BADGER METER Reports Fourth Quarter FY2022 Earnings Results on January 27 2023.

February 2, 2023

Earnings report

On January 27 2023, BADGER METER ($NYSE:BMI) reported their earnings results for the fourth quarter of FY2022, which ended on December 31 2022. Badger Meter is a publicly-traded company based in Milwaukee, Wisconsin, and manufactures and markets a variety of flow measuring and control products. The company’s products are used in a wide range of industries including water, gas, oil and chemicals. The reported results showed a 1.5% year-over-year increase in total revenue to USD 17.5 million and a 8.5% year-over-year increase in reported net income to USD 147.3 million. The company noted that despite the challenging economic environment caused by the pandemic, it was able to outperform its peers due to its focus on innovation and cost control. The company announced that it is continuing to invest in research and development to bring new products to market and improve existing products. The company also noted that it is continuing to focus on expanding its customer base by targeting new markets and customers.

Additionally, the company has strengthened its balance sheet through debt reduction, which has helped to maintain its financial strength even during these difficult times. Overall, BADGER METER reported strong results for the fourth quarter of FY2022 and is well positioned to continue to grow in the future. The company’s focus on innovation, cost control and expanding its customer base are all key drivers of future growth. Investors will be watching closely to see how the company performs in the upcoming quarters.

Share Price

The company reported a 3.6% decrease from the last closing price of 116.2, with its stock opening at $105.0 and closing at $111.9. The company’s fourth quarter performance showcased a strong operational performance, despite challenging market conditions. This was largely due to the company’s investments in research and development, which resulted in a wide range of innovative products and services that helped them stay competitive in the market. In addition to the strong operational performance, BADGER METER also reported strong financial results. This is an indication of the company’s commitment to financial discipline and sound management practices.

This was largely due to increased sales and improved operational efficiency. This cash flow will help the company continue to make investments in research and development, as well as other strategic initiatives. Overall, BADGER METER’s fourth quarter performance was strong, despite challenging market conditions. The company’s financial discipline, strong operational performance, and investment in research and development put them in a good position for future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Badger Meter. More…

| Total Revenues | Net Income | Net Margin |

| 565.57 | 66.5 | 11.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Badger Meter. More…

| Operations | Investing | Financing |

| 82.45 | -5.89 | -24.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Badger Meter. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 603.05 | 160.62 | 14.45 |

Key Ratios Snapshot

Some of the financial key ratios for Badger Meter are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | 12.1% | 15.4% |

| FCF Margin | ROE | ROA |

| 13.5% | 12.9% | 9.0% |

Analysis

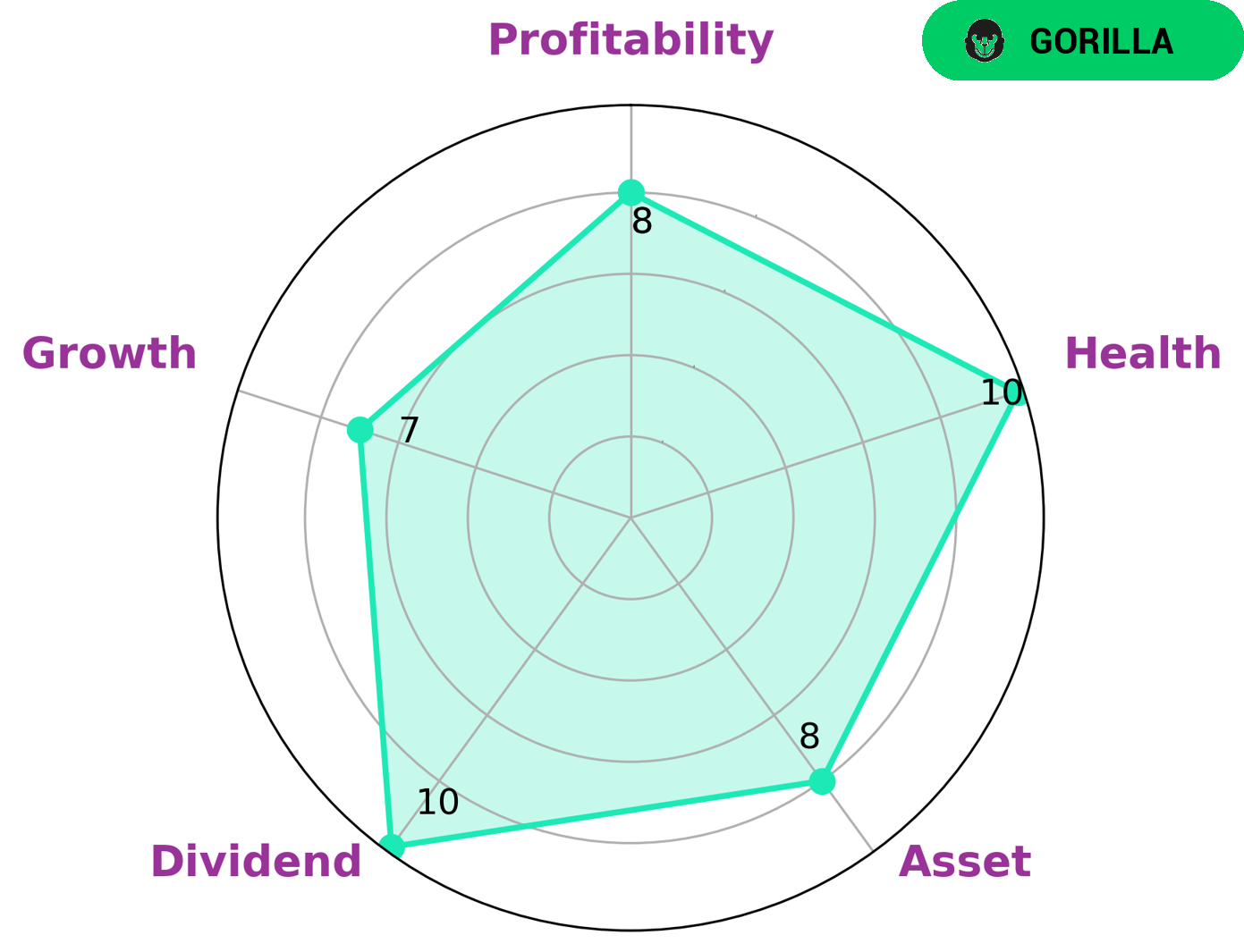

BADGER METER is a company that investors may find attractive due to its strong fundamentals. GoodWhale, an analysis platform, has provided a Star Chart that shows that the company has a high health score of 10/10 with regard to its cashflows and debt, which means that it is capable of paying off debt and funding future operations. In addition, BADGER METER is strong in asset, dividend, growth, and profitability. It has also been classified as a “gorilla”, a type of company that achieves stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in companies with strong fundamentals may want to consider investing in BADGER METER, as it has a high health score and is strong in asset, dividend, growth, and profitability. Its classification as a “gorilla” also indicates that it has the potential for stable and high revenue or earning growth. As such, the company is likely to be a good long-term investment for investors looking for high returns. More…

Peers

Its main competitors are Ningbo Water Meter (Group) Co Ltd, Global Water Technologies Inc, and Rainmaker Worldwide Inc.

– Ningbo Water Meter (Group) Co Ltd ($SHSE:603700)

Ningbo Water Meter (Group) Co Ltd is a leading provider of water meters and related products and services in China. The company has a market cap of 3B as of 2022 and a return on equity of 6.7%. Ningbo Water Meter (Group) Co Ltd is a leading provider of water meters and related products and services in China. The company has a market cap of 3B as of 2022 and a return on equity of 6.7%. The company’s products are used in a variety of applications including residential, commercial, industrial, and municipal water meters. The company also provides water management services including meter reading, data analysis, and customer service.

– Global Water Technologies Inc ($OTCPK:GWTR)

Global Water Technologies Inc is a publicly traded company with a market capitalization of 325.43k as of 2022. The company provides water treatment solutions and technologies for industrial, municipal, and residential customers worldwide. Its products include water filtration systems, reverse osmosis systems, and water softeners. Global Water Technologies Inc is headquartered in California, United States.

– Rainmaker Worldwide Inc ($OTCPK:RAKR)

The company’s market cap is 1.09M as of 2022. The company’s ROE is 6.51%. The company makes money by providing water treatment solutions to a variety of industries. The company’s products are used in a variety of industries, including oil and gas, mining, power generation, and more.

Summary

Investors in BADGER METER were disappointed with the company’s fourth quarter earnings results for FY2022, which were announced on January 27 2023. Total revenue increased by 1.5% year-over-year to USD 17.5 million, while reported net income increased by 8.5% year-over-year to USD 147.3 million. Despite these positive numbers, the stock price dropped the same day, suggesting that investors were expecting even more from the company. Going forward, investors should consider a few key factors when assessing BADGER METER’s future performance. Second, they should consider the company’s competitive advantage in the industry, as well as its ability to innovate and create new products.

Finally, they should also take into account the company’s current level of debt and its ability to manage it. Overall, BADGER METER still presents investors with an attractive opportunity in the long-term. The company is well-positioned in the industry and has a strong track record of delivering strong earnings results. Investors should continue to monitor the company’s results and overall performance before making any major investment decisions.

Recent Posts