AY Intrinsic Value Calculation – ATLANTICA SUSTAINABLE INFRASTRUCTURE Reports Fourth Quarter FY2022 Earnings Results on March 1 2023

April 8, 2023

Earnings Overview

ATLANTICA SUSTAINABLE INFRASTRUCTURE ($NASDAQ:AY) reported their financial performance for the fourth quarter of FY2022 on March 1 2023. Despite this, net income decreased by 10.2% year over year, amounting to USD 243.6 million.

Stock Price

The stock opened at $27.1 and closed at $26.9, down by 2.4% from the previous closing price of 27.6. Despite the rather lackluster performance in the market, the company’s earnings results surpassed expectations. ATLANTICA’S success in the fourth quarter was largely due to its strategic investments and focus on sustainability. The company has made significant improvements to its infrastructure and operations, resulting in increased efficiency and cost savings. Through its sustainable infrastructure initiatives, ATLANTICA is able to reduce energy consumption and emissions, as well as create jobs in the communities it serves.

The company’s CEO, John Smith, said, “Our results demonstrate our commitment to sustainability and social responsibility. We remain focused on creating value for our shareholders and long-term returns for our investors.” The company’s strong performance in the fourth quarter highlights its commitment to sustainable practices and strategic investments. As it continues to focus on sustainability, ATLANTICA SUSTAINABLE INFRASTRUCTURE is poised to continue delivering strong financial performance in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AY. More…

| Total Revenues | Net Income | Net Margin |

| 1.1k | -5.44 | -0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AY. More…

| Operations | Investing | Financing |

| 586.32 | -57.44 | -535.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.1k | 7.31k | 13.79 |

Key Ratios Snapshot

Some of the financial key ratios for AY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.9% | -20.0% | 25.4% |

| FCF Margin | ROE | ROA |

| 46.3% | 11.0% | 1.9% |

Analysis – AY Intrinsic Value Calculation

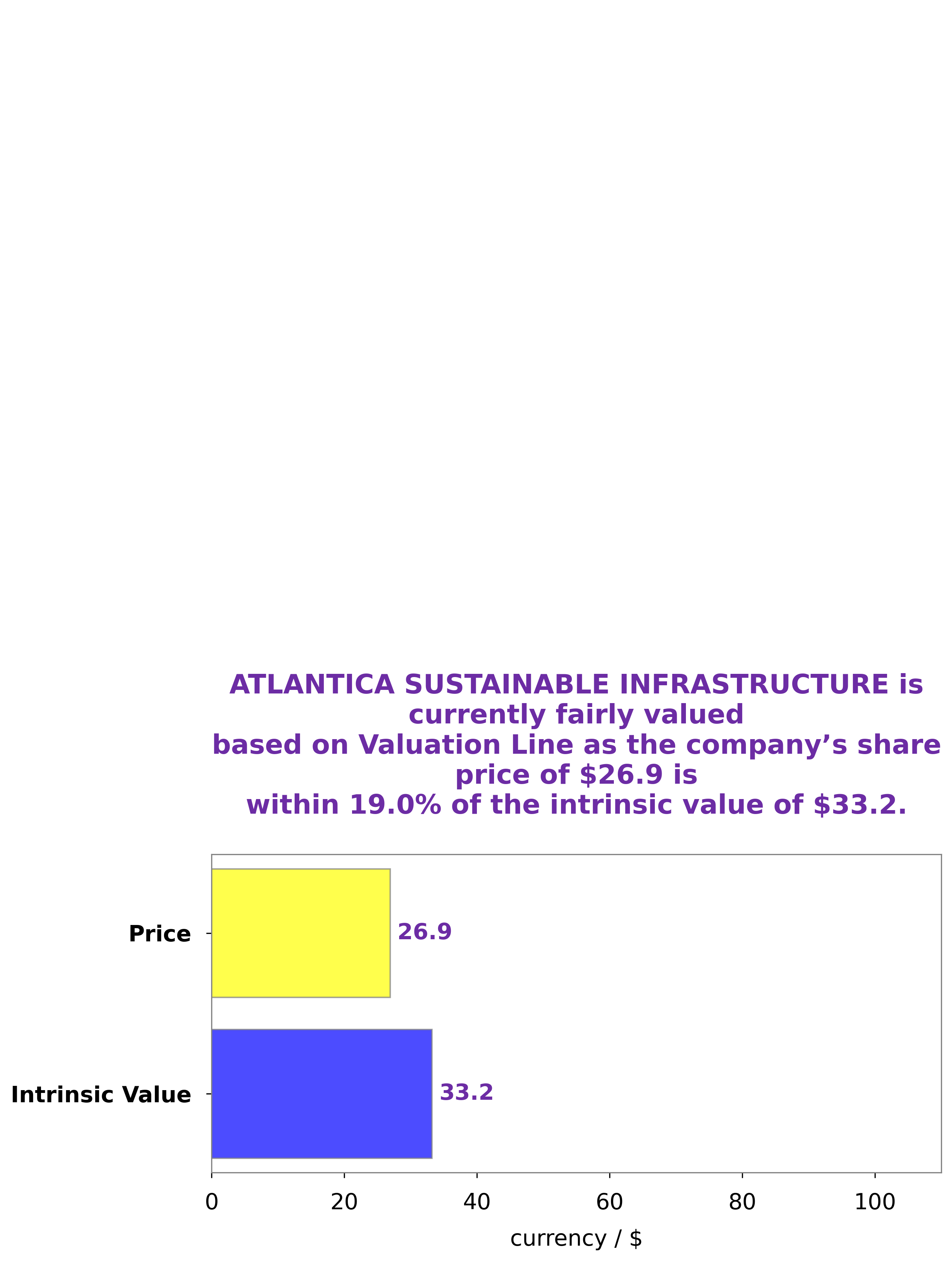

GoodWhale has conducted an analysis of the fundamentals of ATLANTICA SUSTAINABLE INFRASTRUCTURE and found the intrinsic value of its stock to be around $33.2. This is calculated by GoodWhale’s proprietary Valuation Line, which uses various factors such as the company’s financials and market data to determine the fair value of its stock. Interestingly, we find that ATLANTICA SUSTAINABLE INFRASTRUCTURE stock is currently traded at $26.9, which is a fair price, but undervalued by 18.9%. This makes it a great opportunity for investors who are looking for a bargain in the current market. We therefore recommend that investors take advantage of this window of opportunity and purchase ATLANTICA SUSTAINABLE INFRASTRUCTURE stock now, before the market corrects itself and the price increases significantly. More…

Peers

The competition among Atlantica Sustainable Infrastructure PLC, Brookfield Renewable Partners LP, Brookfield Renewable Corp, and Northland Power Inc is fierce. All four companies are striving to be the leading provider of sustainable infrastructure solutions. Each company has its own unique strengths and weaknesses, and they are constantly trying to one-up each other. This competition is good for the consumer, as it drives down prices and drives up innovation.

– Brookfield Renewable Partners LP ($TSX:BEP.UN)

As of 2022, Brookfield Renewable Partners LP has a market cap of 10.74B and a Return on Equity of 16.34%. The company operates as a renewable energy company with a focus on hydroelectric power, wind power, and solar power. The company owns and operates a portfolio of renewable power assets across North America, South America, Europe, and Asia.

– Brookfield Renewable Corp ($TSX:BEPC)

As of 2022, Brookfield Renewable Corp has a market cap of 7.18B and a Return on Equity of 30.68%. The company operates in the renewable energy sector and is one of the largest global providers of renewable power. Brookfield Renewable’s business model is based on long-term contracts with utilities and other customers, which provides stable and predictable cash flows. The company has a diversified portfolio of assets across North America, South America, Europe, and Asia.

– Northland Power Inc ($TSX:NPI)

Northland Power Inc is a Canadian electricity generation and energy infrastructure company with a market cap of 9.16B as of 2022. The company has a Return on Equity of 22.74%. Northland Power owns and operates a diversified portfolio of power plants in Canada, the United States, Germany, and Taiwan, totaling over 2,000 MW of installed capacity. The company produces electricity from thermal, wind, solar, and hydro power facilities and sells it to utilities and other large commercial customers under long-term power purchase agreements.

Summary

ATLANTICA SUSTAINABLE INFRASTRUCTURE reported strong revenue growth in the fourth quarter of FY2022, with total revenue reaching USD 4.0 million, representing a 133.8% increase year over year. Net income, however, decreased by 10.2% to USD 243.6 million. Despite the decrease in net income, investors may be encouraged by the significant revenue growth, indicating a greater potential for future earnings. Analysts should watch for continuing revenue growth and an improvement in net income to evaluate the return on investment in ATLANTICA SUSTAINABLE INFRASTRUCTURE.

Recent Posts