

Earnings report

BCE INC ($TSX:BCE) is a publicly traded telecommunications and media company headquartered in Montreal, Canada. The company provides a suite of services ranging from cable television to internet and mobile phone services. On February 2 2023, BCE INC released its earnings report for the fourth quarter of fiscal year 2022, which ended on December 31 2022. According to the report, total revenue for the quarter was CAD 572.0 million, representing a decrease of 13.1% from the same period a year prior. Despite the decline in revenue, net income for the quarter was CAD 6439.0 million, which was a 3.7% increase from the same period a year earlier. This increase was likely due to cost-cutting initiatives implemented by the company during the quarter, as well as improved customer retention rates and customer acquisitions.

In response to these changes, the company has been focusing on investing in new technologies to improve its services and enhance customer experience. It also has plans to further expand its services into other markets in an effort to gain market share and boost its revenues. Overall, BCE INC reported a mixed bag of results for Q4 of FY2022, with total revenues decreasing from the same period a year prior, but net income increasing. The company will continue to focus on investing in new technologies and expanding its services, in an effort to improve its financial results in FY2023 and beyond.

Share Price

On Thursday, BCE INC reported its Q4 FY2022 earnings with CAD 572.0 million in revenue and CAD 6439.0 million in net income. Despite the positive results, BCE’s stock opened at CA$63.0 and closed at CA$61.4, declining by 2.9% from its prior closing price of CA$63.2. The telecom giant was able to retain its market lead, as the strong fourth quarter earnings were driven by its robust mobile, internet, and television services. The telecom giant also achieved strong customer retention rates and saw an increase in its average monthly revenue per customer. These factors helped BCEC balance out the increasing price competition and macroeconomic uncertainties in the market.

BCE’s strong financial performance has been further bolstered by its strategic investments in research and development, as well as its increased focus on customer satisfaction. These investments have helped the company to remain competitive in an increasingly saturated market and to continue to drive growth in its key segments. Overall, BCE’s Q4 FY2022 earnings demonstrated strong growth despite stock decline on Thursday. With its robust mobile, internet, and television services, the telecom giant has been able to remain a market leader and to drive growth in its key segments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bce Inc. More…

| Total Revenues | Net Income | Net Margin |

| 24.17k | 2.72k | 13.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bce Inc. More…

| Operations | Investing | Financing |

| 8.37k | -5.51k | -2.99k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bce Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 69.33k | 46.81k | 24.32 |

Key Ratios Snapshot

Some of the financial key ratios for Bce Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.3% | -1.4% | 20.8% |

| FCF Margin | ROE | ROA |

| 13.4% | 14.1% | 4.5% |

Analysis

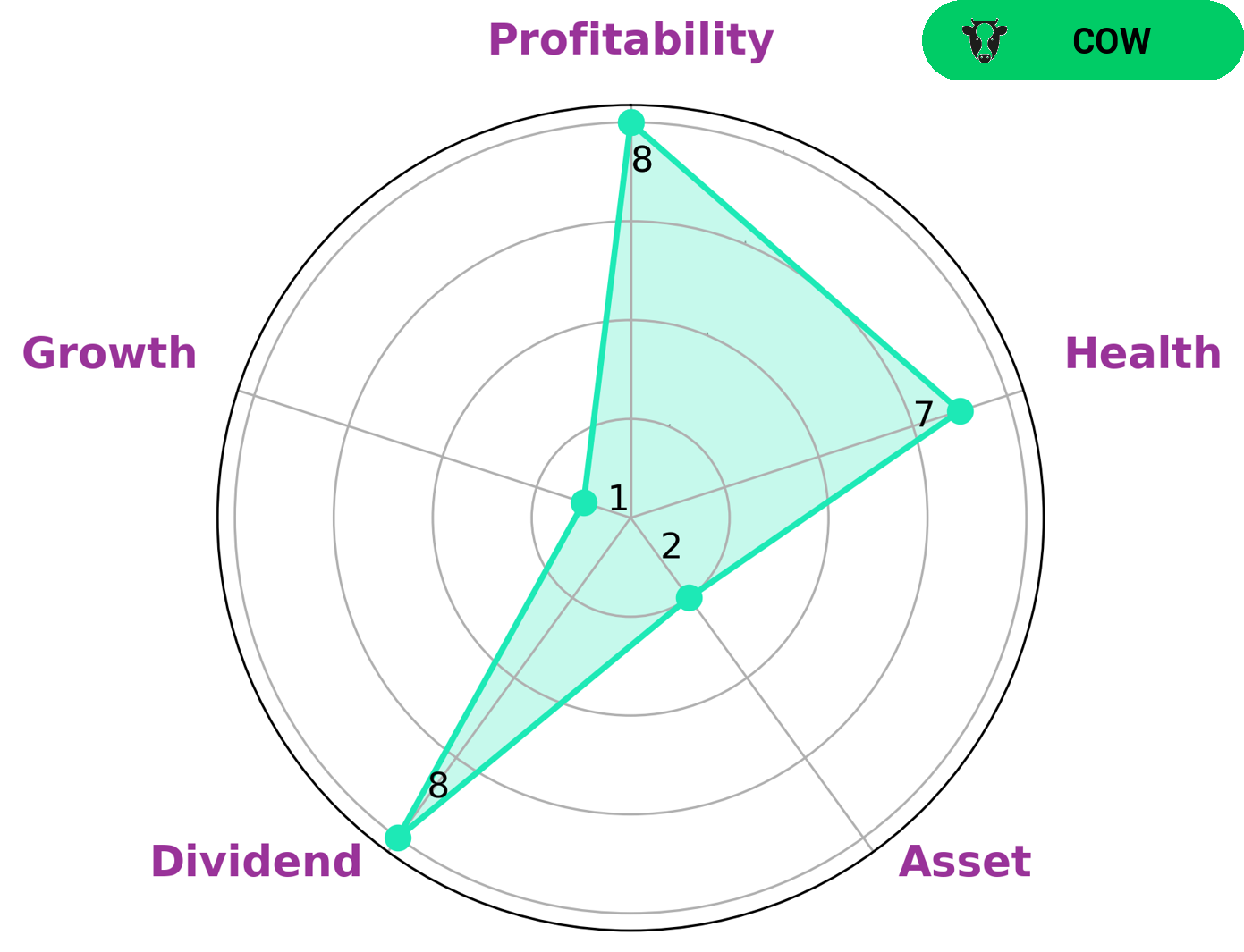

BCE INC‘s financials are analyzed by GoodWhale using the Star Chart model, which shows that the company is particularly strong in dividend and profitability, but comparatively weaker when it comes to asset and growth. According to the health score of 7/10, BCE INC has good cashflow and debt management abilities, allowing it to pay off debts and fund future operations. Due to its track record of paying out consistent and sustainable dividends, BCE INC is classified as a ‘cow’ type of company. Investors who are looking for income or capital preservation may be interested in investing in BCE INC. The company’s relative safety means that investors may be willing to take on less risk when investing in BCE INC. For investors who seek regular income flows with low risk, the dividend payments of BCE INC may be attractive. Since the company has a good cashflow and debt management ability, investors can trust that their dividend payments will be consistent and reliable. Furthermore, as BCE INC is considered a ‘cow’ type of company, investors who are seeking to preserve capital may also be interested in investing in the company due to its relatively low volatility. Overall, investors who are looking for a steady income stream with low risk may find BCE INC an attractive option for their portfolio. The company’s good cashflow and debt management abilities make it a reliable source for dividend payments, while its “cow” classification offers capital preservation for investors. More…

Peers

Its competitors are Quebecor Inc, Rogers Communications Inc, and Shaw Communications Inc.

– Quebecor Inc ($TSX:QBR.B)

Quebecor Inc is a media and telecommunications company with a market cap of 5.99B as of 2022. The company has a Return on Equity of 52.27%. Quebecor Inc owns and operates several media and telecommunications businesses, including Videotron, an integrated communications company. Videotron provides television, Internet, and mobile phone services to residential and business customers in Quebec. The company also owns and operates TVA Group, a French-language television network in Canada. In addition, Quebecor Inc owns and operates several news websites, including Canoe.ca.

– Rogers Communications Inc ($TSX:RCI.B)

Rogers Communications Inc. is a Canadian communications and media company. It operates in three segments: Wireless, Cable, and Media. The Wireless segment offers wireless voice and data communications products and services to consumers and businesses in Canada. The Cable segment provides television, Internet, and phone services to residential and business customers in Canada. The Media segment operates radio stations, digital media properties, and the Rogers Sportsnet television service.

– Shaw Communications Inc ($TSX:SJR.B)

Shaw Communications Inc is a Canadian telecommunications company that provides telephone, Internet, television, and wireless services to residential, business, and government customers in Canada and the United States. The company has a market cap of 17.47B as of 2022 and a return on equity of 12.9%. Shaw offers a variety of services including Internet, television, and telephone services. The company also provides wireless services to customers in Canada and the United States.

Summary

BCE Inc. is a major Canadian telecommunications and media company with a strong presence in the domestic market. As such, it is an attractive investment opportunity for investors looking for exposure to the industry. In Q4 of FY2022, which ended on December 31, 2022, BCE Inc. reported total revenues of CAD 572.0 million, a 13.1% decrease year-over-year. Despite this, net income saw an impressive 3.7% increase to CAD 6439.0 million. Analysts noted that the company’s cost-saving initiatives and digital transformation efforts have allowed them to remain competitive in the face of declining revenues. This is evidenced by the fact that their net income rose despite the lower revenue figure.

Additionally, the company has been able to leverage its strong balance sheet and generate positive free cash flow for the quarter. Going forward, investors should be encouraged by BCE Inc’s focus on technology and digitalization as it has enabled them to remain competitive in an ever-changing market. With a strong balance sheet and attractive free cash flow, BCE Inc. is well positioned to deliver long term value to investors.

Recent Posts